It has become a matter of public debate whether to maintain or revise Tierra del Fuego’s Regime. Other than general references to a need for change and even calls for immediate termination, there are no concrete proposals or guidelines to facilitate the discussion and consensus necessary for any modifications. To address this need, this second paper in the series Towards a possible productive transformation in Tierra del Fuego puts forward a Proposal for the Reformulation of the industrial sub-regime and analyzes its impact on key economic and social factors, including production, employment, prices and fiscal costs.

Reformulating the Tierra del Fuego Regime

This paper proposes a reformulation of the Tierra del Fuego Regime that seeks to gradually reduce —over eleven years— most of the tax sacrifice associated with the industrial sub-regime and overhaul tax incentives to foster innovation and enhance value creation. The proposal is supplemented by Paper 3 in this series, which addresses the construction of a more competitive productive base, less dependent on state support, with robust social protection mechanisms to encompass this transformation.

Any proposed amendment to the industrial sub-regime would naturally raise concerns and reluctance due to the potential impact on employment, individuals’s income and provincial government revenues, possibly amplified by an overall drop in economic activity. Therefore, this proposal includes a quantification of the potential impact on a set of key variables through a simulation model. This quantification is the basis for a comprehensive transformation approach: the impact on employment and fiscal savings are in turn used to calculate investments in productive stimulus —for new sectors of the economy— and social stimulus —to support job retraining and assistance for affected workers— as presented in Paper 3.

However, the availability of evidence does not make decisions self-evident: every decision implies a challenge to articulate conflicting interests. For this reason, we have created a flexible simulation model that allows the analysis of alternative scenarios other than those considered here, by modifying the input parameters or the sequence and the way in which each policy instrument is instrumented. The purpose of this series is to provide these key inputs to shed light on different public policy dilemmas and to enable the design of comprehensive solutions.

Proposal for the Reformulation of the industrial sub-regime

Based on the diagnosis made in Paper 1 of this series, this paper presents a Reformulation Proposal that entails a profound revision of the tax incentive scheme established by the industrial sub-regime. Its ultimate purpose is to shift from rewarding companies for their sales to fostering local innovation and value creation initiatives, while seeking significant tax savings by eliminating benefits linked to foreign value added.

