Córdoba is the second largest city in the country. It is a technological and educational hub, with great potential, capabilities and experience to attract new industries. However, how complex is the city’s export panorama? A diagnosis of the productive framework from the point of view of economic complexity.

Unlike income-based wealth indicators such as GDP or GDP per capita, the Economic Complexity approach allows us to measure the value of a region in terms of its capabilities. These technical skills are the engine of a region’s current production, but they can also be catalysts for its future development. The series of documents “Productive Opportunities for the City of Cordoba: an Economic Complexity Approach” applies this methodology to the analysis of the Cordoba economy.

Economic Complexity as a methodology of analysis

In order to drive local economic and productive development effectively, it is essential to identify specific sectors or products that enhance competitiveness. The identification of these areas is crucial for a strategic agenda focused on initiatives.

Research indicates that economies boasting higher complexity levels also exhibit elevated per capita income. This correlation underscores the significance of prioritizing complex products, as they contribute to economic prosperity. Therefore, these sectors should be accorded priority status in development strategies.

Utilizing the Economic Complexity methodology, this series aims to augment our understanding of Cordoba’s productive capabilities. The objective is to facilitate an informed selection of viable niches that can be nurtured through effective public policies.

Socioeconomic performance of the City of Córdoba

The city boasts a significant track record, propelling it to become the second-largest in population and an eminent technological and educational hub. It has a wealth of capabilities and experience, making it well-positioned to attract new occupations and industries.

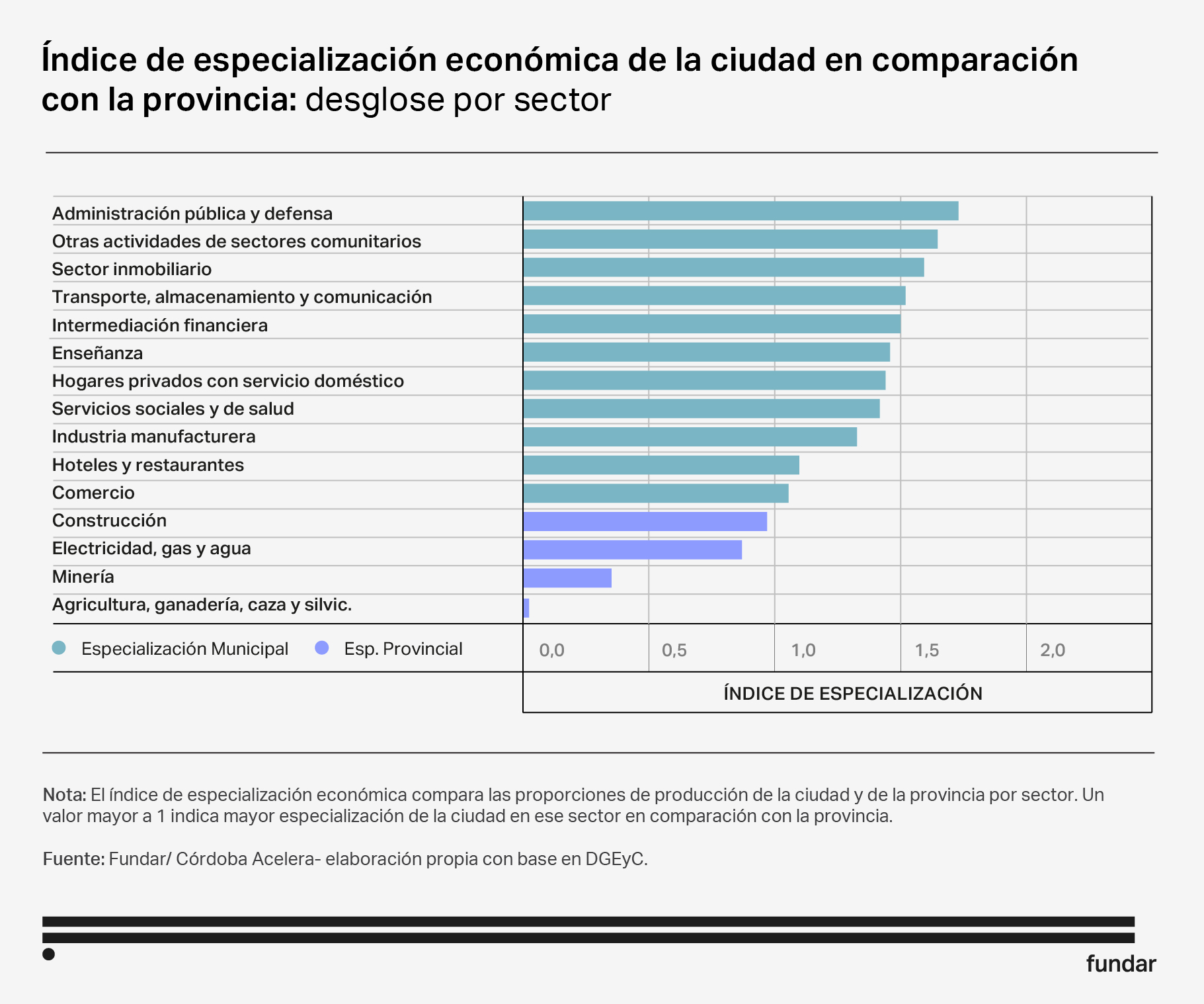

The current economic landscape is primarily service-oriented, underlined by a robust industrial presence. Noteworthy features include five industrial parks, four automotive terminals, and a well-established network of auto parts companies.

