Inflation rises without stopping while salaries lag behind, trying to catch up. And the state? When it enters the equation, salary negotiation returns. When not, we lose. What happens to salaries when inflation increases without stopping? A document on the evolution of income.

Illustration: Juli Álvarez

Inflationary acceleration stands as one of the most notable features of Argentina’s macroeconomic crisis, with an ever-increasing impact on the population’s income. Evidence suggests that in contexts of high inflation, registered workers’ wages tend to decrease in real terms. However, in the post-pandemic period, real wages stagnated, while the incomes of the most vulnerable sectors deteriorated. The Argentine labor market exhibited diverse dynamics in response to this new inflationary environment and the policies implemented. How can the stagnation of real wages be explained and how does it manifest itself when analyzing different occupational segments in detail?

Wage trends in the post-pandemic period (2021-2022)

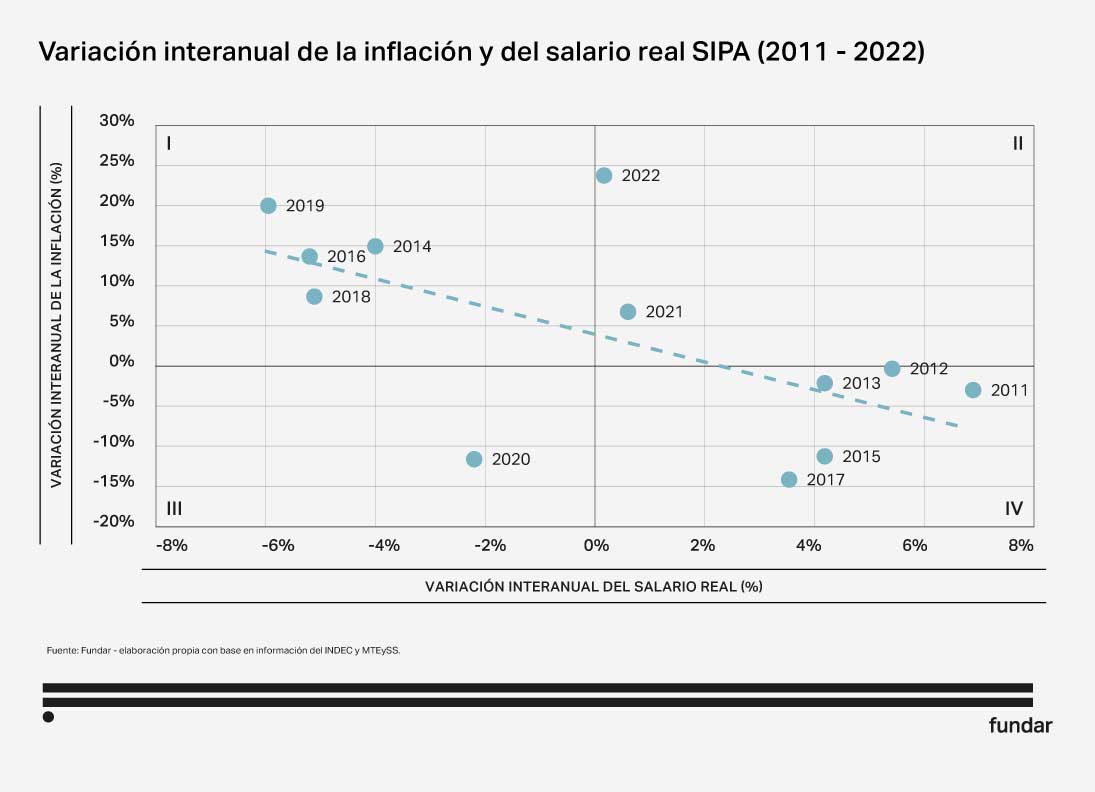

The graph depicts the relationship between inflation and real wages. Typically, there is an inverse correlation between real wages and inflation, as an increase in prices leads to a decrease in purchasing power, in turn, real wages only manage to grow if inflation falls.

However, during the pandemic, this relationship seems to have broken down, as none of the three years fall into the traditional quadrants. In 2020, inflation slowed down significantly, but real wages fell. In contrast, purchasing power remained stable in 2021 and 2022, despite a clear acceleration in inflation. Contrary to widespread perception, real wages did not fall in the last two years, but rather remained stagnant. Additionally, a historical comparison shows that real income has reached its lowest point in the past 12 years.

