To find a virtuous path towards economic normalisation, Argentina must establish a viable and stable macroeconomic framework. In this direction, this paper studies and proposes a prudent regulation of the capital-financial account. It is neither with severe “exchange-rate restrictions”, nor with unrestricted liberalisation based on erroneous assumptions about the ideal functioning of markets. It is a regulation that takes into account the imperfect characteristics of international markets, the paths taken by other more successful countries, and learning from the historical mistakes of the Argentine administration.

A document written by Fundar and Suramericana Visión.

Argentina has failed to establish a consistent and stable way of inserting itself into international financial markets. In an international comparison, it has exhibited an excessively volatile policy pattern.

This paper first reviews the different tools that countries use to regulate capital inflows and outflows. These are then contextualised in international monetary and exchange rate regimes, especially those chosen by advanced countries and international institutions and organisations.

It also reviews the experience of capital-financial account regulations in Argentina since the end of convertibility. To this end, a comparison is also made with the regulations applied by a broad sample of countries and their link with certain structural characteristics of these economies.

Finally, a series of policy recommendations are proposed regarding the configuration that the regulation of capital flows should take. These recommendations are also available in the policy brief that accompanies this paper.

Instruments and policies for regulating capital flows

A taxonomy of regulatory form

In a general characterisation of the different types of regulations, a distinction is made between:

- Those that regulate cross-border financial activity by using the residence criterion, i.e. transactions involving residents and non-residents.

- Those that relate to the type of transaction, but do not discriminate between the residence of their originators. All types of transactions involving the use of foreign currency as a form of payment can be included under this category.

Flow Type |

Instrument |

Description |

| Inward flows | Settlement obligation | The requirement to settle certain flows to the central bank, avoiding arbitrage and channelling supply to the formal market. |

| Reserve requirements | Percentage of income from capital temporarily tied up in domestic non-interest-bearing accounts. | |

| Temporary immobilisation | Short-term immobilisation of assets to generate transaction costs and discourage speculation. | |

| Tax | Taxation of specific transactions or their return, generating tax revenues and discouraging speculative operations. | |

| Limits on use (quota or prohibition). | Restrictions on the purchase of assets or post-entry activities, such as limitations in strategic sectors. | |

| Outflows | Prior approval requirements and access limits | Restriction on the purchase of foreign exchange up to certain amounts or with prior central bank approval. |

| Post-dated access | Establishment of deferred access to payment transactions, similar to reserve requirements. | |

| Taxes | A tax that makes capital outflow decisions more expensive. |

Macroprudential regulatory policies

Regulation is not the only tool that affects capital flows, as the magnitude and allocation of capital flows are unconnected to other policies. In addition, there is a macroprudential policy.

This is another set of policies that seek to influence the behaviour of economic agents and the functioning of financial systems. Its objective is to prevent the breakdown of the payment chain of part or all of the financial system. This is what is usually referred to as “balance sheet problems”.

The aim is to achieve two simultaneous and interrelated objectives: to minimise the impact that changing external financial conditions can have on the domestic economy and, at the same time, to provide a policy framework to foster economic growth with employment generation.

The theory and practice of capital flow regulation: the positions of academia and international organisations

Over the last 50 years, the debate on the regulation of capital flows has evolved significantly. International financial institutions have followed the same trajectory.

The issue of capital outflow management deserves attention because of its role in the context of International Monetary Fund (IMF) programmes for Argentina. In the case of the 2018 IMF programme, there is a broad consensus that its financing has been used to fund capital flight. In such circumstances, the point is not so much whether the IMF should accept and legitimise exit controls requested by a member country, but why it does not require such controls when the alternative is widespread flight financing. Indeed, this seems to compromise the economic objectives of the programme.

It is crucial that IMF member countries pursue policies that take into account factors to control macroeconomic risks or reduce inequality. In a world where “market efficiency” is increasingly questioned as the sole provider of individual welfare, it is counterproductive to try to impose such one-dimensional views.

Recent developments in the regulation of capital flows in Argentina

Since the 1970s there have been at least three episodes of deregulation of capital controls in Argentina. Combined with a process of external indebtedness and real exchange rate appreciation, these have generated or contributed to macroeconomic unsustainability.

