In Argentina, a judicial process to determine compensation for a road incident can take up to 6 years on average. This delay, combined with the impact of inflation, puts at risk the right of victims to receive fair compensation. However, the analysis of this phenomenon reveals disparate criteria and insufficient solutions. We analyse this situation to understand how inflation can affect the proper performance of the justice system and consider ways to address this challenge.

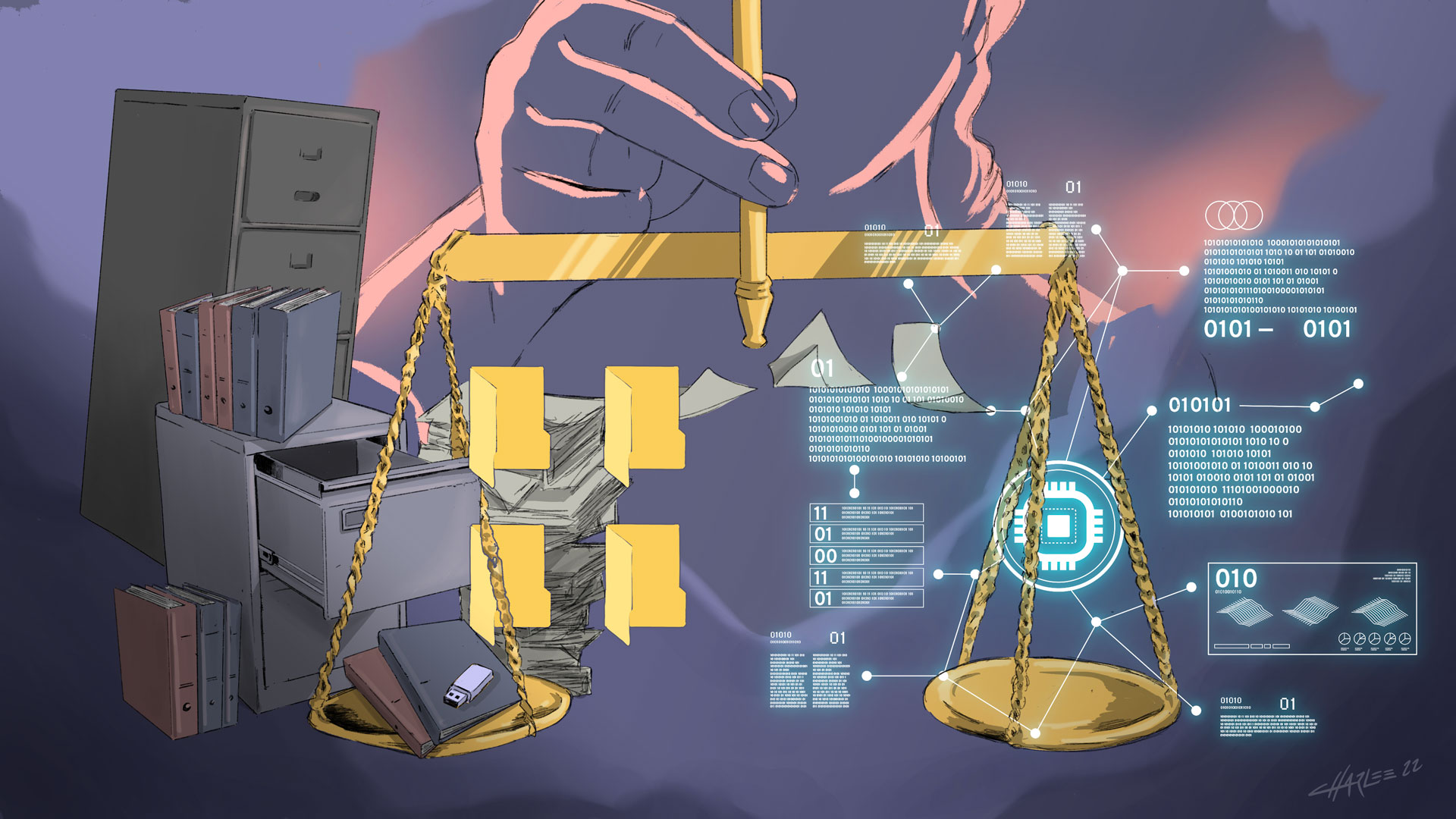

Illustration: Charlee.