Collective income determinations

The post-pandemic period reveals an exception in the relationship between inflation acceleration and wage purchasing power, in which a group of workers was able to defend themselves with a certain degree of efficiency against inflationary acceleration. This anomaly is the result of a combination of factors, including:

- a lenient government wage policy that responded positively to wage demands, and did not attempt to lead them;

- the promotion of compensatory bonuses; and

- a shift in the wage bargaining process behavior in response to inflation, reflected in growing indexation.

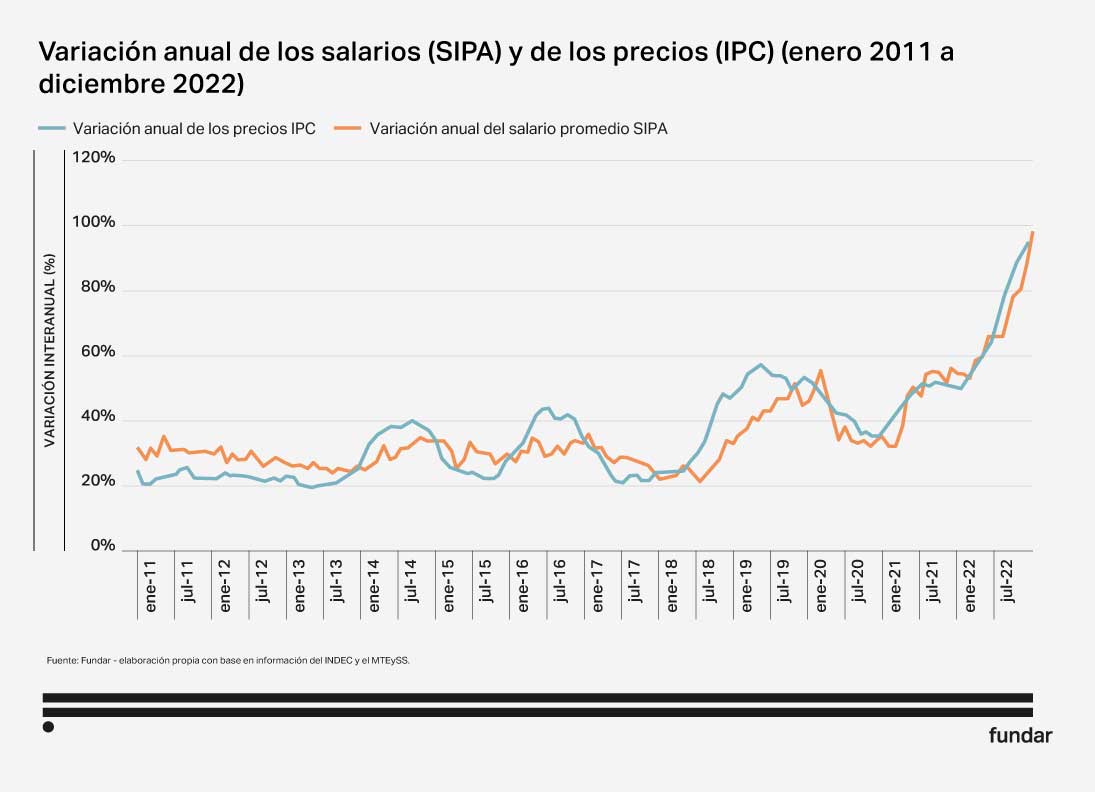

This phenomenon highlights the importance of institutional factors in income determination. In previous inflationary ramp-ups (especially in 2018-2019 under Macri’s administration), salaries lagged significantly behind price increases. In contrast, the last two years have seen a process of increasing indexation, with wages defensively adjusting rapidly with past inflation, explaining the convergence of the two curves.

Sectors in a stronger position to withstand Inflation

The impact of accelerating inflation on wages has not been uniform across all workers. The ability of different sectors to cope with price dynamics is largely determined by three factors: the level of formality, government intervention, and wage bargaining performance.

Formal and informal workers

In 2022, the incomes of salaried employees, both registered and unregistered, remained stagnant compared to the 2021 averages. This consolidated the drop in income recorded during the 2020 pandemic. The differences are particularly noticeable between salaried and non-salaried workers. The latter group was the most affected, especially in 2022, as they were ill-equipped to protect themselves against the acceleration of inflation and were also hit by the fall in activity levels. A possible explanation is that collective wage determinations, such as bargaining agreements and the minimum wage, especially in establishments where formal and informal workers coexist, may have provided greater protection for registered workers than for non-salaried workers, such as informal self-employed workers.

Public and private sector employees

While public sector workers historically experienced greater purchasing power loss than their private sector counterparts, this trend partially reversed in the last two years. Unions negotiating with the State (state employees and teachers) have even achieved improvements in real terms in the post-pandemic period, reflecting the government’s supportive stance towards public sector wages. In comparison, private sector workers showed a tendency to stagnation or real decline.