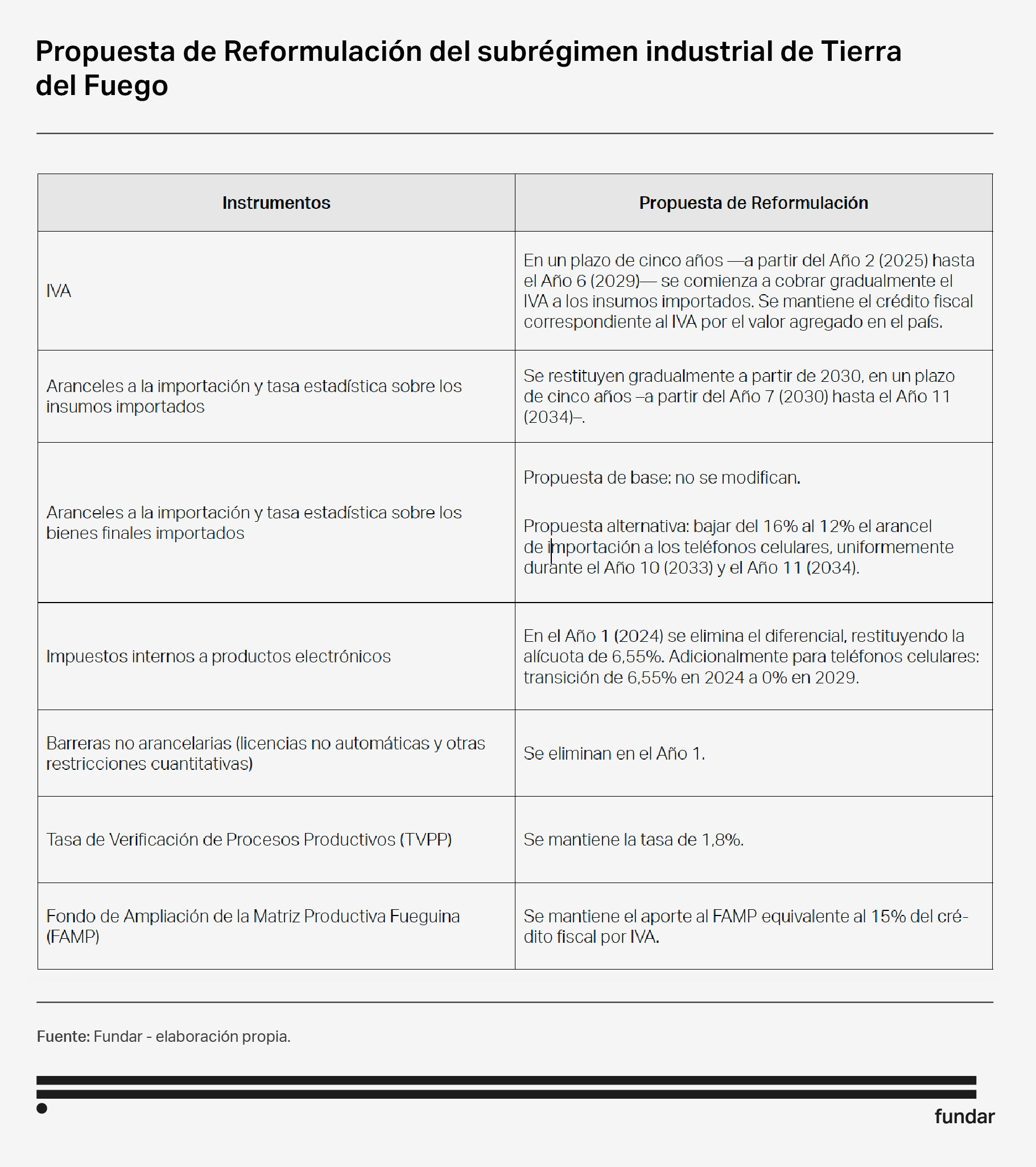

Generally speaking, the proposed amendment calls for the immediate removal of all non-tariff barriers and the elimination of the internal tax gap between domestic and imported electronics, establishing a common 6.55% tax rate (except for mobile phones, for which it will be gradually reduced until it is completely eliminated.) Then, from Year 2 to Year 6, imported inputs would gradually start paying VAT, in addition to import duties between Year 7 and Year 11. As a result, value added in Argentina would continue to be exempt from VAT while also benefiting from the effective protection provided by tariff escalation.

The proposal lays down a gradual implementation over a period of 11 years, from 2024 to 2035. This phased approach seeks to mitigate the impact and essentially allows this alignment to be as synchronized as possible with the development of new production activities, while allowing companies to adapt to the new incentive scheme and offer a social and labor transformation plan for affected workers, as described in Paper 3 of this series.

As for the legal device to implement this proposal, a law of the National Conference would be the preferred device, since it would better secure the funding required to carry out this productive transformation within the established time frame.

Simulating the impact of the Reformulation

We set to evaluate this Reformulation Proposal by forecasting price fluctuations —both domestic and foreign— in response to tax and custom reforms, as well as the impact of such fluctuations on the competitiveness of the companies subject to the sub-regime compared to foreign producers, so as to assess the potential impact on production, employment and tax revenues.

