In Argentina, the textile apparel industry still maintains its importance within the national productive apparatus. In 2022 it represented 1.5% of employment and 0.9% of the country’s value added. Despite this, the employment it generates is – as in the rest of the world – mostly precarious. And the high prices of clothing are the subject of intense debate in public opinion. To think about the future of the Argentine textile apparel industry, it is relevant to draw lessons and lessons learned from other countries in the region. We analyze the trajectories of Brazil, Chile, Colombia and Peru in search of inputs to design public policies aimed at the sector.

The textile-apparel industry in South America

In the first documents of the series “The textile-apparel industry in Argentina in the 21st Century” we elaborated a diagnosis of the current state of the sector in the country. Beyond the local perspective, to answer the basic question – what should we do with the Argentine textile-apparel industry – it is important to know more about what other countries in the region have done.

The choice was not casual. The countries were chosen from the region (South America) with cultural and historical similarities, the four largest economies in the subcontinent, excluding Argentina. Despite these similarities, the textile-apparel industry in each of these countries has shown heterogeneous trajectories, and their study opens up a range of possible strategies.

Brazil

Defensive strategy concerning globalization aimed at protecting its industry and offensive for the primary sector, with important stimuli for the expansion of cotton cultivation.

Chile

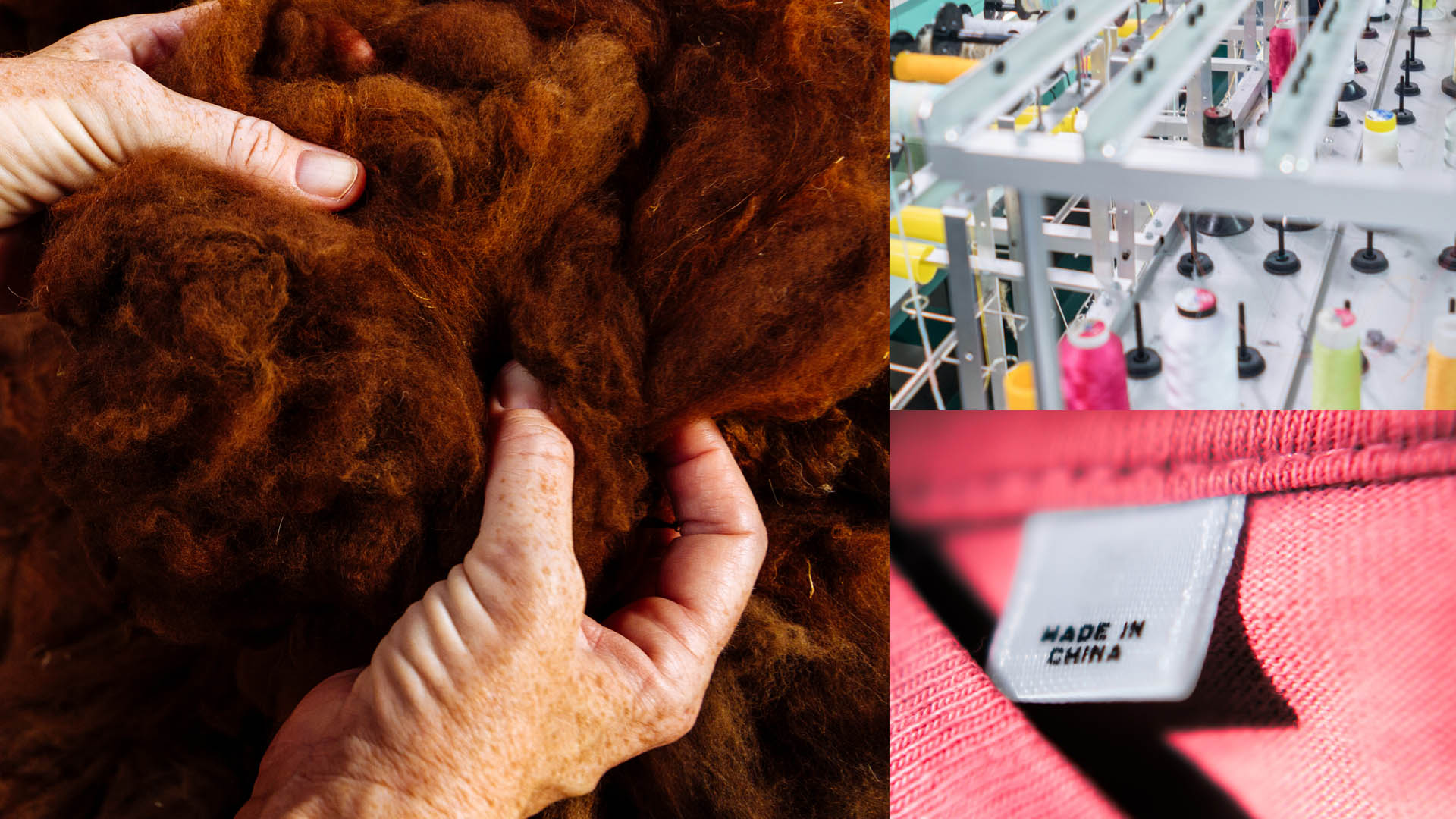

The best example of the productive disarticulation of this industry is caused by the phenomenal growth of Asian imports.

Colombia

Perú

They have an important textile-apparel industry -in line with what is happening in Argentina-, although with a significant export outlet thanks to greater trade integration with the United States, the main export destination.

What do the trajectories of the textile-apparel industry in South America have in common?

The importance of the textile-apparel industry in industrialisation processes

The four countries -as well as Argentina- underwent a process of import substitution industrialization (ISI) towards the middle of the 20th century, with the textile-apparel industry as one of the most dynamic sectors.

Although production was mainly destined to supply the expanding domestic market, the sector achieved a certain export outlet in Brazil, Peru and Colombia. The application of trade protection policies and incentives for industrial development allowed the sector to expand, which generated an increasing number of jobs.

Strong competitive pressure given the export insertion of the Asian nations