Private sector employees

An analysis of major private sector bargaining agreements reveals that real increases are unrelated to previous wage levels or the union’s historical bargaining capacity. The evolution in purchasing power is not explained by historical increases obtained by unions. Strategies such as indexation, trigger clauses, fixed sums, and the frequency of increases and renegotiations explain the evolution of purchasing power. In this volatile scenario, differences in the performance of various unions in bargaining processes is not at all stable. In this rapidly changing environment, the winners of today may be the losers of tomorrow.

Most vulnerable sectors in the distributive struggle

The impact of accelerating inflation on different groups varies greatly in terms of their ability to defend their purchasing power. Non-salaried workers were the most impacted by the jumps in inflation, but they were not the only ones. In 2022, the purchasing power of the most vulnerable population decreased significantly in real terms. Among the four categories analyzed, only domestic workers experienced an increase in their income in real terms. Despite government efforts to preserve the incomes of these sectors, in a regime of sustained high inflation, these segments are the most affected. The decrease in purchasing power among lower-income segments could explain the hike in poverty rate in 2022.

Lower-income workers

In 2022, the Minimum Wage (SMVM) experienced a 3.9% real drop compared to the 2021 average. This affects both lower-income registered workers and informal workers who receive 50% of the Minimum Salary under the Potenciar Trabajo program. Although the Wage Council (the forum where Minimum Wage negotiations take place) met the same number of times in both periods, 2021 had eight monthly increases distributed throughout the year, while the first half of 2022 saw only two. Despite a significant increase in June, it failed to offset the previous drop. This highlights a lesson from high inflation: those who do not receive frequent raises tend to lose out in the face of accelerating inflation.

Domestic workers

Domestic workers showed a different performance in terms of income. Their average income increased by 5% in real terms in 2022 compared to the previous year. However, this improvement only compensated for the loss sustained in 2021. The increase can be attributed to the frequency of nominal raises distributed throughout the year, which allowed them to keep up with inflation and even outperform it in some months. However, the improvement occurred during a period of declining job registrations in this category, which particularly impacted female workers.

Retirees

An initial analysis of retired individuals who receive passive income reveals a significant difference between those who receive the minimum retirement pension (47%) and the rest. Pensions are adjusted quarterly based on the pension mobility formula, which can result in disruptions and a subsequent decrease in income. Retirees who receive the minimum pension have been compensated for this delay with lump-sum bonuses to offset inflation, while all other retirees have experienced a significant decline.

Informal workers

Families with informal worker heads benefit from the Universal Child Allowance (AUH) supplemented by the Alimentar Card since 2020. However, in 2022, there was a significant 21% year-on-year loss of average purchasing power due to a deterioration in the aggregate benefit granted under both programs. Although the AUH is adjusted through the same mechanism used to adjust retirement pensions, the amount of bonuses was much more limited.

The Government demonstrated its commitment to Welfare State policies through two major programs: the Alimentar Card and the free medicine program for retirees. However, despite these efforts, neither of the two groups most impacted by these policies was able to maintain their income levels in the face of post-pandemic inflation.

Three political economy implications

Partisan, social and union organizations still matter in a highly inflationary regime

Contrary to certain orthodox views asserting that ‘everyone loses in inflation,’ this analysis demonstrates how certain groups managed to defend their incomes during the crisis. This is unlike situations of similar general impact, such as the 2018-2019 external crisis under the Cambiemos government. This achievement was largely due to the alliance with the Frente de Todos government’s decisions on fiscal policy and collective income determination mechanisms designed or reinstated in the 2000s, such as sectoral bargaining or the National Teachers’ Agreement.

Labor institutions are crucial to understand the heterogeneities within the popular sectors

Those groups with more active institutional instances to determine wages, such as public and private employees, teachers and, to a certain extent, domestic workers, were the ones that best defended their incomes in a high inflation regime. On the contrary, those without collective income bargaining or with poor representation (unregistered non-salaried workers, retirees and beneficiaries of the Universal Child Allowance and Alimentar Card) experienced a significant decline in their real incomes. In a high-inflation regime, popular actors are affected by the underlying logic of ‘survival of the fittest.’

Promoting wage agreements and coordination is crucial

The events of 2022 underscore the importance of promoting wage agreements and coordination in the context of high inflation. This emphasizes the need for an income policy that addresses inflation in a forceful and definitive manner within a heterodox stabilization program. Such a policy is a necessary starting point for the sustainable recovery of the purchasing power of all workers.