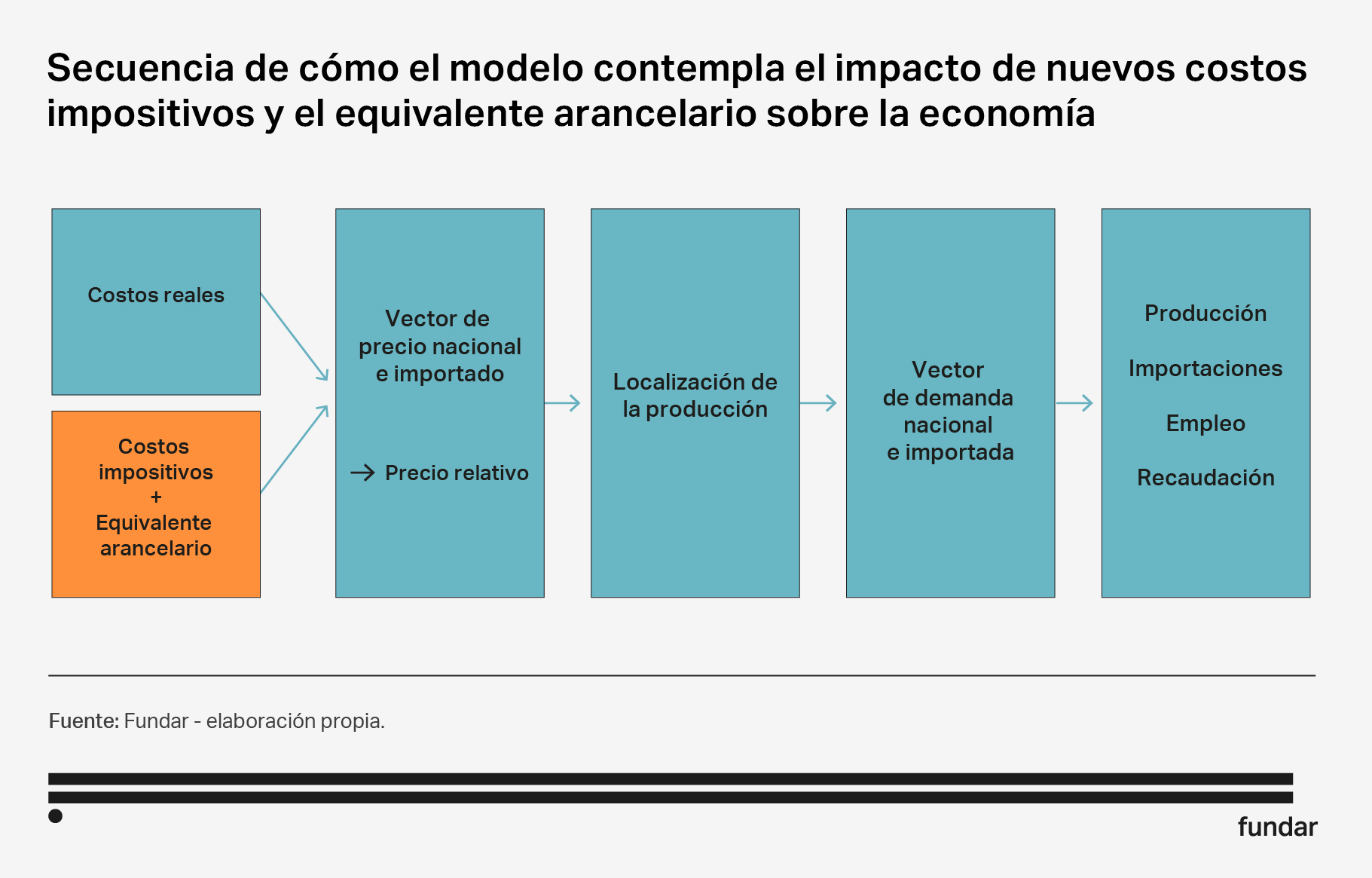

We created a simulation model of a possible scenario upon completion of the 11-year transformation. The model focuses on the three main products of the subregime: mobile phones, televisions and air conditioners; then, it extrapolates the results to the rest of the products. It focuses on these three products because they represent 77% of sales to the continent and 82% of the fiscal costs of the sub-regime. It runs independent simulations for each of the three products, based on the following sequence of expected impacts.

Sequence of how the model accounts for the impact of new tax costs and tariff equivalents on the economy

- The model calculates the impact of the Proposed Reformulation on product prices (domestic and imported) and determines a relative price for each domestic product or import.

- The relative price will determine production location decisions. The model assumes that if the domestic price remains the same or below the imported price, the decision to produce in Tierra del Fuego will remain unchanged. Conversely, if the domestic price exceeds the price of the alpha percentage threshold —in this model alpha would be around 10%-14%, depending on the type of product— total relocation abroad will be promoted (for example to China, Vietnam or India), with increasing offshoring in the intermediate range between 0 and alpha.

- New demand levels for domestic and imported goods are calculated based on the new prices and production location decisions.