Globalization in the 1970s, the Latin American external debt crisis in the 1980s and the period of structural reforms in the 1990s challenged the industrial structure of the ISI. The growth of global trade and the export insertion of several Asian nations represented a strong competitive pressure for Latin American industries, which were reduced in relative terms for the economy as a whole, particularly with respect to services.

Precarious working conditions in the textile-apparel industry

Despite the stagnation in production, sectoral employment levels continue to be significant in all the countries analyzed except Chile. Nevertheless, employment in the sector is characterized by precarious working conditions, particularly in the apparel sector. As in the rest of the world, growing competition from Asia has generated pressure to make jobs more precarious to reduce costs. Long working hours, informality, poor health and safety conditions, income instability and the presence of a majority of women and immigrants are a constant in all the countries analyzed, as well as in Argentina.

Systematic apparel reduction

A final feature shared by the four experiences analyzed has been the systematic lowering of prices of clothing relative to other goods and services over the last three decades, in contrast to the Argentine case. However, the magnitude of the fall in relative prices has varied from country to country: between 2001 and 2023, garments became 83.6% cheaper in Chile, 57% in Colombia, 22.2% in Peru and 5.4% in Brazil.

What is unique about the trajectories of the textile-apparel industry in South America

These common trends overlap with unique national trajectories, specifically since the 1990s, linked to the different development strategies adopted by countries to respond to the challenge of economic globalization.

Sectoral policies have been limited in their effects. The trajectories of each country are largely explained by macroeconomic policies, the aggregate performance of the economy and the signing, or not, of free trade agreements and tariff policy in general. Broadly speaking, we can differentiate them into three general orientations: defensive, offensive and passive.

Brazil

Defensive strategy with respect to globalization aimed at protecting its industry and offensive, with important stimuli for the expansion of cotton cultivation.

Chile

Passive laissez-faire strategy, which resulted in the reduction of this industry to its minimum expression.

Colombia

Perú

Offensive strategy with policies focused on promoting the internationalization of the sector.

Brazil: boosting cotton production

Brazil has been the world’s fastest-growing country in cotton production over the last 25 years and has become one of the world’s leading exporters of raw cotton, which ends up being manufactured in Asia.

In the last two decades, the country has deployed a dual strategy: defensive with the industrial links and offensive at the agricultural level. In terms of industry, it was the most proactive country regarding sectoral policies. It sought to limit the adverse effects of Asian competition through measures such as tariffs above the global average and additional trade defence mechanisms.

