The path to electric mobility has sped up globally over the last decade. Beyond the pace of its future evolution and the uncertainty as to the choice among the possible technological alternatives that will eventually replace internal combustion engine vehicles, the change already seems imminent and poses enormous challenges for countries. Particularly for those countries that, like Argentina, have an important local automotive industry based on traditional technologies.

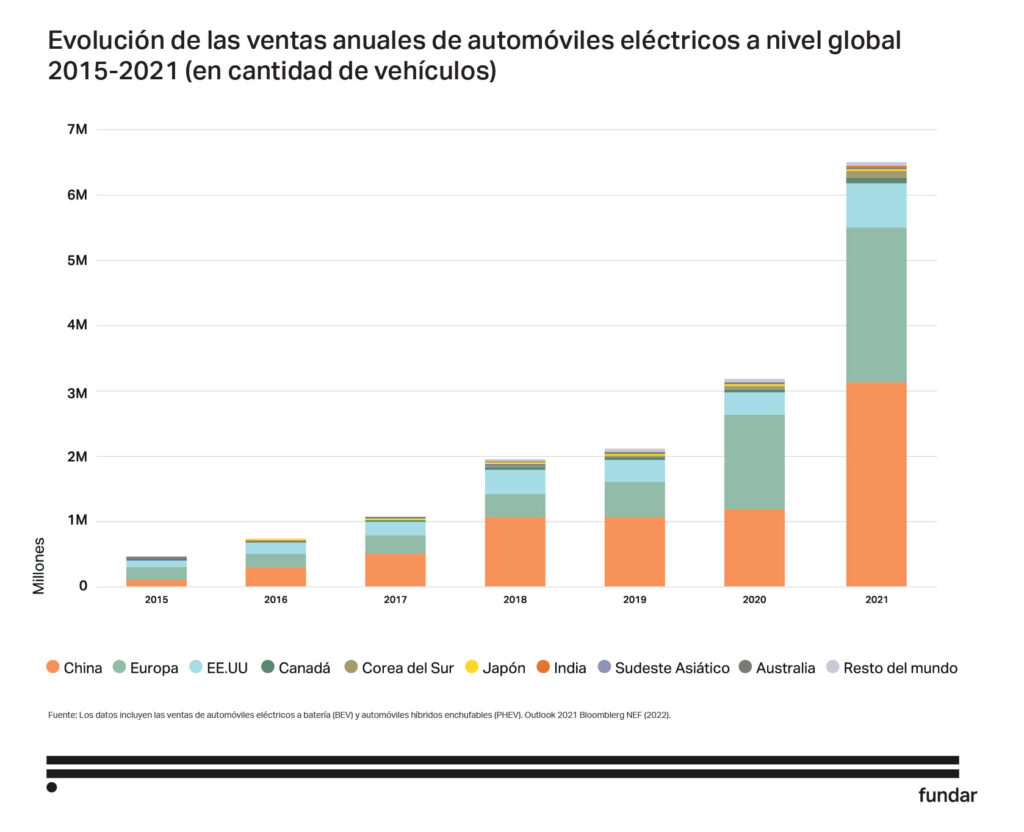

Electric vehicles are gradually and increasingly penetrating the market. Global annual sales of electric cars increased from 130,000 units in 2012 to more than 6.5 million in 2021 (IEA, 2022). Although they still account for less than 9% of total sales, they have doubled 2020 figures and consistently exceeded previous year’s forecasts every year. Meanwhile, other electric vehicle segments such as motorcycles, buses and light commercial vehicles have also seen a significant increase in sales.

This growth may be explained by country motivations related to the reduction of CO2 emissions and dependence on fossil fuels, climate change mitigation and, in the case of countries with longstanding automobile industries, the need to remain competitive in this newly emerging global value chain.