- Changes in demand will lead to changes in local production and imports; which will in turn impact local employment and the fiscal savings to the national government.

As a final step, employment and tax savings results obtained for the three main products are extrapolated to the remaining products of the sub-regime.

(Simulated) Impacts of the Reformulation Proposal

The purpose of the simulation model is to predict and assess the results and impacts expected from the implementation of this proposal. Based on the model results, at the end of the implementation period (2035):

- Mobile phone production in Tierra del Fuego would cease entirely —they would be completely imported—, while 61% of the current production of TV sets and 28% of AC units would be maintained.

- Mobile phone average prices would hardly be altered (approximate 2% increase), while prices of TV sets would increase by 27% and prices of AC units by 10%. An alternative proposal is to reduce tariffs on mobile phone imports from 16% (current level) to 12%, causing mobile phone prices to fall by 1% from their 2021 value).

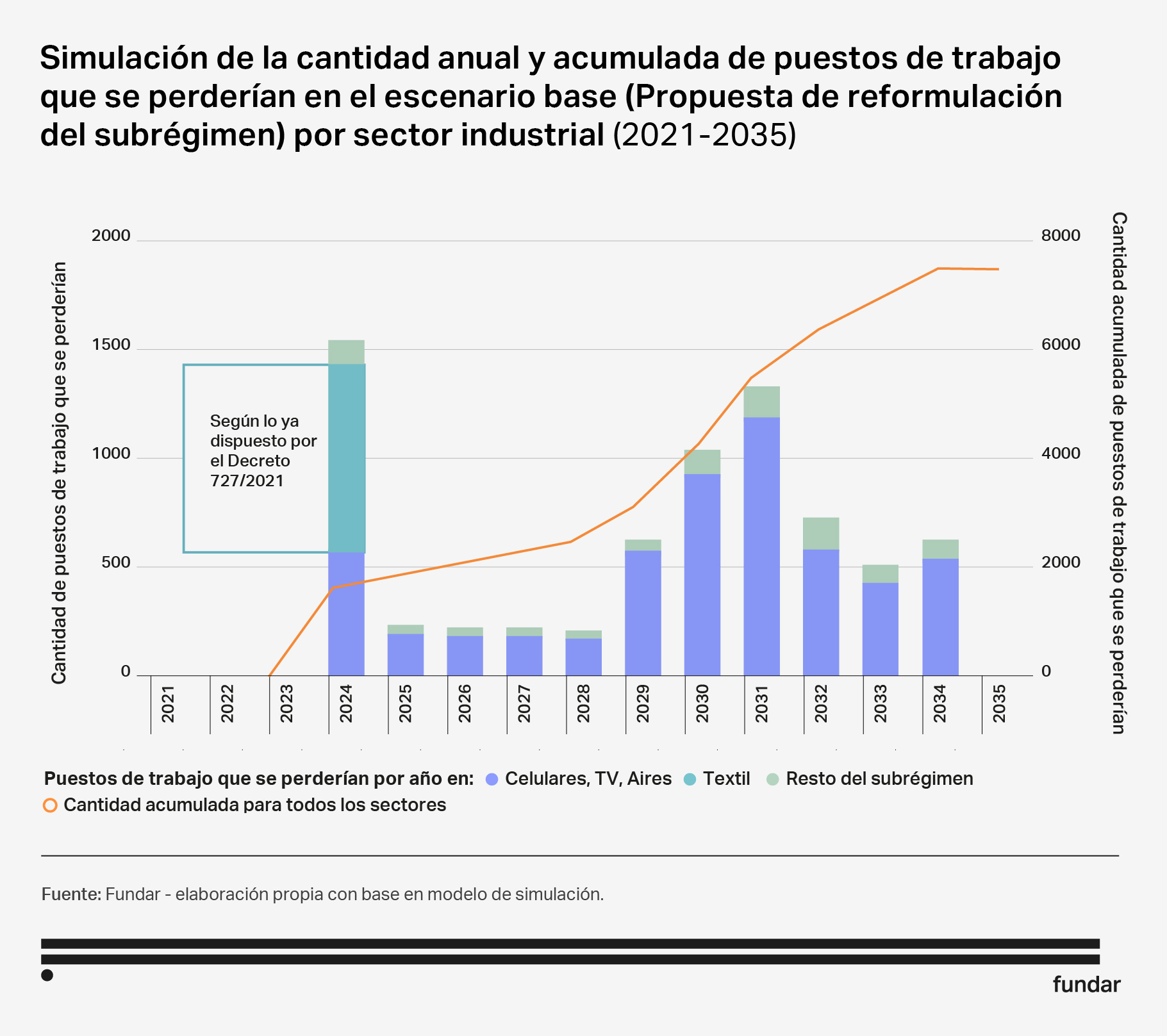

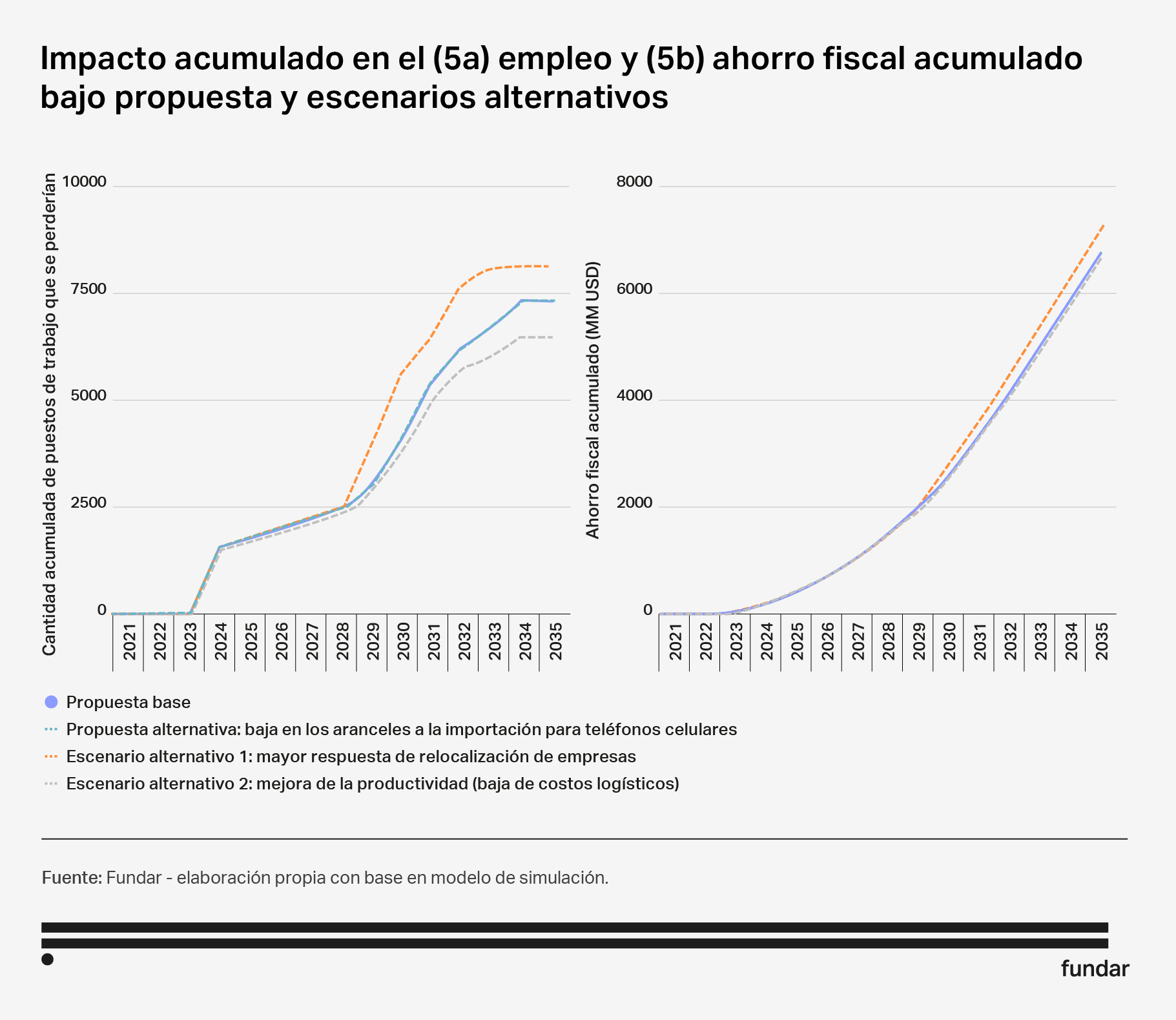

- The total number of jobs lost over the 11 years of implementation would be 7254 (an average of 659 jobs per year), with no additional losses expected in subsequent years.