As for the agricultural link, the strategy was offensive, with significant incentives for the expansion of cotton cultivation to new regions. Embrapa – the public sector – was a central agent. Through investment in R&D, this agency stimulated the development of better quality and more productive varieties. This was accompanied by a solid quality certification policy, boosted by adherence to the Better Cotton Initiative program.

This experience could serve as a reference for Argentina, given that it has historically been a cotton producer, albeit with a much more stagnant production than Brazil and with an intermediate quality. Although improving cotton productivity and quality does not guarantee greater production in the industrial links of the chain, it is a factor that can favour higher quality and, therefore, competitiveness.

Chile: productive disintegration and trade strengthening

Chile is a paradigm of productive disintegration of the textile-apparel industry. Since the seventies, the country opted to deepen its international insertion by importing a large part of its manufactured goods at prices lower than the local ones. This resulted in an exponential growth of Asian garment imports and a sharp contraction of production and jobs generated.

Although Chile has lost most of its manufacturing capacities in the sector, it has built them up in the commercial link. Large nationally-owned retail companies, such as Falabella, have emerged in the country. These retailers are the main importers of clothing and have a majority market share (unlike in other Latin American countries, where the commercial channel is more atomized). This is a relatively unexplored topic in the literature on productive development and deserves further analysis.

Despite decades of productive disintegration, there is still a small textile-apparel industry in Chile today, which teaches a lesson. Even if a country so far geographically from Asia frees imports and reduces tariffs, certain marketing niches need to be supplied locally (to quickly replenish depleted stocks ) or satisfy niche demand preferences. This same dynamic can be seen in other countries around the world and is part of the new strategy adopted by the major global players, known as “near-shoring”.

Colombia and Peru: specialisation as a key to improving export competitiveness

The cases of Peru and Colombia are more similar. In recent decades, both countries have followed a path of trade liberalization leveraged by the signing of multiple free trade agreements. Although in Peru and Colombia, this sector also lost weight in total value added and employment, the performance of the quantities produced over the last three decades was more positive than in Brazil and Chile.

The strategy adopted by Colombia for the textile-apparel industry is part of the orientation chosen for the Colombian economy in general: openness, internationalization based on trade agreements and treaties, and the use of mostly horizontal instruments. However, in recent years there has been a growing use of defensive tools; the most notorious is the sharp increase in tariffs on apparel imports in 2021-2022.

The Peruvian case deserves special attention. Of the four countries, it is the one with the highest exports of finished products based on quality. Unlike Brazil, cotton production in Peru has fallen sharply since the early 1990s. This did not hinder the growth of the rest of the chain, which began to source cotton from the United States, thanks to a free trade agreement. This is a case that defies the general trend whereby these treaties tend to result in higher-income countries consolidating their manufacturing exports, while lower-income countries consolidate their primary exports.

Three lessons for the Argentine textile-apparel industry

Looking at what happens in the non-manufacturing links of the chain

All the cases analyzed show that, in recent decades, this sector has sailed against the global current and the industry has not been able to experience sustained growth. Within this adverse scenario, it is necessary to pay more attention than usual to what is happening in the non-manufacturing links of the chain, such as agriculture and marketing.

Brazil’s extraordinary boom in cotton production -based on its own science and technology- leads us to wonder about the possibility of Argentina following a similar path. On the other hand, the successful trajectory of Chilean retail encourages us to explore the feasibility of any of the national brands achieving a strong internationalization process and to inquire about the public policies required for this purpose.

Avoid abuse of discretionary tools of foreign trade administration over this industry.

In the four countries analyzed, there was no abuse of foreign trade administration tools and trade initiatives were limited, in some cases, to high tariffs and the selective application of non-discretionary trade defense mechanisms. Possibly for this reason, the relative prices of clothing followed the downward trend recorded in other parts of the world.

Improve external insertion by specialising in certain products and segments.

The experiences of Colombia and Peru -with relatively better performance in industrial production- pose an interesting example for Argentina, since the design of sectoral policies allowed them to improve their external insertion based on certain types of garments aimed at middle and high-end market segments. This option would probably require greater trade integration with other countries in the region, in addition to Mercosur.