Structural reforms do not necessarily improve a country’s macroeconomic performance, but neither should the lack of them be unconditionally positive. They are capable of assisting the government in achieving its objectives, but experience shows that, to work, this type of reform needs a clear development model and a stable macroeconomy. Knowing previous experiences of implementation is key to knowing when these reforms can enhance development and which contexts are not conducive to the success of these strategies.

Ilustración: Micaela Nanni

What are structural reforms?

Structural reforms: a tool of the current government

The current government has shown a reformist vocation. In its first month in office, it issued a decree of necessity and urgency and sent an omnibus law to Congress with the aim of modifying or eliminating more than 300 laws and regulations. Such initiatives to reform the labour market, privatise public companies and deregulate markets are nothing new.

They are called “structural reforms” and, in their most common meaning, refer to a series of measures that aim to boost the economy through policies of deregulation and liberalisation of markets and the downsizing of the state apparatus, reducing the frictions and rigidities that limit the free functioning of markets.

Structural reforms: a tool for economic development

In the 1980s and 1990s, so-called “structural reforms” played a central role in the recommendations and programmes of international organisations (particularly the IMF and the World Bank) with highly indebted countries and former communist bloc economies facing difficulties in sustaining growth.

The results of the countries that adopted these reforms were mixed.

- In some cases, economic performance was satisfactory, restoring growth without worsening – or even improving – social indicators.

- In others, growth was accelerated with very negative effects on employment, poverty and income distribution.

- In others – including Argentina and Latin America – even long-term economic performance did not improve substantially.

For this reason, it is a mistake to attribute positive or negative macroeconomic effects per se to structural reforms. To understand what effect these types of reforms can have in Argentina today, it is key to revisit the cases in which they were carried out, taking into account the contexts and starting points, as well as the effects of their implementation.

The effects of structural reforms on economic performance

The experience in Latin America

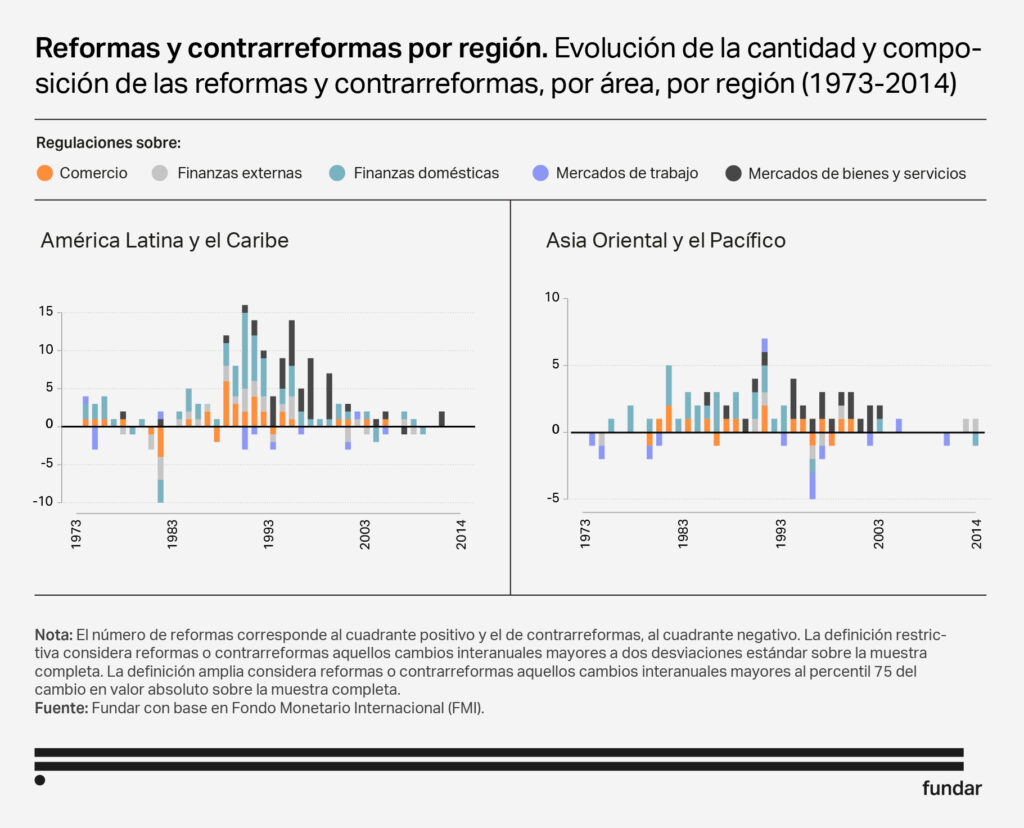

In the late 1980s and early 1990s, a large number of low- and middle-income countries undertook structural reforms, striving to reduce state intervention and take advantage of the opportunities offered by international markets.