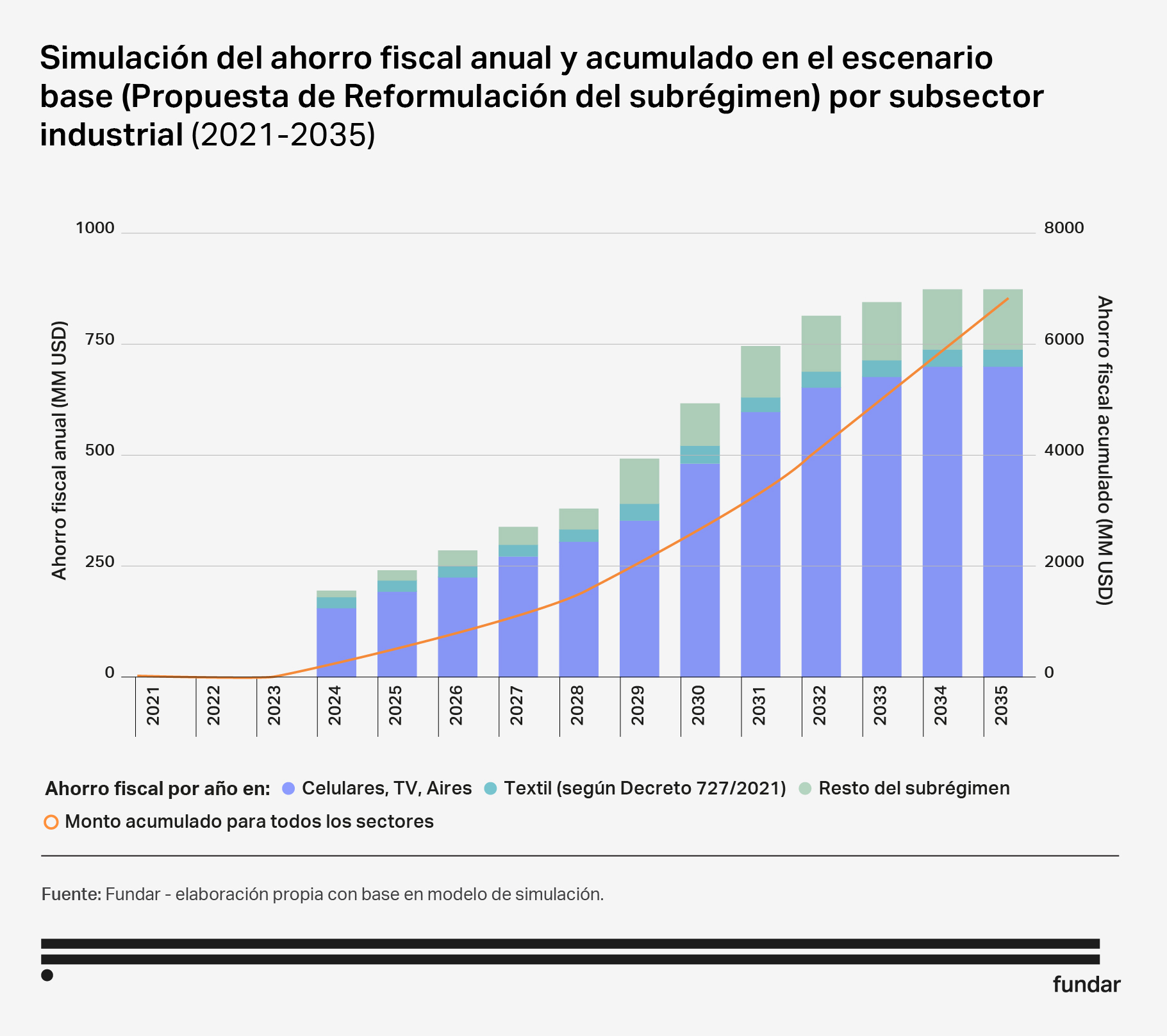

- Over the same period, fiscal savings would amount to USD 5864 million, plus USD 881 million per year following completion.