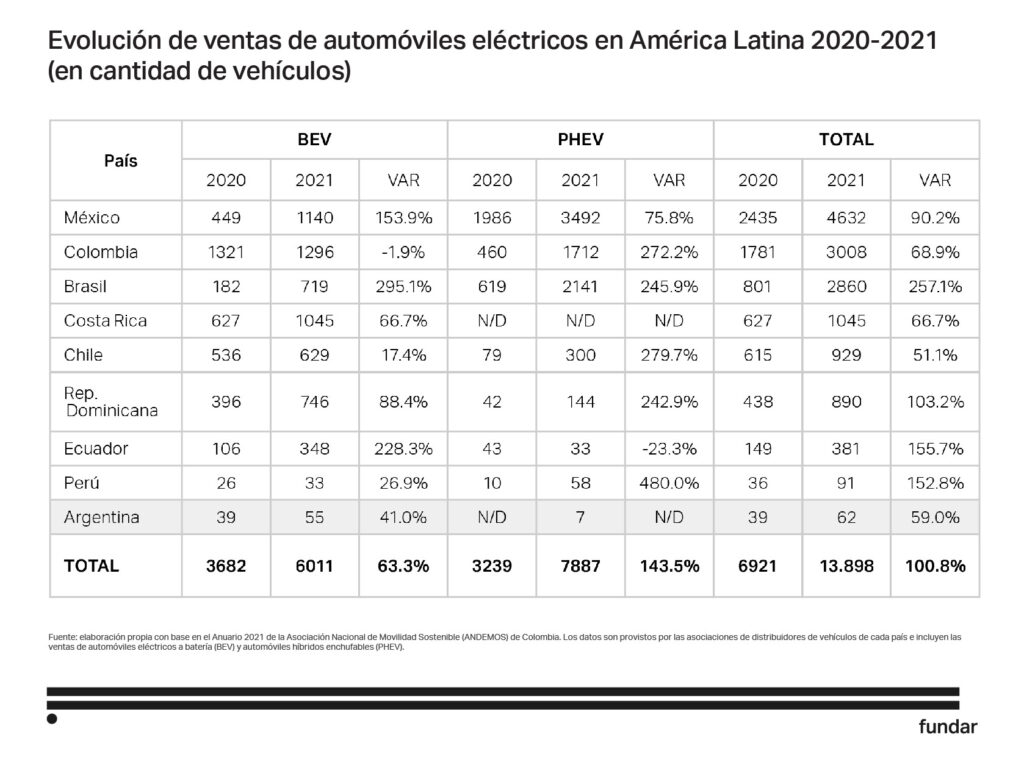

Unlike China, India and developed countries in Europe and North America, the transition to electromobility in Latin America is still at a very early stage. Sales of battery electric cars (BEVs) and plug-in hybrids (PHEVs) totaled 13,898 units in 2021, almost 2x the number sold in 2020 (6,921 units). In the region, sales were led by Mexico (4,632) and Colombia (3,008), with Argentina trailing far behind, with only 62 units sold in 2021. The still marginal penetration of these vehicles is almost exclusively attributable to imports facilitated by tariff cuts and tax-exempt sales.

The transition to electromobility creates new links between transportation systems and energy systems, entails substantial transformations in the organization of global production and value chains, and paves the way for the repositioning of firms and countries as well as the emergence of new competitors. In this sense, it represents a challenge, threat and opportunity for Argentina, which has an important automotive industry in terms of employment and production.