In almost all countries, reforms were effective in boosting exports, attracting foreign investment and increasing productivity in “frontier” sectors. However in the case of Latin America, economic growth remained low and volatile, while domestic savings and investment remained depressed. While some sectors highly integrated into the global economy expanded, the benefits did not always spill over to the rest of the economy. This dualism generated adverse effects on income distribution, weakening the impact of growth on poverty reduction.

Despite their reform efforts, Latin American countries – with a few exceptions such as Chile – have not managed to accelerate their economic growth to a level sufficient to catch up with developed countries, or even to prevent the gap from widening further.

The miracle of Southeast Asia

Southeast Asian countries not only adopted structural reforms more cautiously and gradually but also relied on a broader set of tools, including industrial policy, with much better results. With the exception of isolated cases such as the Philippines in Southeast Asia, reforms were adopted more cautiously and without breaking the pattern of productive development, which allowed an uninterrupted catching-up process to be maintained.

While in Latin America structural reforms were adopted in a desperate attempt to cope with the negative repercussions of the debt crisis of the 1980s, in the context of a very fragile macroeconomy, structural reforms in Asia tended to reinforce the development strategy in place during the second part of the twentieth century.

The Argentinean case (reforms 1.0)

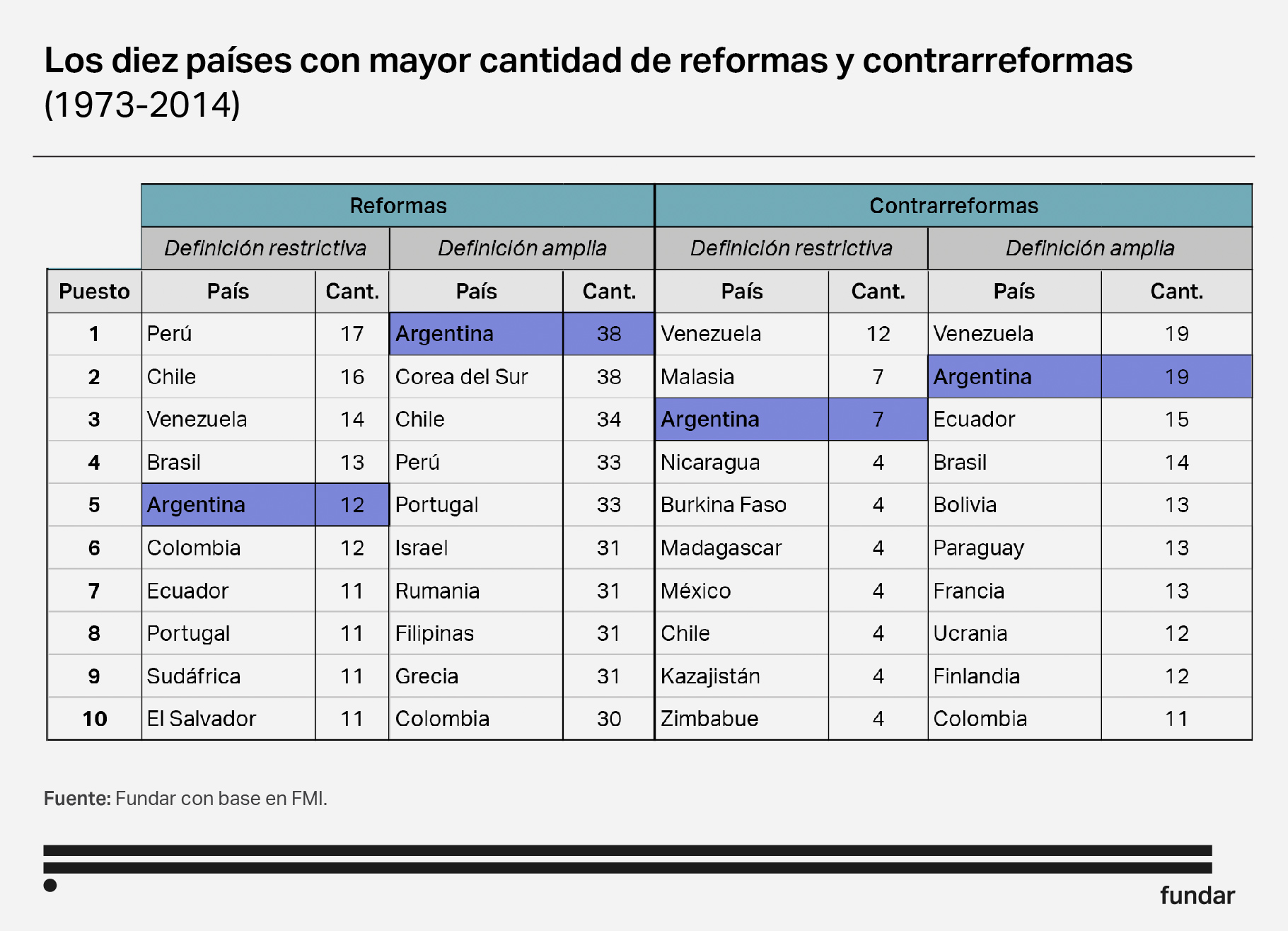

If we look at the countries that have implemented the most reforms and counter-reforms since 1973, Argentina stands out. In the country, the concept of structural reforms burst into the discussion in the context of hyperinflation and over-indebtedness. During the end of the Alfonsín government (1983-1989) and the beginning of the Menem government (1989-1999), the country undertook one of the most ambitious reform programmes, including significant trade and financial liberalisation, and the privatisation of public enterprises and the social security system.

As we saw in the regional analysis, the structural reforms adopted during the 1990s (the “1.0 reforms”) had some success in helping dynamic sectors and certain types of firms to access better and cheaper capital inputs and newer technologies, as well as diversify and expand internationally. However, by hindering the development of labour-intensive sectors, these processes were characterised by falls in employment and worsening income distribution.

What do these cases tell us?

Experience illustrates an important point when assessing the results of structural reforms. The effects of structural reforms should not be confused with those of macroeconomic stabilisation policies. At first glance, stabilisation programmes and the adoption of reforms seem to go hand in hand. But, as these experiences show, adopting structural reforms does not guarantee satisfactory economic performance.

