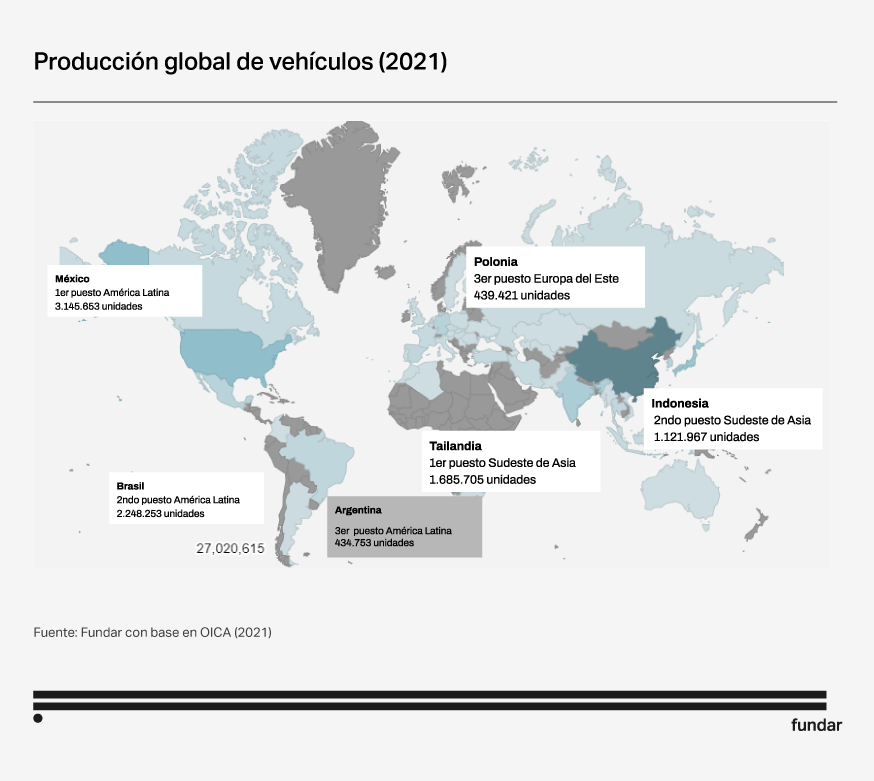

Electromobility is a booming industry globally and Argentina has the opportunity to enter this growing market. It has a traditional automotive industry and lithium, the raw material for batteries. But the road to this change in the industry is not paved. To move in this direction, Argentina must look at countries with similar conditions and define what measures to take. Below we outline critical routes for the local electromobility industry based on case studies of Mexico, Brazil, Poland, Thailand and Indonesia.

Illustration: Micaela Nanni

An opportunity for the Argentinean automotive industry

The race towards electromobility has grown globally

The race to develop electromobility has accelerated globally in recent years. It has mainly focused on high-income countries (Europe and the United States) and large emerging economies (China and India). But this race was also driven in other regions such as Eastern Europe, South East Asia and, to a lesser extent, Latin America;

Middle-income countries with a traditional automotive industry are struggling to find their place. Argentina is part of this group of nations for which the transition to electromobility represents an opportunity to make a “leap to green development”. But, so far, our country has not deployed a clear production strategy. The possibility of making this leap presents today more questions than answers;

The opportunity to join these global value chains requires the implementation of specific industrial policy instruments. It also requires considering the structural characteristics that explain each country’s position.

Global electric car sales also increased

They grew from 130,000 units in 2012 to more than 10 million in 2022. Although they still account for less than 15% of annual car sales, they increased more than threefold over 2020 and each year they exceed the previous year’s projection. In fact, by 2030, electric vehicle (EV) sales are projected to account for 35% of the global total. This trend is evidence that technological change is hard to stop.

In Latin American countries, the transition to electromobility is still in its infancy. Although the number of sales grew at an exponential rate, its weight in global sales is still marginal (0.27%). Brazil and Mexico lead the regional market. Far behind is Argentina with only 365 units sold in 2022.

