Half a century after the enactment of Law 19,640 to promote settlement and economic activity in the national territory of Tierra del Fuego, Antarctica and the South Atlantic Islands, the time has come to take stock and assess the wins and limitations of the industrial policy associated with the Regime —the so-called “industrial sub-regime”, the details of which were outlined after the 1972 law— to identify the potential for improvement. This paper is the first in the series Towards a possible productive transformation in Tierra del Fuego and offers a diagnosis of the industrial sub-regime. It has been structured based on an analysis of its legal framework and incentive scheme, the resulting economic and productive structure and the fiscal cost it creates for the federal Government.

The Tierra del Fuego Regime, an introduction

The so-called Tierra del Fuego “Regime” was established by Law 19,640 of 1972. This law, along with a vast body of implementing regulations, established a special tax and customs regime for the territory aimed at promoting population and employment growth in a far-off region, isolated from the rest of the country, but of great strategic importance.

The Law established, on the one hand, a set of benefits aimed at reducing the cost of living in said territory; and, on the other, a subset of economic incentives associated with the so-called “industrial sub-regime”, which still today regulates the entry of products manufactured in the province to the mainland.

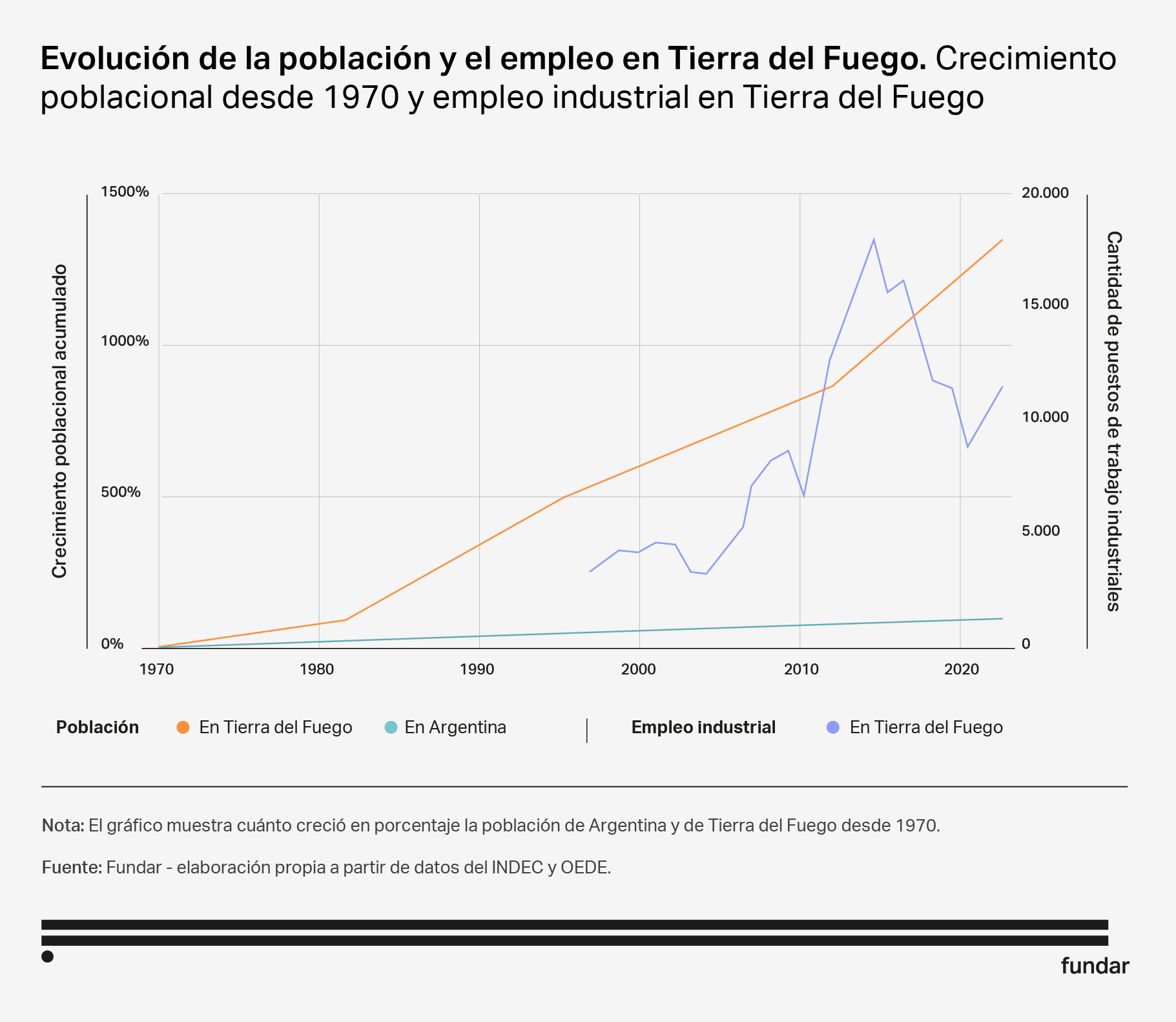

Fifty years after its enactment, the main objective of the law has been more than achieved: the island has been populated at a rapid pace, reaching 190,000 inhabitants by 2022. The sub-regime has driven the establishment of new productive enterprises and, with them, the creation of jobs in the private sector. And, although the playing field for the people who live and work in Tierra del Fuego and for the companies located there continues to be tilted by the multiple challenges posed by geography, it can be said that the Regime has largely leveled it over these 50 years.

A diagnosis of the industrial sub-regime on three areas

The analysis of the effects of the sub-regime on population rates, employment, productive structure and provincial tax revenues clearly points to the importance of this incentive scheme for the economy and society of Tierra del Fuego, but also to the challenges of maintaining it.

A key issue not often discussed is that, as is, the industrial sub-regime does not promote the creation of value in Tierra del Fuego, as it offers tax and customs incentives based on companies turnover instead of on the creation of added value.

