Until the 20th century, the textile-apparel industry was centralized in developed countries, but after World War II production was delocalized to peripheral countries. What drove the transformations in this industry? How did its evolution affect the different countries that -like Argentina- participate in this global value chain?

How did the textile-apparel industry evolve?

Evolution of textile and apparel production

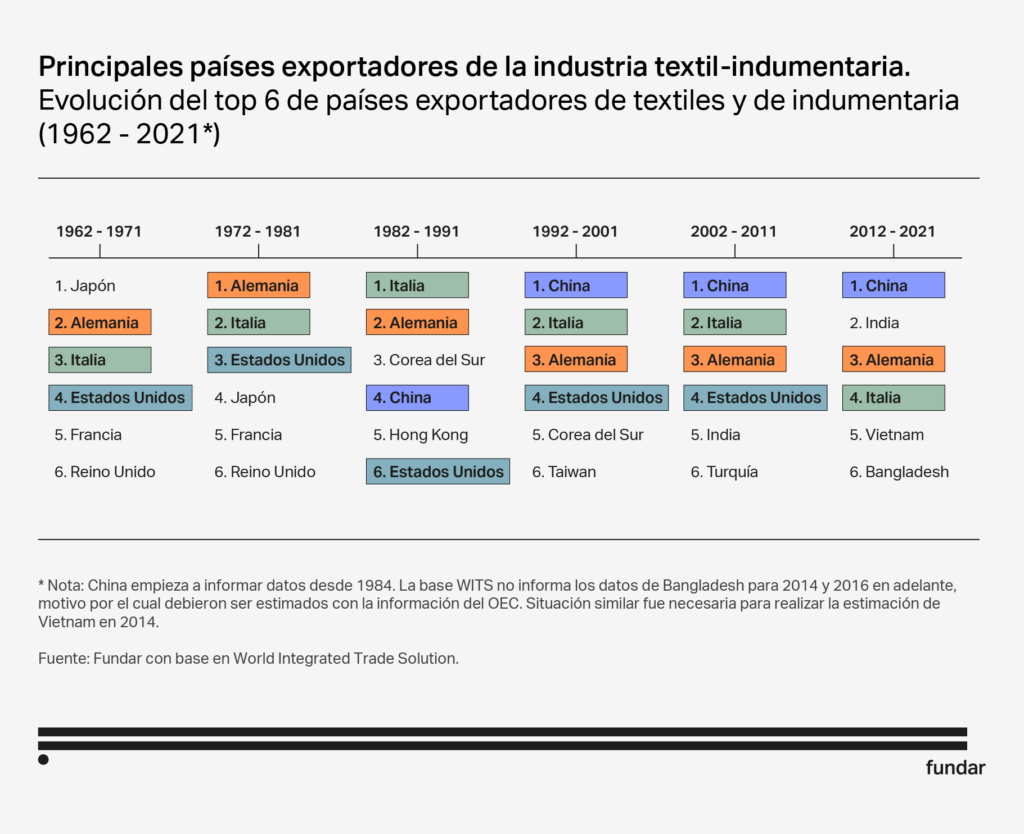

The first relocations were to Japan during the 1950s and then during the 1960s and 1970s to the so-called “Asian tigers” (South Korea, Hong Kong, Singapore and Taiwan). From 1980 onwards, the “dragons” (the Philippines, Malaysia, Thailand and Indonesia) joined in, albeit with less success. Since 2000, Bangladesh and other countries in the region, such as India and Vietnam, have gained participation. Since 1990, China has been integrated into the world market as the main global exporter, a position it still holds today. Some companies also retained industrial links in developed countries: this is the case of Germany with the manufacture of technical textiles or Italy with the production of luxury apparel.

By 2019, 74% of the global value added of the industrial links, both textile and apparel, leather and footwear was generated in Asia. This figure has China as the main world power, with 44.3% of the global product. Within this continent, it is followed far behind by India (6.8% of the total) and Turkey (3.2%).

By 2019, 74% of the global value added of the industrial links, both textile and apparel, leather and footwear was generated in Asia. This figure has China as the main world power, with 44.3% of the global product. Within this continent, it is followed far behind by India (6.8% of the total) and Turkey (3.2%).

Employment trends in the textile-apparel industry

For developed countries, offshoring and the formation of global value chains meant, on the one hand, a significant reduction in the cost of clothing and, on the other, the destruction of thousands of jobs in this sector.

In underdeveloped countries, this meant the creation of thousands of jobs for workers from rural areas, particularly women. Although wages in this chain were much lower compared to those in advanced Western countries, rural-urban migration meant, in many of these nations, an upward social mobility that, in part, explains the significant reduction of their extreme poverty during these decades.

Globally, in 2018, the apparel textile chain employed 70 million people, 2.2% of total employment. This employment is much less geographically concentrated than production. For example, China accounts for more than 30% of global exports in this chain and 44% of added value, but only 22% of employment. The reason: the productivity of people employed in China is twice that of the world average. Conversely, South America accounts for 5.7% of employment and only 3.8% of production in this industry.