The transition to electromobility: from technology adoption to production transformation

The transition to electric vehicle production is a risky and costly for the traditional automotive industry. It requires a radical change in production technologies. It repositions companies and countries and allows for the emergence of new competitors. This creates threats of displacement, the need for adaptations of many of the established players, and great uncertainty.

The different speeds at which each country faces this transition can be explained by looking at the different starting points. These differences can be explained by various factors, such as the type of specialisation of their automotive industry, the form of insertion in global value chains, and the existing capacities to implement productive policies for the sector, among others.

Transition policies in middle-income countries

Argentina is in the group of countries that have a traditional automotive industry with some degree of export orientation, are highly dependent on multinational terminals and are less able to make a technological transition. These countries are seeking to maintain the competitiveness of the sector, while at the same time dealing with the tensions of defining their transition strategies to sustainable mobility.

To identify ways to promote the growth of electromobility, we analysed the main policy instruments used by five countries in similar situations: Thailand, Indonesia, Brazil, Mexico and Poland.

Strategies to be developed are influenced by the target markets

Broadly speaking, in the five countries analysed, the transition towards electric car production is conditioned, on the one hand, by a high dependence on the strategies of multinational terminals to distribute their production and investments and, on the other hand, by a limited role of states in influencing these corporate decisions with incentives to attract foreign direct investment.

In all the countries analysed, part of the automotive production is destined for the foreign market. This is an important factor because the higher the export share, the greater the influence of what happens in the target markets on the speed and technological trend of the local transition.

Poland, Mexico and Thailand are countries whose industries are heavily driven by the European, North American and Southeast Asian markets, respectively. In Indonesia and Brazil, on the other hand, the strategy adopted by their automotive industry will be strongly influenced by what their own markets define.

Main features of implemented policies

- In Southeast Asia, Thailand and Indonesia aim to lead the EMV markets in the region. In both cases, their states played a strong role in implementing policies to promote EV production and demand.

- Within Eastern Europe, Poland sought to play a more active role in the transition to electromobility than the other countries in the region through domestic EV production projects.

- In Latin American countries, policies to promote the sector are lagging. Mexico and Brazil are receiving increasing foreign investment to produce EVs. However, so far, their states have played a limited role in promoting local production capacities. This difficulty in moving forward highlights the tension between accelerating the transition and the risks it creates for traditional automotive industry actors.

Critical routes for the local electromobility industry

Where do we stand? Challenges to transition

Argentina as a middle-income country, with a low domestic market scale, no geographical proximity to countries with a high demand for this type of vehicle, and a traditional automotive industry that has been losing productive and technological capacities, faces serious challenges to undertake this reconversion.

On the one hand, Argentina’s traditional automotive industry is facing major difficulties. Between 2012 and 2022, total vehicle production contracted by 30%. At the same time, the auto parts sector has suffered from company closures and job losses, while the surviving domestic companies are increasingly supplying standard and low-complexity components;

On the other hand, Argentina’s automotive industry is focused on the foreign market. Brazil is the main export destination with 65% of exports in 2022. The delay in the electrification of transport in Brazil and the weight of the use of biofuels limits the progress of EV production on a larger scale in Argentina. In turn, this makes it difficult for local subsidiaries to win investments within their multinational organisations if there is no demand (local or external) for these products.

Lessons for Argentina on Policy Instruments

On the one hand, Argentina has so far not defined a clear strategy for the electromobility sector. There are several plans developed by different ministries that define lines of action and goals for the sector. However, a comprehensive and focused policy on the productive transition towards electric vehicles has not yet been established;

On the other hand, the country’s position as a lithium producer raises debates around local battery manufacturing and puts the focus on the presence of the resource without addressing its potential link to the electromobility sector;