What are the main challenges for the judicial calculation of compensation in inflationary contexts?

An analysis based on the case of compensation for road incidents

In recent years, the Argentinean justice system has faced a particular challenge which, although not new compared to other periods in our history, has highlighted the multiplicity of factors that can affect the effectiveness of the system in responding to claims involving rights of great importance to individuals. Since 2008, the Argentine economy has been experiencing a scenario of increasing inflation, making the work of judicial operators in calculating compensation or other forms of property rights more complex.

An illustrative example of the impact of this macroeconomic phenomenon on the functioning of the justice system is the judicial procedures for the determination of compensation in cases of road incidents and work-related accidents. A large number of cases are processed in the justice system in which financial reparations must be determined for people who have suffered physical, psychological or moral damage in different circumstances. This paper seeks to elucidate the effects that judicial delays, inflation and the absence of common criteria for adjusting compensation may have on the results of this type of proceedings. In particular, it explores the extent to which the compensation awarded to victims of road incidents set by the courts complies with criteria of reasonableness and proportionality.

Starting point: delays in the processing of road incident cases

Although in recent years it has been shortening, the average time it takes to resolve a road incident case (from the beginning of the lawsuit to the Chamber’s ruling) is seventy months and twenty-two days, i.e. almost six years. These are very long times considering that, for example, in 2020, EU countries had an average resolution time for civil and commercial cases of around fourteen months. This lengthy duration reflects an inefficiency in the administration of justice and can have serious implications for the full reparation of the damage suffered.

The interest rate applied to the amounts of the judgments to define the final amount of compensation is set by the National Chamber of Civil Appeals and varies according to the chamber of the Chamber involved in the case.

Different interest rates applie

The time limits are not the only thing that affects the compensation of the injured parties, but also the currency depreciation. In addition to the long duration of the cases, there is the inflationary context that our country is going through. Given this, adjusting debts according to inflation would be the most appropriate approach. However, this is vetoed by law (Convertibility Law, as amended by Law 25.561) and, in practice, there has been no single way of making this adjustment.

The interest rate applied to the amounts of the judgments to define the final amount of the compensation is set by the National Chamber of Civil Appeals and varies according to the Chamber of the Chamber involved in the case.

| Adjustment rates applied to compensation payments | |

| BNA lending rate | The lending rate of the Banco de la Nación Argentina (BNA) is applied from the beginning of the claim until payment is made. |

| Mixed rate | 8% per annum from the beginning of the lawsuit until the date of the first instance judgment; and the BNA lending rate from the judgement until payment is made. |

| Double BNA lending rate | The double lending rate BNA applies from the start of the claim until payment is made. |

| Double lending rate BNA (from 31/7/15) | The BNA lending rate is applied from the event until 31/7/15 and thereafter double the BNA lending rate until the actual payment

(only for some files, depending on that date). |

Source: Fundar, based on Legal Hub database (2001-2018).

Sizing the impact

In the absence of a unified criterion, there is a great disparity for the injured parties. These differences end up representing several million pesos and depend on chance as they are related to the draw of the Chambers that intervene in each case.

Let us take the case of a case decided by a chamber applying the BNA active rate, where the injured party received compensation of $9,593,320 (at February 2024 prices). If the same case had been decided by a chamber applying the mixed rate, the injured party would have received $2,306,037, 25% of the amount paid. On the other hand, if the case had been processed under the dual active BNA rate, the person would have received $68,105,827, seven times more than the compensation awarded.

Three scenarios for measuring the impact of court times and adjustment rates on compensation awards

Para entender cómo estos extensos plazos judiciales y las diferencias de tasas afectan las indemnizaciones, resulta útil analizar los montos pagados en relación, por un lado, a la inflación del período (para definir si perdieron o no poder adquisitivo) y, por otro lado, al costo de oportunidad del capital adeudado (esto es, lo que la víctima dejó de percibir por no disponer de ese dinero).

Counterfactual scenario 1 - Did the amounts received manage to offset inflation and the opportunity costs of that capital?

This first scenario adjusts the amounts of sentences to, on the one hand, preserve the value of money throughout the judicial process (taking the Consumer Price Index, CPI) and, on the other hand, to compensate for the opportunity cost of capital (taking the pure interest rate of 6%, which is usually used in the civil court in this type of cases).