Evolution of international trade in the textile-apparel industry

Since the middle of the 20th century, global trade has grown significantly with the birth of the General Agreement on Tariffs and Trade (GATT). However, due to its importance for employment in developed countries, trade in textiles and clothing was restricted by international treaties until the end of the 1980s. It is only since 2004 that it has been unrestricted.

World exports of the sector grew until 2011 and have remained stagnant since then. This phenomenon is partly explained by China’s shift towards a development strategy more focused on the domestic market (and not so much on exports, as had been the case between 1990 and 2010). If we take into account the global exchange of manufactured goods, this had an even greater dynamism. For this reason, the sector’s share in manufacturing trade declined.

How has this evolution affected the countries that participate in the textile-industry chain?

The textile industry in developed countries

The textile-apparel industry in developing countries

In several Asian nations (such as Japan, South Korea and, recently, China), the growth of their textile-apparel chain and the shift from being exporters of raw materials to exporters of textile and clothing products initiated a process of industrialization that later became increasingly complex as they developed productive capacities in other more complex manufacturing sectors.

Similar trajectories were observed both in the countries that industrialized early in the 19th century (such as the United States and continental Europe) and in those that industrialized late in the 20th century (East Asia).

The industrial policies applied by these states allowed them to move towards other industrial activities with higher added value and technological intensity. In these cases, specialization in the textile industry served as a gateway to manufacturing activity and global value chains.

As the availability of unemployed labour migrating from rural areas was reduced, wages increased. This resulted in the loss of the original competitive advantage (low labour costs). For this reason, the simpler stages of manufacturing (such as clothing) were relocated to nearby countries with a higher relative backwardness (such as Vietnam or Bangladesh).

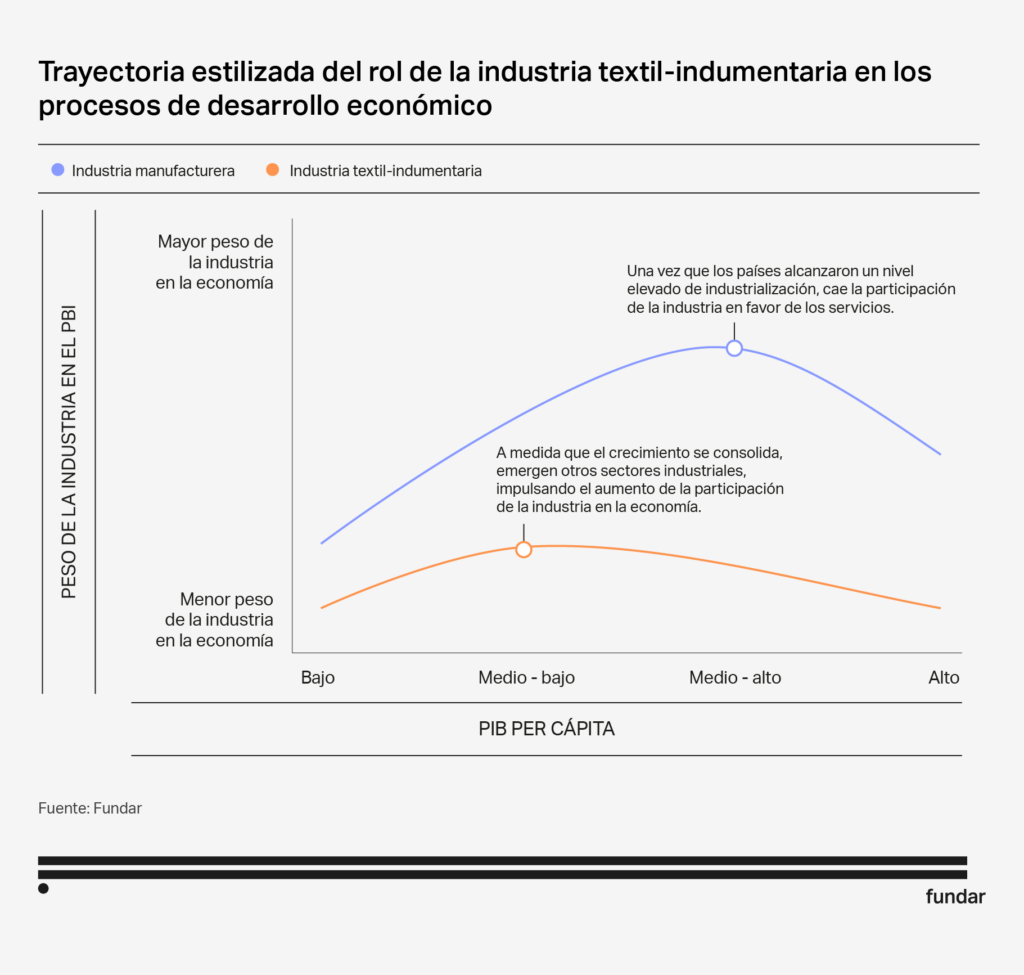

- When countries begin their industrialization – from mostly agrarian-rural societies to urban and increasingly industrial societies – GDP per capita tends to grow and this sector plays a significant role as the initial engine of industrialization.