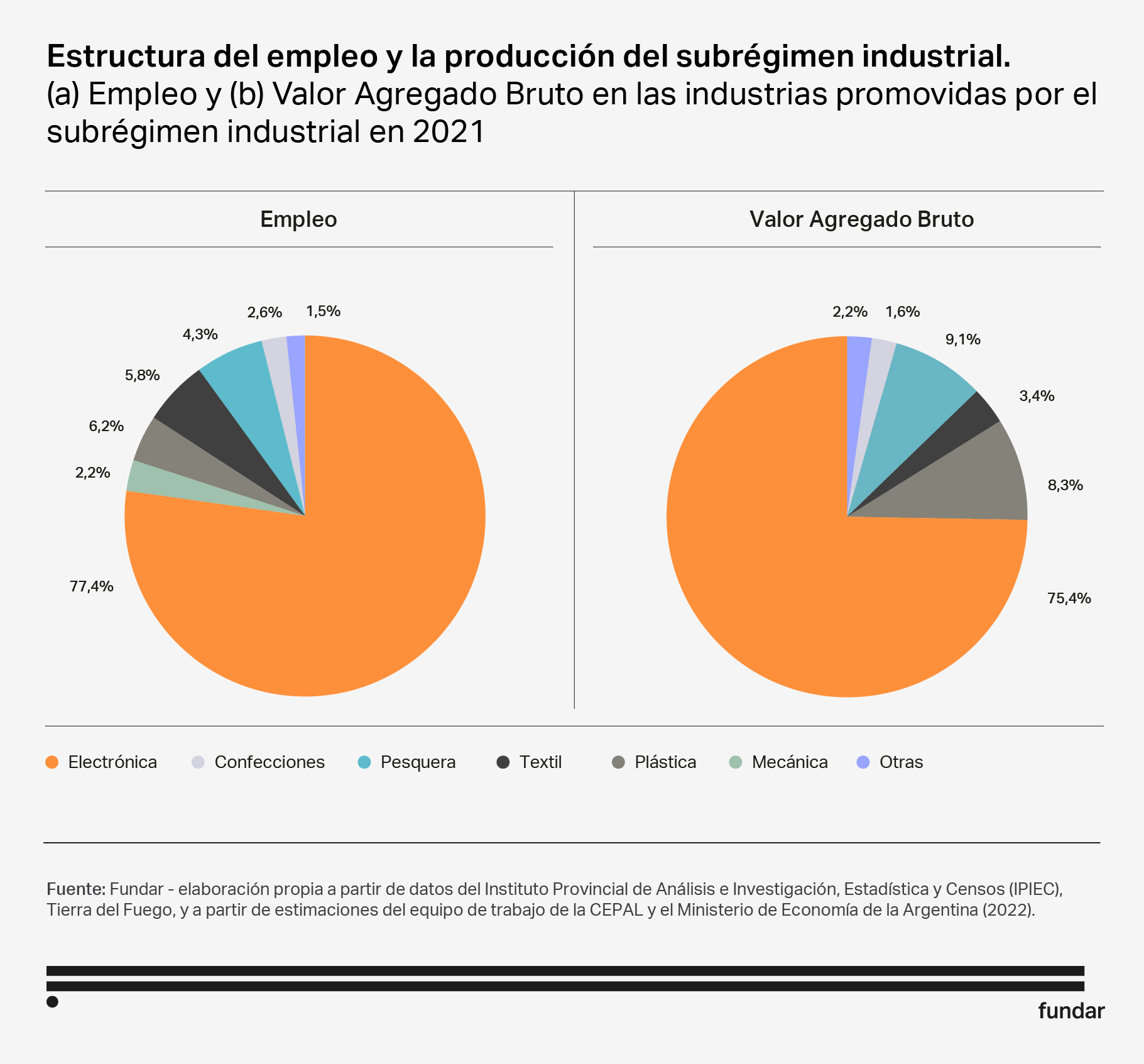

Additionally, the sub-regime has also gradually become more and more focused on the electronics industry, especially over the last two decades. In fact, this industry accounts for 8,500 jobs and 75% of the GVA of all sponsored sectors. This is worsened by the reliance of the island’s electronics industry on foreign supplies and the fact that virtually its entire production is sold in the domestic market.