Detection of productive potential

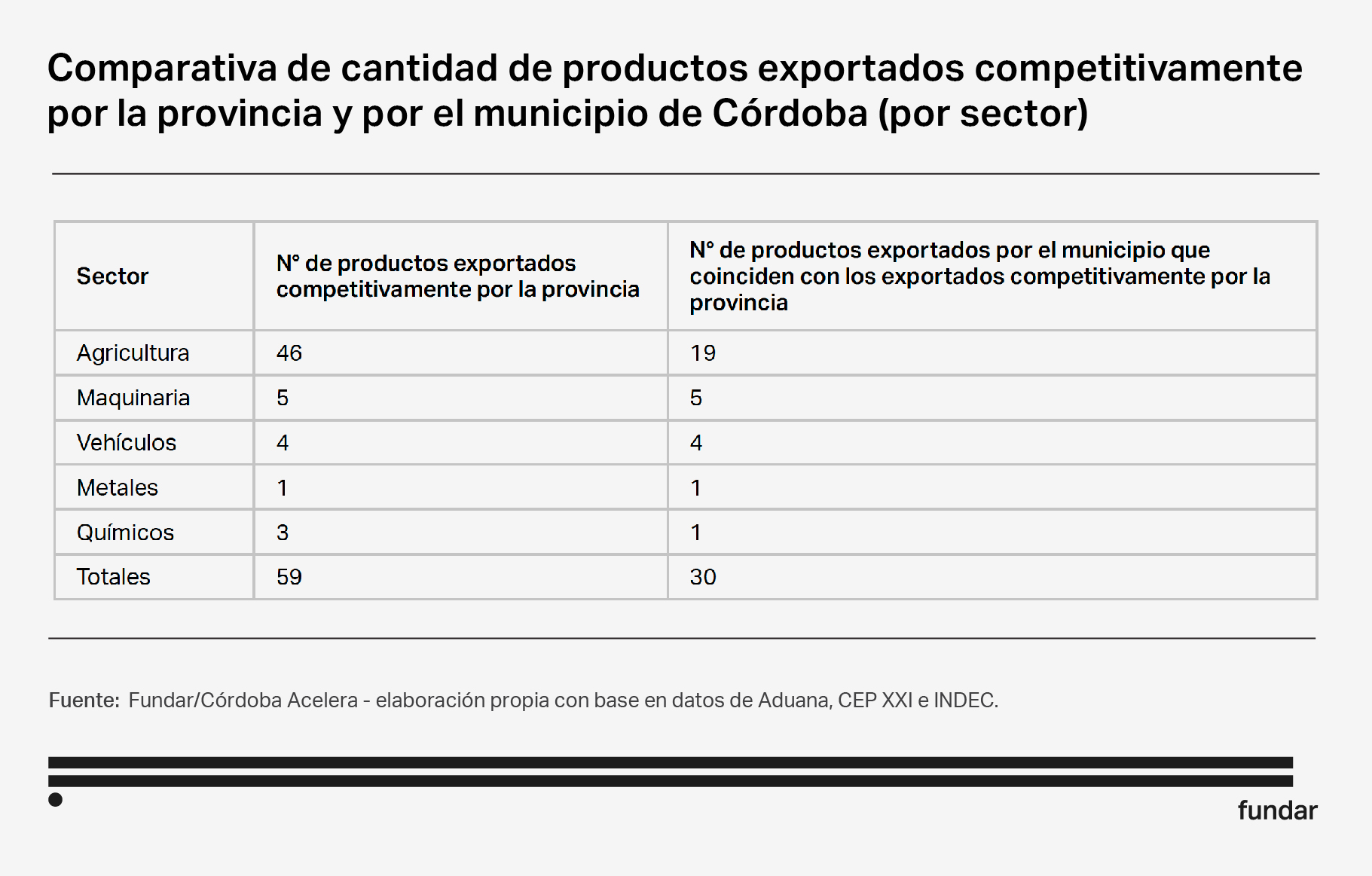

Concerning foreign trade, Córdoba City’s export profile stands out, accounting for 254 out of the 406 products exported by the entire province, with 113 exclusively attributed to the city. Essentially, 28% of all exported products originate from the City of Córdoba, and notably, the products it exports tend to be more complex on average compared to those from the rest of the province.