Structural reforms do not necessarily improve a country’s macroeconomic performance. However, the lack of reforms should not be unconditionally positive either. As we saw in the comparative analysis, the reform agenda is an accessory that can, at best, assist the country in achieving its objectives.

Economic development depends on structural features that include issues such as capital accumulation, better quality infrastructure, a thriving national innovation system, and a healthy and well-educated population, among others. Stabilising the economy and underpinning structural features must come before any discussion of structural reforms. It can be achieved with very different degrees of state intervention, without the need to embrace all reforms.

In short, aggressively deregulating, as has happened in Latin America, does not guarantee the adoption of an economic model that combines macroeconomic stability with insertion into global value chains that allow for sustainable improvements in the living standards of the majority of the population. It is therefore essential that Argentina focus on stabilisation and the identification of a development strategy before reforming.

4 keys to tackling new structural reforms

To think about a “reform 2.0” agenda for Argentina that draws on international evidence and our country’s experience, the following is a list of dimensions to be taken into account.

- Structural reforms can complement, but never replace a well-designed macroeconomic policy. Macroeconomic stability has much more significant effects on variables such as inflation, growth, income distribution, poverty and employment.

- Reforms are not an end in themselves but a means to strengthen the structural characteristics of an economy. It is these that determine the possibilities for economic growth and improved living conditions. The development of dynamic economic activities is not a spontaneous outcome of deregulated and open economies, and there is a risk that other important economic sectors will be severely damaged. For reforms to be successful, they must be complemented by consistent macroeconomic policies and sectoral and social assistance policies.

- Caution is essential when introducing them, particularly when it comes to measures such as trade or financial liberalisation. In the past, their hasty adoption has led to an excessive accumulation of external indebtedness, resulting in financial crises, and a rise in unemployment that increased informality and poverty.

- It is desirable that reform programmes are designed domestically and that their formulation is clear on both essential and secondary issues. An overly ambitious package inhibits consensus-building on the core issues and creates greater risks of subsequent reversal.