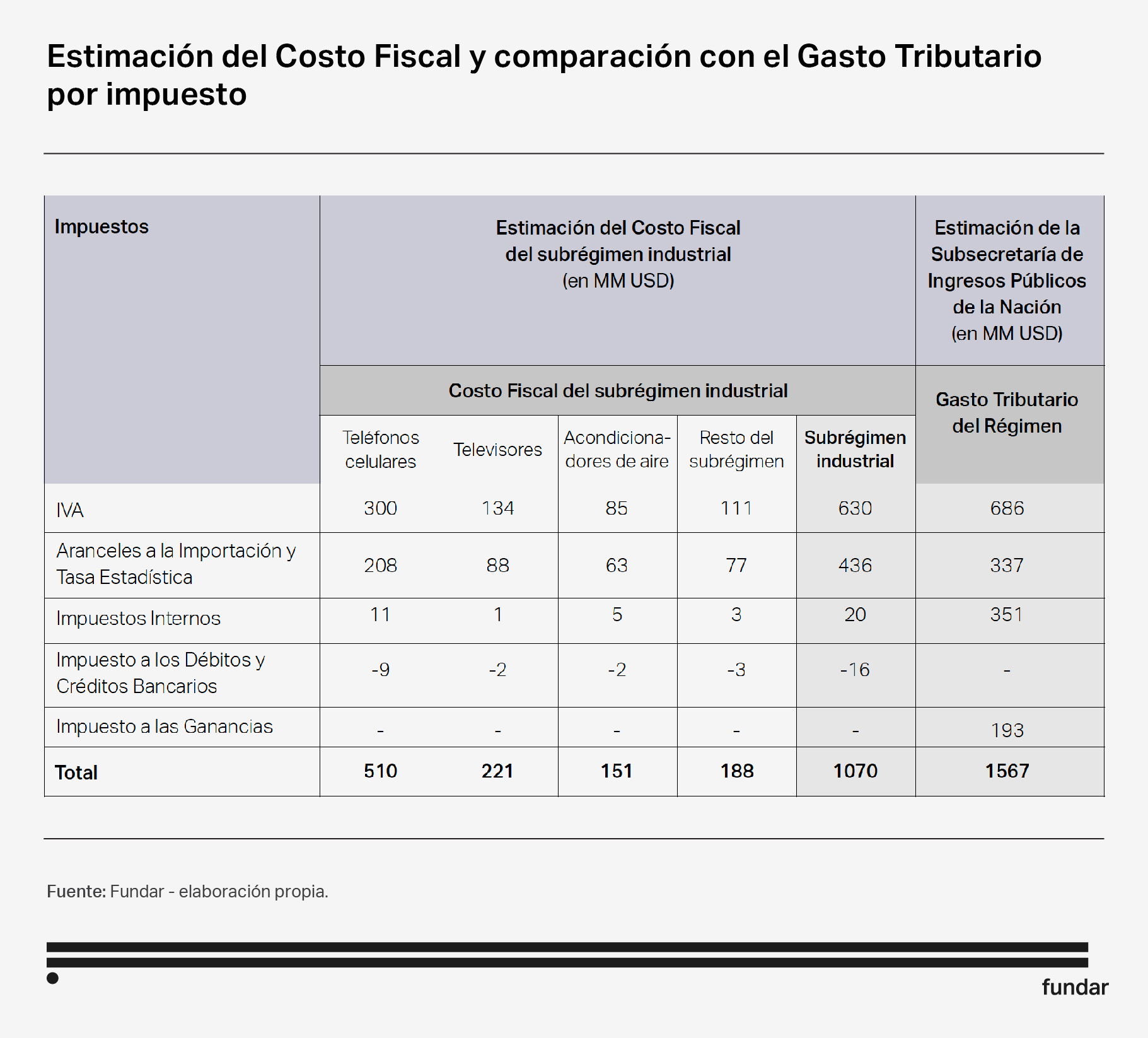

Finally, one of the issues currently in the spotlight is the revenues sacrificed because of the tax benefits granted under the industrial sub-regime. These are currently estimated at $1.567 billion dollars per year for the entire duration of the Regime and represent the amount of revenue that the Treasury will forego by granting these tax cuts. However, this calculation does not consider the potential impact of amendments to the tax incentive package and the ensuing behavioral changes of the major economic agents affected thereby. Our proposal was instead to develop a counterfactual scenario to calculate tax revenues without the sub-regime. The impact of the industrial sub-regime was hence estimated at $1.07 billion dollars (0.22% of GDP), well below conventional estimates, but still significant. The following section provides a more in-depth analysis of all three dimensions to provide a clearer diagnosis of the regime, which will serve as a cornerstone for the reformulation of the industrial sub-regime and the roadmap to the productive transformation.

Legal framework and incentive scheme of the Tierra del Fuego Regime

The main benefit that companies receive under the industrial sub-regime is the Value-Added Tax (VAT) credit for each sale to the rest of the country. Since sales in the mainland are subject to VAT, the tax must be itemized and charged on the invoice, so that the purchaser can in turn deduct it from their own tax liability. The manufacturing producer on the island can then claim a credit equal to the VAT charged on the sale, known as “VAT credit”.