In the following, the main lessons are drawn for the policy dimensions analysed considering the Argentinean context around the electromobility sector;

| Brazil | Mexico | Thailand | Indonesia | Poland | Argentina | |

| 1. Technology transition goals | ||||||

| Prohibition targets | ✓ 2035 | |||||

| Sales targets | ✓ | |||||

| Production targets | ✓ | ✓ | ✓ | |||

| Stock targets | ✓ | ✓ | ||||

| 2. Economic incentives for EV production | ||||||

| Reduction of import tariffs on capital goods and critical components | ✓ | ✓ | ||||

| Income tax reduction | ✓ | ✓ | ✓ | |||

| Direct investment subsidies | ✓ | |||||

| 3. Economic incentives for EV demand | ||||||

| Excise and goods tax reduction | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Reduction of tariffs on imports of complete vehicles | ✓ | ✓ | ✓ | |||

| Direct subsidies for the purchase of electric vehicles | ✓ | ✓ | ✓ | |||

| 4. Freight infrastructure development | ||||||

| Definition of goals | ✓ | ✓ | ✓ | |||

| Marketing regulations | ✓ | |||||

| Economic incentives (tax exemptions and direct subsidies for purchase) | ✓ | ✓ | ||||

| Public enterprises (financing for direct investments) | ✓ | ✓ | ||||

| 5. Cell and battery manufacturing | ||||||

| Public funding | ✓ | ✓ | ||||

| Public companies | ✓ | ✓ | ✓ | |||

Coordinating the definition of transition goals

Of the four types of targets that are usually set, in Argentina, there are only EV stock targets which were defined by different national ministries. This lack of coordination makes it difficult to establish a coherent and comprehensive strategy, leads to possible overlapping of actions and resources, and undermines the credibility of these goals. In turn, these targets mustn’t be only linked to environmental objectives but also take into account other dimensions such as EV production or charging infrastructure.

Promoting and targeting economic incentives for EV supply and demand

Economic incentives for both the supply and demand of EVs are a frequently used policy instrument for the promotion of niche markets and the early commercial adoption of EVs. So far, Argentina does not have such incentives either;

The experience of the countries analysed shows that the implementation of economic incentives is accompanied by targeting or segmentation. An example could be buses or light commercial vehicles, a segment where Argentina has been specialising, mainly in the case of pick-ups medium-sized buses.

Promoting public-private partnerships for the development of electricity charging infrastructure

Taking into account that public electric charging infrastructure in the country is incipient and that this is a fundamental condition to incentivise the use (and purchase) of EVs in the country, it is relevant to implement strategies for its development;

Freight infrastructure is costly to install and maintain, so it is beneficial to promote public-private partnerships and to focus the development of this infrastructure on specific market segments.

As a complement, partnerships of state-owned companies (such as YPF) with automotive terminals could be promoted, following the Southeast Asian model, where state-owned oil and power companies are playing a key role in the extension of the charger network.

Promoting significant R&D efforts for cell and battery manufacturing

Lithium is a key input for the production of lithium-ion battery cells and Argentina has 10.4% of the world’s total reserves. However, the factors that determine the success of battery production go beyond the presence of the input. Achieving profitability in the manufacture of cells and batteries requires scale and cutting-edge technology. Argentina is a late entrant to an advanced technological race that requires significant R&D efforts, especially in the highly competitive electromobility segment.

Public companies can play a key role. An example of this is the project deployed by YPF with Y-TEC and the UNLP. The biggest challenge for projects like this will be to reach strategic alliances with leading companies in the segment that will allow them to scale industrially, obtain financing and position themselves as a supply option for the domestic and regional market.

Designing a specialised institution

The experience of countries such as Thailand shows the importance of having a public-private institution specific to the automotive sector. This entity should be made up of strategic actors in the sector and should have the technical and political capacity to design and implement the necessary policies to address the challenges faced by companies in the face of increasing technological changes in the industry.

Defining an international insertion strategy

New policies need to be framed within a clear strategy of international insertion. This implies promoting and strengthening trade agreements that facilitate access to external markets. In this way, they will be able to overcome the initial restrictions of scale of the Argentine domestic market, and even those of Mercosur itself. A first and fundamental step would be to define a specialisation strategy, in complementarity with Brazil, and to translate it into concrete measures.