Nuclear energy seems to be a thing of the past, but it could be key for the future of the world and also of the country. Argentina could produce nuclear reactors: the capabilities and infrastructure exist. What could be the role of this sector in Argentina? A study on the potential of the nuclear industry.

Illustration: José Saccone

Argentina needs to generate wealth. To do so, it can take advantage of the global nuclear industry, currently experiencing a potential revival due to climate change and political crises. Does the country have the potential to develop a Latin American nuclear market, before that opportunity is claimed by China, Russia, France or the United States? Is it looking for it? This paper provides an overview of the history of the nuclear industry, both global and local, analyzes the projects currently underway in Argentina and proposes a plan with the nuclear industry as the main driver for boosting the country’s industrial export capacity.

Nuclear energy on the brink of potential expansion

Nuclear power stands at a turning point. After decades of relative paralysis, there now seems to be potential for the deployment of new nuclear facilities. This responds to several reasons. First, the energy transition to mitigate climate change is gaining strong momentum. Second, with no economical technologies to store the energy produced from renewable sources, these cannot offer a solution by themselves. Accordingly, it appears that any robust and reliable roadmap must acknowledge a key role to nuclear energy.

So far, nuclear power is not on track to significantly increase its share in the global energy generation mix. However, the situation is changing at a dizzying pace. Russia’s invasion of Ukraine unveiled the vulnerability of fossil fuel energy supply and created growing interest in expanding nuclear energy capabilities.

Argentina's Nuclear Industry

Argentina has three nuclear power plants, all of them natural uranium-fired, with technology developed in the 1970s. However, there are conflicting opinions on a number of important aspects regarding the future of the industry.

There is an ongoing debate on how advisable it is to continue to use natural uranium technology for power reactors, switch to enriched uranium power plants, or even eliminate nuclear power plants completely for future energy generation. Meanwhile, over the last ten years, the country has been considering the purchase —not yet completed— of one or two reactors of this type from China.

What is the role of nuclear energy in Argentina?

With the current structure and installed capacities, Argentina does not need new nuclear power sources in the middle term (10 years).

The country has sufficient gas reserves to extract and export in significant quantities, as transitional energy for the next two or three decades; replacing both coal overseas and liquid fuels within the country, while also allowing for the expansion of the national generation park.

Electric generation from any of the newly emerging nuclear sources would be considerably more costly than gas generation.

A few years from now, Argentina will know whether it has its own nuclear generation technology (CAREM), which would make it unnecessary to buy a foreign reactor.

Also, supporting energy transition at the cost of more expensive power generation conflicts with the overall development of the economy in the list of national priorities, especially with current budgetary constraints and poverty levels. The adoption of expensive power generation technologies, like nuclear, finds less justification in Argentina, because of its low incidence overall, because investment in such technologies must be funded with public resources, and because the economy is currently in crisis.

Planning Argentina's nuclear future

What strategies should Argentina consider to expand the local nuclear industry? We will focus on two of them. First, the purchase and incorporation of a new large-scale reactor (Hualong-1 or “Atucha III”). Second, the development of a national small-scale reactor (CAREM) with potential not only for local supply, but also for export.

Importing a large-scale reactor

Fueled by increased economic development and population growth, demand is expected to grow 3 to 4% per year, thus doubling in 20 years. If the growth is distributed between renewables, gas and nuclear and in line with global trends, it would then be necessary to incorporate a new nuclear power plant virtually every 6 years.

Back in 2014, Argentina signed an agreement for the purchase of a Chinese reactor, which has not yet been concluded. This new reactor would make it possible to increase the energy supply to make up for the projected increase in demand, but the choice of model is not trivial. The Hualong-1 —to be purchased under this agreement— has been criticized. The main reasons are: the high risks of exceeding the original budget, a design with no real possibilities of replication (neither in Argentina nor in the world), and the high capital cost per MWe installed. If Argentina were to purchase a Hualong-1, the impact on the cost of electric power would be significant. Conservatively, it may be estimated at USD 82 per MWh, USD 20 above average costs (USD 62 per MWh).