The second most important incentive granted to manufacturers in Tierra del Fuego is the exemption of VAT and import duties. The extent of this exemption will depend on the breakdown of inputs required to manufacture each product, which in some cases may account for up to 80% of the product. The greater the percentage of imported inputs, the greater the “effective tariff protection”.

These two benefits constitute a key element of the sub-regime’s incentive scheme, and the resulting fiscal cost: the benefit obtained by companies is not tied to the percentage of inputs they import, but is calculated based on turnover rather than value added. This tax benefit impliedly promotes the import of inputs at lower price than the domestic price, which is often the case, thus discouraging local production and the associated creation of value on the island.

Likewise, since these benefits are the same as any others available to any Argentine exports (see document attached), they create a differential advantage for Tierra del Fuego products compared to mainland production for sales to the domestic market, but not for exports. This is key to understanding why most of the products manufactured under the sub-regime are sold in the domestic market. Within this framework, companies based in Tierra del Fuego are constantly devising strategies focused on mass-consumption electronic devices for the protected domestic market, instead of seeking to identify specialization niches where they can improve their competitiveness.

The granting of the benefits under the sub-regime is subject to a formal resolution by the federal government. It is the responsibility of the National Secretariat of Industry (SIN) to lay down the requirements applicable to the production processes and approve related projects, which must comply with the requirements of such production processes.