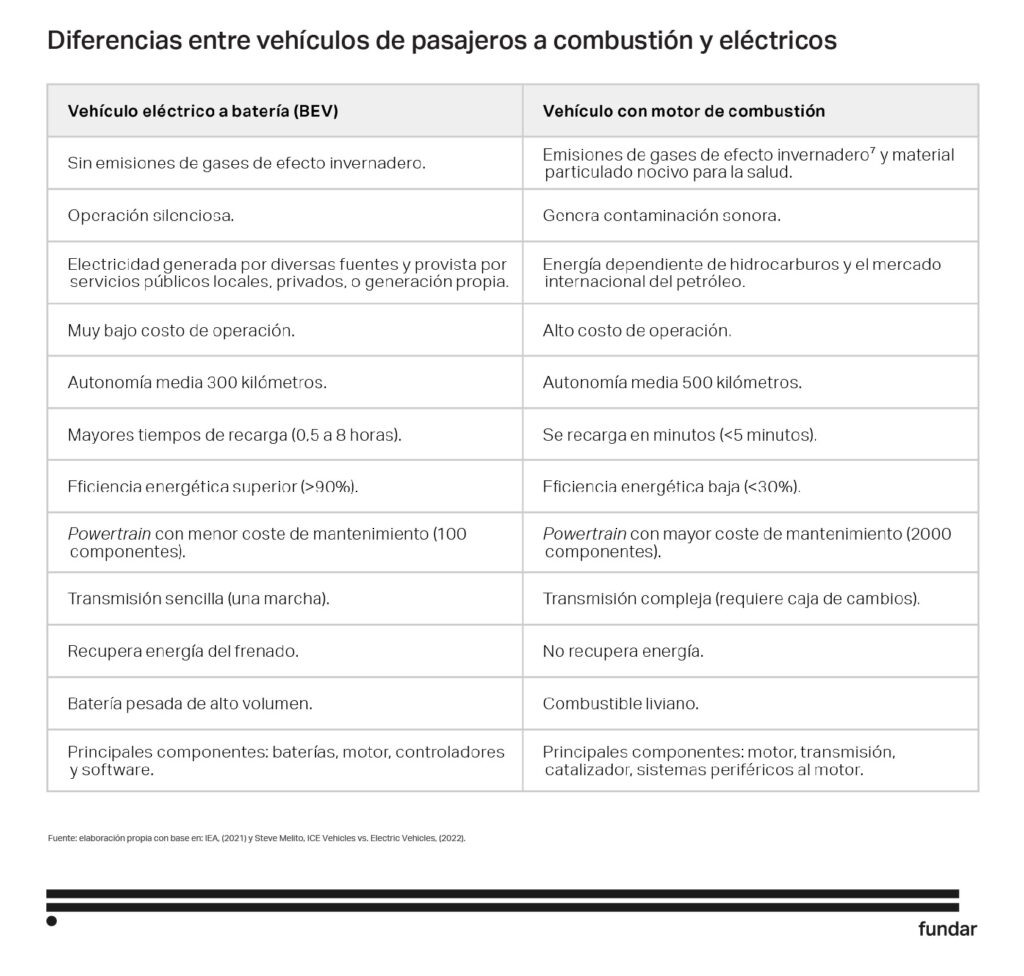

The change of paradigm brings about a gradual abandonment of traditional components and technologies, prioritizing the role of other technologies and actors, such as electronics and software. By way of example, a battery-electric car has, on average, 2000 fewer components than a combustion vehicle (including engine and transmission systems, precisely one of the few auto parts that Argentina exports relevantly outside the region). In turn, it requires high power and duration batteries, electric motors and the associated thermal management systems, the incorporation of lighter materials, new tires compatible with the higher weight of the batteries and a more intensive use of electronic, electrical and connectivity devices that interact with the vehicle’s powertrain, among others.

However, the traditional automotive industry also offers a set of advantages to join the global productive transformation process. New technologies require many of the firms developed by automotive and auto parts companies operating in the traditional paradigm, both technical (mechatronics, software and new materials) and organizational (lean production systems). Also, some areas where the gap in capabilities between Argentina and the world has historically been unfavorable, such as internal combustion engines, will be displaced by batteries and electric motors. These components rely heavily on chemical and electromechanical knowledge, which represents a comparative advantage to be explored by Argentina in the face of a global reconfiguration of the value chain.

Some links in which the capacity gap between Argentina and the world has historically been unfavorable, such as internal combustion engines, will be replaced by batteries and electric motors.

Improving the competitiveness of the automotive industry and boosting exports in the context of the transition towards electromobility requires exploring the conditions related to market opportunities, productive capacities and existing barriers in Argentina for local component integration. In which segments and components should the Argentine industry specialize and what international insertion strategy would best serve its insertion? How would the country regulate the charging system and would it promote the expansion of the corresponding infrastructure? How would incentives be assigned and the scientific system be improved in order to coordinate it effectively and efficiently with the productive system? How would the technological transition be managed in relation to the actors of the traditional automotive industry? How would the country design and implement a long-term policy and strategy with the high technical capabilities and skills required to coordinate the various stakeholders and mechanisms?

In an attempt to respond to some of these concerns, assess the potential of Argentina’s automotive industry and the public measures and policies required, we developed a method based on the diagnosis prepared by the Council for Structural Change and Fundar’s “green” industries analysis. This method has never before been used, as far as we know, to analyze Argentina’s electromobility industry, and in our view proves appropriate to rethink a mid-term industrial and institutional policy.

We disaggregated the powertrain of an electric vehicle into its main systems and components and identified the technical and institutional barriers to its production, the technical capabilities and know-how required, the predominant global market organization and some “successful” business cases and policy experiences. The purpose has been to aid in formulating an industrial policy aimed at maximizing the local integration of parts and components and their associated technological development. Within this framework, three working groups were organized, focused on the battery pack, micro-mobility and bus segments, with the participation of 24 individuals from the business sector, the scientific-technological system, public technological organizations and sectoral experts. Ten individual interviews were also conducted with business stakeholders in order to design, prepare, and inform working table discussions, as well as validate important technical information.

This research systematizes the discussions held at three meetings called to discuss the situation and potential of Argentina’s electromobility industry and outlines proposals intended to go beyond a general framework for investment promotion. The recommended actions are complex in terms of design and coordination, and are not exempt from probable tensions; they will surely require time for maturation, progressive and sequential implementation, and constant monitoring of emerging opportunity advantages. At any rate, it is imperative and essential to design a roadmap balancing urgent needs with long-term challenges, and outline a strategy to promote Argentina’s successful insertion in global and regional electromobility chains. Failure to enhance required technological and institutional capabilities not only carries the risk of missing the productive transformation call but also of losing hard-earned accumulated industrial assets.