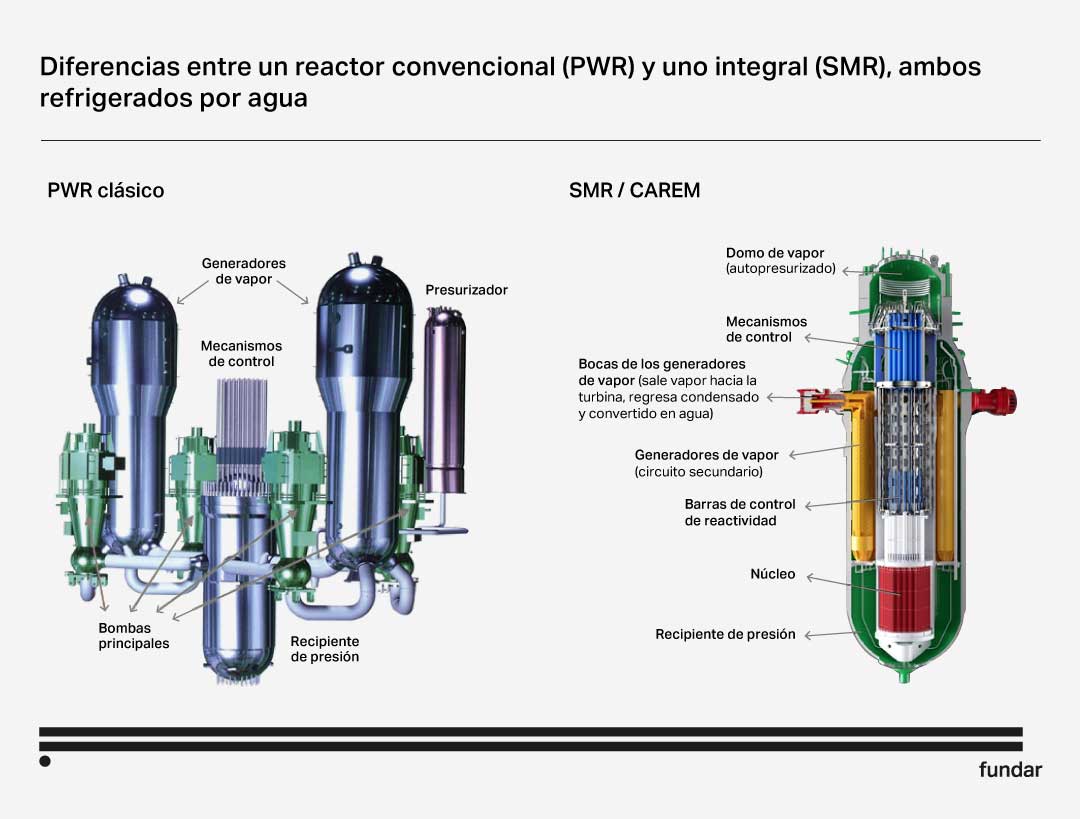

If Argentina decides to expand power generation while contributing to climate change mitigation, it needs to conduct a thorough analysis of the current global nuclear context. Nuclear generation as we know it today (based on high power reactors such as Hualong-1) could be the solution to decarbonization, but these reactors are expensive and two strong competitors have emerged. On the one hand, renewable sources, which have transformed the scenario in a few years. On the other hand, in the nuclear industry, small modular reactors (SMRs) could potentially present significant advantages.

Manufacturing the first domestic small-scale reactor

In the early 2000s, a multinational initiative was launched by 14 countries to bring innovative SMR designs to maturity. This alternative would reduce costs and construction time, due to serial and factory assembly. It would be a way to avoid the financial barriers that penalize the high capital costs of larger units. Their simplified designs also set new standards for passive safety; and their low power offers the operational flexibility required to combine them with renewables to compensate for their intermittency. There are many SMR designs in the world. Argentina is one of the few countries that is currently building one: CAREM.

CAREM is not alone. Of the more than 80 SMRs under development, 33 (41%) are similar to it. So, one might ask, what are the country’s chances of playing a role in the niche opportunities that are likely to open up in these years and capturing a share of the international market for such reactors?

After more than 35 years in planning, CAREM is currently at an advanced stage of full-scale construction. However, there is no certainty that it will be completed ahead of other competitors.

For the completion of CAREM in less than two years, it is estimated that the resources generated by the nuclear sector are sufficient. However, the construction of the first 4-module power CAREM, estimated at USD 3 billion, requires opening the project to joint ventures with companies, countries or investment groups.

Government and industry will have to work together, both identifying markets and accelerating the deployment of the first prototypes, to prove that the modular concept and factory assembly makes them truly competitive, something that is not yet evident in any of the proposals in the world.

The natural market for CAREM is Latin America, the current focus of China, and Russia. An aggressive export strategy will have to find a way to neutralize the advantages offered by Russian and Chinese offers. To this end, its close ties with Brazil could be strengthened to form a partnership where Brazil supplies the enriched uranium and our country supplies the reactors.

Drawing up a strategic plan to enhance nuclear development

The Argentine nuclear industry aspires to become a major player in the export market, contributing with high value-added products to the growth of the knowledge economy. It will achieve this by capturing part of the world SMR market, particularly in the region.

In a country close to proving that the national industry can make a small-scale reactor (CAREM) and whose modularization allows reaching any power value needed, it is paradoxical that it is considering buying a turnkey reactor with foreign technology.

It is a matter of setting priorities. It is suggested to declare a 5-year moratorium for decision making regarding the purchase of imported nuclear power plants. In that time, the world and Argentina will have a clearer picture of the role of nuclear energy in general and SMRs in particular.

The current national nuclear industry is a net profit generator. If the State were to reinvest them in the expansion of the sector, we would have a nuclear flourishing as rarely seen in our history. In fact, it would be enough not only to finance all the development projects underway (and more), but also to generate challenges, enthusiasm and expectations in professionals and technical profiles of the sector, substantially improving their job prospects and providing the country with a new and genuine source of wealth.