Overall, these regulations create a cumbersome web of regulations and administrative proceedings and, as a result, companies generally settle for meeting the minimum requirements instead of seeking to attain the purpose of the law. They have no incentive to go beyond the requirements set out in the regulations and focus all of their innovation efforts on making their production processes more efficient. Along with the existing tax incentive framework, this ultimately creates restraints that discourage companies´ efforts to innovate and create value.

Structure and performance of the industrial sub-regime within the Tierra del Fuego Regime

Originally, the main purpose of the Tierra del Fuego Regime was to drive a significant increase in the island’s population as part of a geopolitical strategy to defend the territory. Law 19,640 was intended to foster immigration from other provinces of the country. In order to attract migratory flows, the regime promoted the creation of new jobs by attracting new businesses. This resulted in an increased number of workers, to the point that the province is today the one with the highest number of industrial jobs per inhabitant and the largest share of industrial jobs out of Argentina’s total number of private jobs.

Electronics is the sector with the greatest bearing in the industrial sub-regime. In this respect, it accounts for almost 8 out of 10 of the jobs under the sub-regime and 75% of the GVA of the firms benefiting from the regime. In turn, the sector is concentrated in the production of three main products (mobile phones, televisions and air conditioners). In terms of market share, Mirgor and Newsan are the two holdings that stand out among the 30 firms in the industry.

These companies are part of global value chains characterized by a strong presence of manufacturers such as Samsung, Motorola and LG. They design and develop the kits that serve as the main input for the Fuegian terminals. The peculiar package of financial incentives and the framework that regulates the industrial sub-regime determine not only the original role of Tierra del Fuego in these global value chains, but also two key characteristics that have remained unchanged since the very beginning: the dependence on imported inputs and the relatively low value added at the local level.

In spite of the original purpose of the Regime (Law 19,640), namely, to promote the creation of value on the island, the origin of most of Tierra del Fuego’s current products may only be certified because the production process complies with the applicable requirements.

Tax cost of the industrial sub-regime

One of the most controversial aspects about the Tierra del Fuego Regime is the tax sacrifice associated with the economic benefits it offers, also referred to as “fiscal cost”. This cost is calculated based on official figures, through the concept of tax sacrifice, i.e. the amount of income foregone by the Treasury by granting a tax treatment different from the general one, with the purpose of benefiting or promoting the development of certain activities.

One of the main weaknesses of this calculation method is that it is inherently mechanical and fails to take into account the change in behavior of the main economic agents involved resulting from changes in incentives. Moreover, because of its inherent simplicity, it falls short of the objective of providing a more accurate calculation.

For a more accurate forecast, it would be necessary to estimate public revenues in two different scenarios: one with the current policy in force and another without it, with the fiscal cost being the difference in tax revenues between the two scenarios. In other words, in addition to estimating more accurately the fiscal effort of the federal government to promote economic growth in Tierra del Fuego, we should also assess how this effort would vary in the event of changes in the tax incentive package.

Since no real data is available, we must estimate public revenues in the counterfactual scenario without the sub-regime. Using this methodology, the fiscal cost of the entire industrial subregime to the National Treasury is estimated at $1.07 billion dollars, $497 million less than the tax sacrifice estimated by the National Undersecretariat of Public Revenues (SIP) for the entire Regime.

Although the Tierra del Fuego Regime has achieved its geopolitical objectives in terms of population growth, half a century after the adoption of the Law of 1972, it has proven incapable of developing productive activities in the country’s southernmost province that would be sustainable on their own, in the absence of the benefits currently available. In particular, the so-called “industrial sub-regime” established after the adoption of Law 19,640 has not only failed to promote sustainable activities, but has also expanded to include new products, such as mobile phones, thus deviating from the minimum thresholds of local added value that originally inspired Law 19,640. The lack of clear progress on the road to self-sustainability is surely at odds with the significant fiscal cost (0.22% of GDP) of providing financial support for existing activities.

Based on this diagnosis, the two articles that complete this series propose a reformulation of the industrial subregime (Paper 2) and an analysis of the feasibility of the productive transformation process (Paper 3). The aim is to reformulate the fiscal incentives scheme so that they truly foster innovation and value addition and to build a more competitive and diversified productive base, one less dependent on state aid.