The first is the period between 1976 and 1982, led by the de facto government – self-styled National Reorganisation Process. This ended with the financial and external crisis that began in 1980. Then there is the episode that began in 1991 with the convertibility and ended in 2001 with a new financial and external crisis. Finally, there is the shorter one, which began in late 2015 and ended in 2018 with the reversal of the flow of external financing and the subsequent Stand-By programme with the IMF.

The reversals of capital flows generated severe problems in terms of economic activity, poverty and income distribution. These were no longer associated only with the business cycle but extended to continuous periods. Thus, the unsustainability of indebtedness and the restructuring of financial obligations to external agents led to decades of stagnation.

In other cases, regulations on capital flows in the country were not related to the need to avoid exposure to the volatility of international financial cycles. Rather, they sought to make up for inconsistencies in the exchange rate, and fiscal and monetary schemes prevailing in those periods. The extensive use of these controls, known as “exchange rate cepos”, has led to the emergence of wide exchange rate gaps. This has led to distortions in economic agents’ decisions and reduced incentives to export and attract long-term investment. The consequence was a slowdown in the expansion of productive capacity, to the detriment of the country’s economic growth.

Capital flow regulations in international comparison

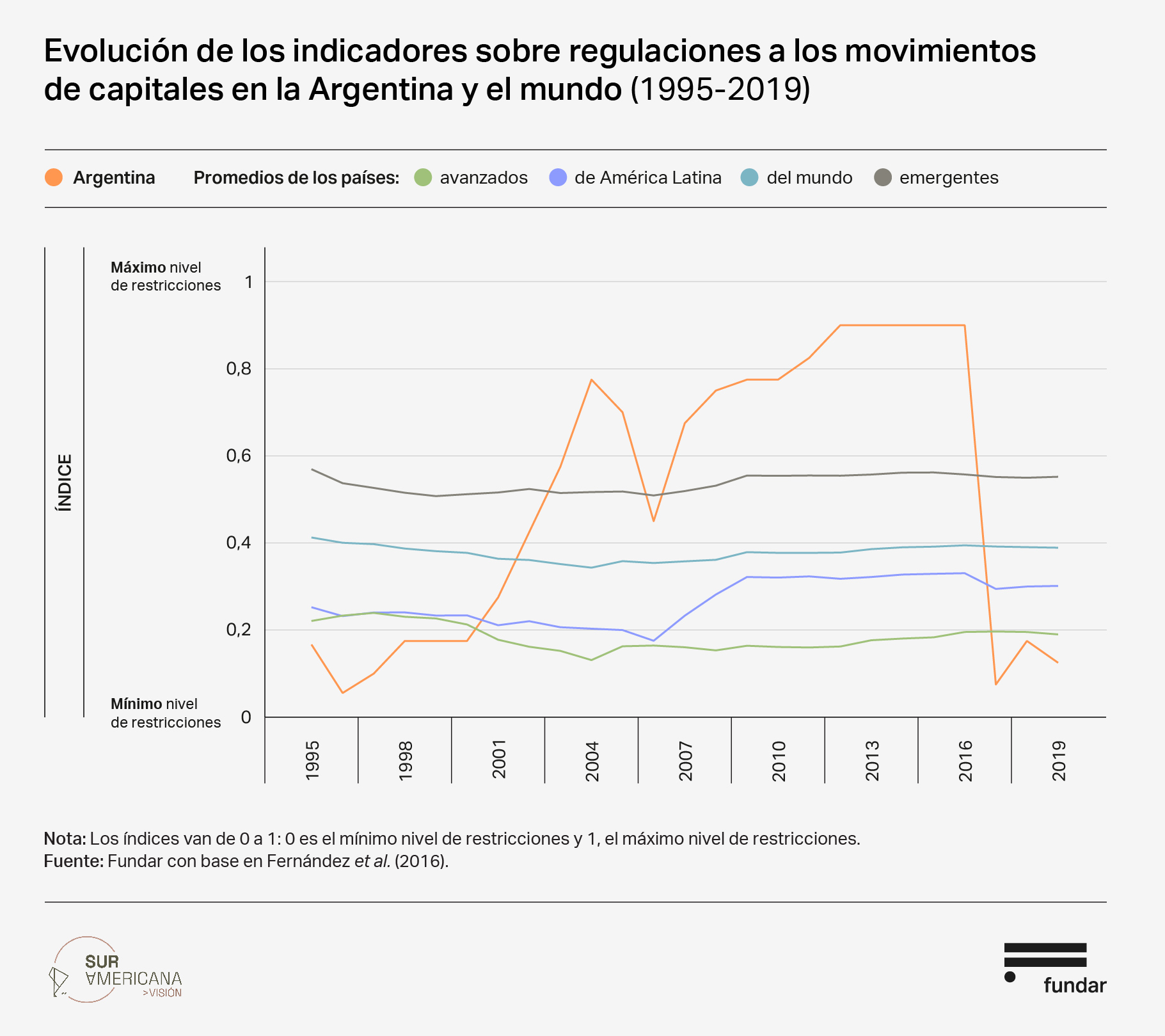

Argentina’s ups and downs in terms of capital flow regulation are reflected in the main “synthetic indicators” of capital movement regulations. Likewise, an international comparison of these indicators shows that Argentina has been one of the most volatile countries in the world in terms of regulation of capital movements.

The following graph clearly distinguishes between periods of full openness and others of strict restrictions on capital flows. During periods of deregulation, Argentina exceeds the average levels of financial liberalisation in the world -both advanced and non-advanced countries-. In stages of increased regulation, it exceeds average levels of controls.

Economies with different characteristics regulate capital movements to different degrees. It is useful to find patterns and trends to compare regulation in Argentina with that of similar countries. The choice of the set of characteristics to be considered is not trivial. These should be structural factors of the economies that are expected to influence the level of capital controls. On the contrary, they should not be measures associated with fiscal, monetary or exchange rate policy, as these are intrinsically linked to the choice of whether or not to regulate capital movements. In other words, the regulatory framework for capital movements imposes restrictions on the rest of the macroeconomic framework, and vice versa.

To this end, data from 99 economies between 1995 and 2019 were used to estimate the relationship between the level of regulations and a set of structural characteristics, detailed in the paper.