- As this growth consolidates, other more dynamic and complex industrial sectors emerge (for example, the metal-mechanical or chemical industries), which contribute significantly to the growth of the economy. These new sectors are gaining weight, not only within the industrial product but also driving the increase in the share of industry in the economy. At the same time, the textile industry began to lose relative weight, both in its contribution to total GDP and, in particular, to industrial GDP.

- Once the countries reached a high level of industrialization and per capita output, the share of the industry fell in favour of services, particularly those intensive in skilled employment (such as telecommunications, information technology, professional, technical, educational, health and financial services)

This “upgrading” in this value chain is not an automatic or universal trajectory for all countries, but a situation that occurred in late-developing Asian nations. Other countries that were inserted in the last decades continue to be trapped in the same links, without achieving improvements towards other activities of greater profitability and/or social benefit.

The textile-apparel industry in Argentina

In 2022, the textile industrial link accounted for 0.4% of Argentina’s gross value added at current prices, while apparel had a 0.5% share (according to INDEC). In other words, only the industrial stage of the chain accounted for 0.9% of GDP. However, in 2005, it had reached 1.6% of GDP. As in most middle- and high-income countries in the world, the textile-apparel industry has been losing share in recent decades.

Evolution of the textile-apparel industry in Argentina

In our country, the textile-apparel industry has had an erratic trajectory. Since its emergence in colonial times, it has had moments of growth and major crises. If we look at the evolution of the sector, we see over the years some key variables. On the one hand, the development of the apparel textile industry is linked to macroeconomic cycles: during years of GDP growth, the number of industrial companies in this chain generally grew as well. Improvements in the economy and wages are determinants of consumption levels. Production and trade policies are also key: favourable incentives for domestic production (or the absence of them) as well as more or less protectionist measures against imports have their correlation with the number of formal industrial enterprises.

1895 -1935 Birth and growth of the local industry

The Argentine textile industry is one of the oldest in the national industry. It dates back to the 1600s, with the handmade production of ponchos. These ancient regional economies practically disappeared during the 1800s due to the massive importation of English garments. However, by the end of that century, imports fell substantially due to higher tariffs and currency depreciation.

During the first decades of the 1900s, merchants from all over the country -who originally sold imported clothing- began to manufacture their garments and this industry became an emblematic sector of import substitution industrialization (ISI).

1935 -1975 ꘡ Production peak and insertion into the global market

The interruption of global trade due to World War II and Peronism’s impulse to ISI boosted its growth. Between the mid-1950s and 1975, the sector’s production continued to grow, although at a slower pace than other branches of industry. Production was concentrated in larger industrial establishments (such as the iron and steel, automotive, metal-mechanic and petrochemical industries). In the 1960s and 1970s, this sector had achieved an important export insertion. Argentina exported mainly cotton fibre and sheep wool.

1975 -2003 ꘡ Decline of the industry

Between 1977 and 1981, the last military dictatorship cheapened the dollar and liberalized foreign trade, which stimulated the entry of a large amount of foreign products, particularly clothing. The average real wage fell, further depressing the sector’s sales. And interest rate hikes and the end of subsidized credit to the productive sector strongly increased costs, affecting its profitability.

The 1990s were marked by a new wave of liberalization. Convertibility, trade liberalization and deregulation once again set favourable incentives to import. This combined, since 1998, with the onset of a prolonged recession, which hit sales and affected the sector even more.

By 2003, employment in the sector was 61% lower than in 1973, while the number of establishments had collapsed by 55%.

2003 - 2022 ꘡

The last twenty years

2002-2011

From the end of 2002 to 2011, Argentina began a process of strong economic growth that reduced unemployment and increased purchasing power, boosting consumption and strengthening demand.

2012-2015

From 2012 onwards, import controls became a central axis of the productive policy. This period was also characterized by the promotion of industrial branches, such as credits to the productive sector and the consumption of durable goods (such as the Ahora12 program).

Despite these incentives, the low economic dynamism of the period and the growing macroeconomic problems explain why production levels contracted considerably.

2016-2019

With the change of government, import controls were eliminated and credit subsidies to the productive sector were discontinued. Successive devaluations in 2018 and 2019 accelerated inflation and generated a marked contraction in purchasing power and local consumption.

This scenario was negative for economic activity in general, although particularly more intense in the manufacturing industry and, within it, in textile-apparel industry.

2020 – 2022

Towards the end of 2019, the new government introduced important changes in the incentive scheme. Foreign trade administration policies were resumed and productive credit and consumption were again subsidized. But the outbreak of the COVID-19 pandemic represented a new negative shock.

Between 2021 and the first half of 2022, the economy, in general, and this sector, in particular, experienced a strong rebound. However, while the manufacturing industry surpassed 2018 levels, the textile-apparel industry achieved only a moderate recovery.