The figures presented so far allow an “end-to-end” comparison between the first and last year. However, the proposal is meant to be implemented gradually. It is therefore worth considering the impact over time, focusing on the expected evolution of the main social and economic variables: employment and fiscal savings.

As for employment, the initial negative impact is partly due to the regulations in force that excluded the textile industry from the industrial sub-regime when it was renewed and to the two high-impact measures implemented at the onset of this proposed reformulation, namely, the elimination of non-tariff barriers and the elimination of the internal tax differential. Impacts will be heterogeneous over the next few years, initially weaker (2025-2028) and stronger (2029-2034) as production of mobile phones and air conditioner units shifts abroad (2029-2034) in response to changes in relative costs of local production and imports.

The reformulation would also result in significant fiscal savings. First, because of the gradual substitution of taxed imports for tax-exempt local production; and, second, because of the taxes on imported inputs that would gradually be applied on the island’s activity. This would cause fiscal savings to grow annually from the implementation to the completion of the proposed reformulation, totaling $ 881 million dollars in 2034 (82.4% of the current fiscal cost of the sub-regime, as estimated in Paper 1 of this series).

Evaluating the Reformulation Proposal: simulating contingency scenarios

The use of a simulation model of this type helps provide a horizon of predictability for a rigorous analysis of the potential implications of any policy change being considered for implementation. However, the results presented are naturally subject to prediction errors. They are based on a set of assumptions the validity of which is not beyond question, which makes it necessary to analyze alternative assumptions for some key parameters of the model. Three alternative scenarios are hence proposed to cross-check the results obtained by the simulation.

Baseline proposal

Corresponds to the Reformulation Proposal of the industrial sub-regime, described above, which was used as the basis for comparison with the other proposed scenarios.

Alternative proposal — Reduced import tariffs for mobile phones

It entails a reduction of import tariffs on mobile phones from the current 16% rate to 12%, which would be implemented in two equal phases in 2033 and 2034, once these products are no longer produced in Tierra del Fuego. This would cause a 1% drop in the average price of mobile phones with respect to 2021 values, with a $43 million dollar reduction in long-term annual tax savings.

Alternative Scenario 1 — Increased business relocation

This scenario assumes that companies are more sensitive to the difference between domestic and foreign product prices. Specifically, it reduces the percentage difference which would result in no production left in Tierra del Fuego. This new scenario would not affect the final landscape for mobile phones, while only increasing the speed of the relocation process. For TV sets, the effect would be almost nil, given that domestic prices would virtually match the price of imported products by 2034. For air conditioner units, the entire production would eventually be replaced by foreign products.

Alternative Scenario 2 — Productivity improvement (reduced logistics costs)

Finally, another scenario was considered in which companies manage to improve their productivity by reducing one of the main components of local costs, logistics, by 30% over a five-year period. This reduction would lead to a decrease in the domestic price, which would allow domestic products to compete with imported products under better conditions.

The analysis of the various scenarios indicates that the simulated impacts in the model do not have a high sensitivity to significant alterations in the parameters considered. This validates the dependability of the results as an estimation of the anticipated effects of implementing the proposal outlined in this study.

While the Reformulation Proposal maintains certain economic incentives —now linked to value creation in Tierra del Fuego— it could also save a large portion of the fiscal cost of the current incentive scheme. Nevertheless, a reformulation of Tierra del Fuego’s industrial sub-regime will be politically and socially viable if and only if there is a strong national and provincial political will to implement a robust long-term social protection and labor reconversion program. As stated in Paper 3, the cost savings should be allocated towards creating new productive endeavors that create new jobs in a number similar to those that have been lost, and towards financing a social protection and labor reconversion program to address the sectoral job displacement and safeguard the income of individuals and families during the transition.