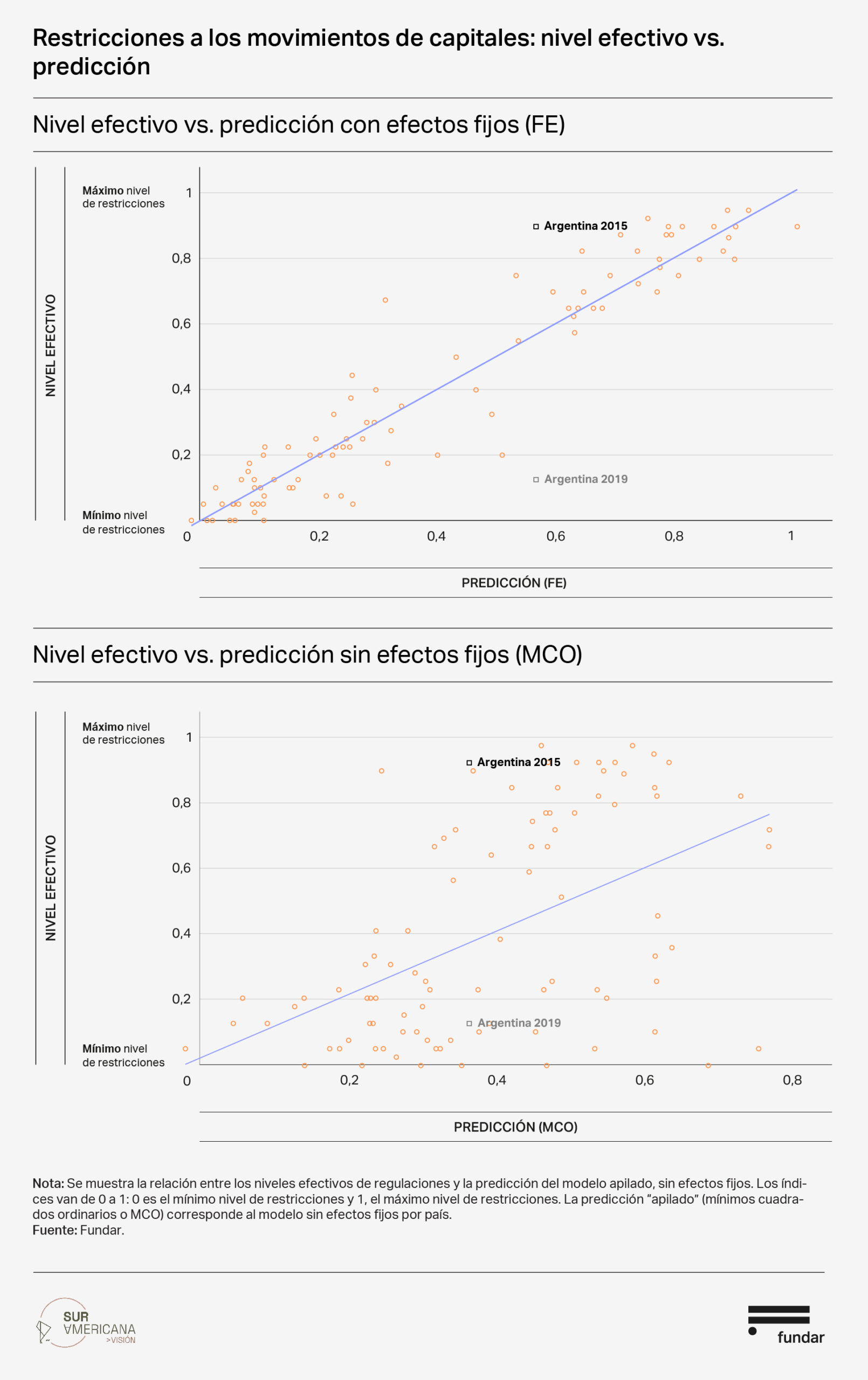

To assess the performance of the estimates, the prediction can be compared with the actual levels for each country in the world. This is shown in the graph below for the fixed effects model (first panel) and the stacked model (second panel). As can be seen, the former predicts quite well the extent to which countries regulate capital movements, while the performance of the latter model is poorer. In other words, the economies of the world are not too far away from the levels of regulations approximated by the fixed effects model.

Due to its structural characteristics, the estimate for Argentina is similar to the average for non-advanced countries when considering the fixed effects model. However, when the stacked model is taken into account, it is close to the world average (see the previous graph). That is, the predictions of the models are similar, although the one that controls for individual country effects does so at a relatively higher level. One interpretation could be that there are structural factors other than those included in the model that predict a higher level of capital controls for Argentina. However, this could also simply indicate that, over the period analysed, Argentina has had high average levels of controls.

In summary, from this analysis, it again emerges that regulation in Argentina is not only highly volatile but also that its fluctuations are particularly intense. It has combined in relatively short periods episodes of strong deregulation and others of greater control, always at a higher level, respectively, than advanced (more deregulated) and non-advanced (regulated) countries, and also with greater depth than the standards predicted on the basis of its structural characteristics.

Recommendations for the regulation of capital flows in Argentina

Establish macroeconomic conditions for strengthening the currency and the domestic capital market

Strengthening the currency and the domestic capital market is a fundamental step towards greater integration of capital flows without falling into recurrent balance of payments crises. One of the conditions for stabilisation is fiscal order, within a framework of growth, which reduces dependence on monetary financing and short-term external capital.