In the vast majority of the cases analysed (90%), the injured party would have received a higher (more convenient) compensation than the one actually received if, instead of the applied rate, the amount of the judgment had been adjusted by CPI and a pure rate of 6%. The only case where this is not the case is for those who received the adjustment for double BNA lending rate.

In other words, if the case was resolved by a court that applied a mixed or BNA rate, the indemnified person was neither able to maintain the value of his money throughout the process, nor to recover the opportunity cost of his capital; while in cases where the double BNA rate was applied, the indemnities are not only adjusted above inflation but also show a capital appreciation at higher levels than the Lebacs/Leliqs rates.

Counterfactual scenario 2 - Did the amounts received manage to compensate for inflation?

This second scenario seeks to identify whether or not the rates applied were higher than the CPI and, therefore, whether or not the compensation paid managed to restore the value of the money once the process was over.

42% of the cases analysed would have obtained a more convenient compensation than the one received if the adjustment had been made based on the CPI (as proposed in counterfactual scenario 2). This implies that in almost half of the cases, the rates applied are not sufficient to restore the value of the money. Again, those who suffered the most were those who received a blended rate, whose compensation would have been 240% higher if they had been adjusted for CPI from the beginning of the process.

Counterfactual Scenario 3 - Did the amounts received manage to offset the opportunity costs?

This third scenario allows us to compare the amounts that the courts demanded to be paid to the insurers in the judgements with the yield that the same capital would have had in investments in Lebacs/Leliqs during the period in which the process lasted (almost six years on average) to investigate the impact that the judicial terms in combination with the adjustment rates used have on the opportunity cost of the capital of the injured parties.

52% of the cases analysed received a less convenient (lower) compensation than the profit they would have obtained if they had invested the judgment amount in Lebacs/Leliqs during the judicial process. Those who were mainly harmed by the unavailability of the money were the cases whose judgment amounts were adjusted with a blended rate. By contrast, the amount of awards adjusted at the dual BNA rate was higher than the gain they would have obtained from investment in Lebacs/Leliqs. In the middle, for BNA lending rate-adjusted compensation, the loss becomes more visible from 2015 onwards.

What is the impact of court times and adjustment rates on compensation?

In most of the cases analysed, the rates applied are below the inflation rate of the period, which is why they are not sufficient to restore the value of money. At the same time, most of the compensation adjustment rates also fail to compensate for the opportunity cost of capital of the injured parties. This “double” economic loss is observed especially in those courtrooms where compensation amounts are adjusted at the blended rate and, in some cases, the same happens when the BNA lending rate is applied.

While this seems to be mainly borne by the victims, there are cases where insurers have been forced to pay updated claims well above inflation and a reasonable opportunity cost. Such distortions may be creating greater incentives to litigate such cases and avoid pre-litigation settlements. The direct consequence is an increase in the number of cases and thus longer delays in the resolution of cases and a worsening of the quality of outcomes.

Four recommendations to improve the judicial calculation of compensation awards

Promote in the National Congress the discussion of a legislative reform to overcome the regulatory obstacles that limit the updating for inflation of compensation payments

As the description of the recent jurisprudential debate on the subject shows, the current regulatory framework offers more limitations than opportunities to address the challenges that inflation entails for the calculation of compensation. It is the responsibility of Congress to adapt it correctly, to provide a fair solution for all parties.

Unify the criteria for calculating and adjusting compensation payments

All chambers must find a unified approach that allows them to jointly face the challenge generated by high inflation. The means to achieve this is a plenary agreement that establishes a single way of adjusting awards and ensures that the instruments used do not unfairly disadvantage parties, ensure fair redress for victims and do not increase incentives to litigate.

Establish an adjustment rate that takes into account the effect of inflation and opportunity cost

The choice of a fair rate should be guided by the search for a formula that adequately reflects inflation and opportunity cost. In this regard, we suggest that a possible alternative could be the use of a CPI-adjusted rate plus a rate of between 1% and 3% to compensate for the opportunity cost of unavailable capital.

Reducing delays in judicial proceedings

It is essential to promote a re-engineering of the road incident process to improve the efficiency of the system, shorten times and provide financially fair redress. The first step in this regard is to make efforts, starting with the unification of the interest rate, to reduce litigation levels. This should be accompanied by reforms to modernise the process, either through greater orality (especially in the evidentiary stage) or the incorporation of technology to simplify and automate steps and tasks.