Convergence: no cap and trade liberalisation, towards prudential and permanent regulation of capital flows

Regulation should prevent the occurrence of disruptive events on the foreign exchange market and seek to establish limits that, although not restrictive under normal conditions, serve as a buffer against such events.

- The main tools for regulation are the reserve requirements or taxes that discriminate according to the term of the capital flow (reserve requirements ranging from 30% for capital flows of less than 30 days to 0% for capital flows of more than one year).

- Given the concentration of exportable supply in a few players, it is proposed to maintain the obligation to settle export revenues, although with terms and amounts that do not affect normal business operations (from 90 to 180 days for operations exceeding USD 75 million).

- In addition, it is proposed to establish prior compliance requirements with a high limit (converging to values above USD 3,000,000 per month, but starting with lower values), which allow access to the foreign exchange market but at the same time establish protection against foreign exchange risk situations.

- Finally, the accumulation of systemic risks should be avoided, for which macro-prudential regulation, such as norms and rules on public financing (including provincial and municipal) in foreign currency and foreign legislation, is essential.

Strengthen institutions dealing with the design, monitoring, control and enforcement of regulations

There is no single recipe for how these instruments should be calibrated. It is important to have effective institutions capable of designing, implementing and monitoring regulations. Domestic policy space should not be constrained by bilateral or multilateral agreements that liberalise trade and require liberalisation of capital flows. This requires improving the timeliness of enforcement of penalties for non-compliance, for example through administrative fines. This can increase the perception of risk associated with deviations from the rules, and thus strengthen the capacities of market regulators.