When it comes to competitive exports, Agriculture dominates among the 59 products exported by the province. However, the city also has a strong presence, with export companies contributing to almost 70% of the province’s competitive agricultural products. This is particularly noteworthy due to the capital’s significance within the province and its geographical proximity to other municipalities. Furthermore, the city participates in exporting various products within the Machinery, Vehicles, and Metals sectors, in which the province holds Revealed Comparative Advantages (RCA).

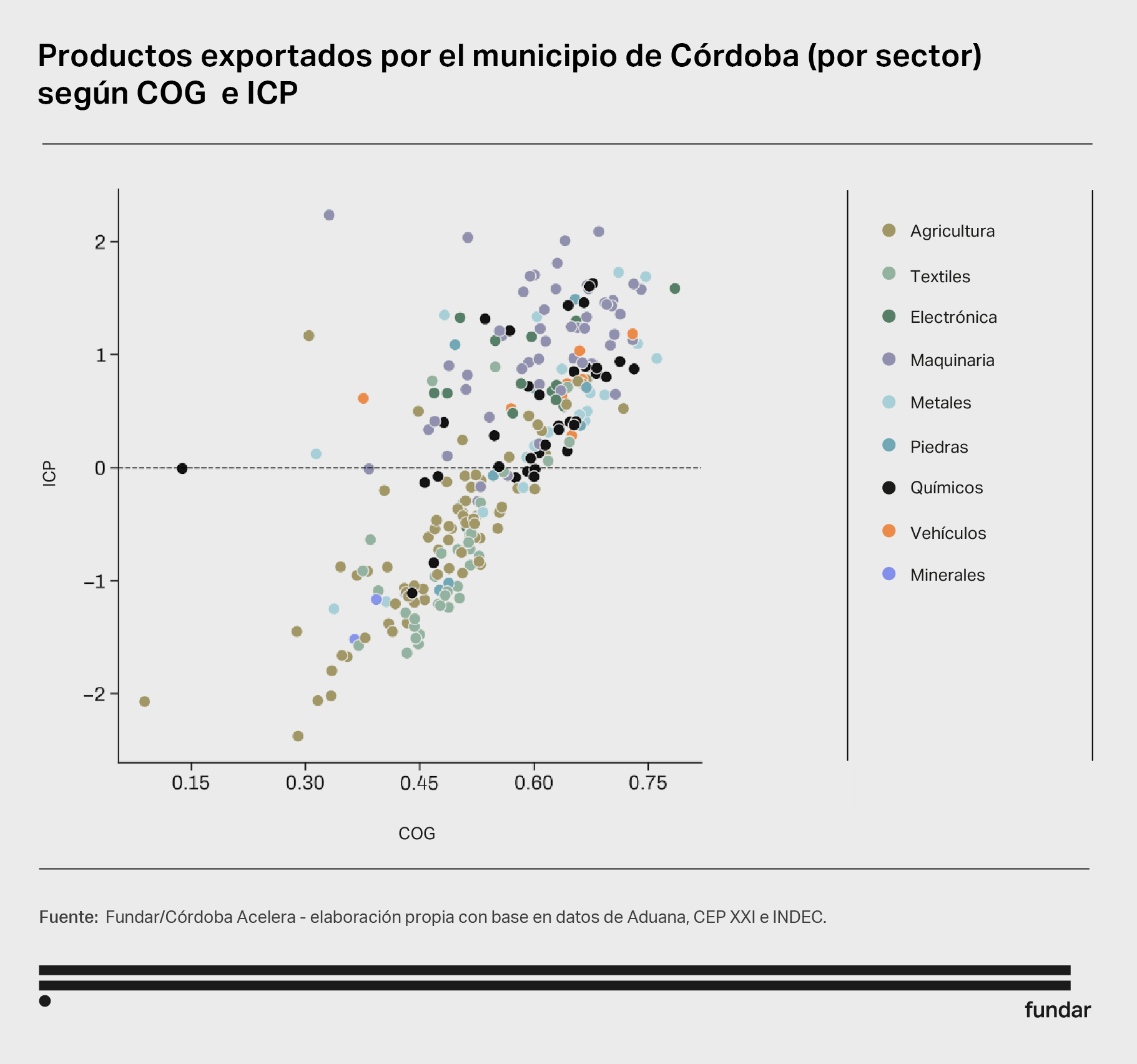

The Product Complexity Index (PCI) serves as a measure of the economic complexity of a given product, factoring in the number of countries capable of competitively exporting it and the number of products those countries export competitively.

The Complexity Outlook Gain (COG) measures the potential change in a country’s, city’s, or region’s Economic Complexity Index (ECI) resulting from the ability to export a specific product competitively.

Complex products are generally considered to have higher strategic value. When evaluating exported products, it is possible to differentiate between their actual and potential complexity based on their position relative to the mean (ICP=0). The graph illustrates how a product can connect and drive a territory towards new, more complex products, indicating its potential to make the economy more complex in the near future, in line with products that are closer to its economy. From this perspective, agricultural products predominantly occupy the lower half, whereas more sophisticated sectors such as Machinery, Chemicals, and Vehicles are situated in the upper half.

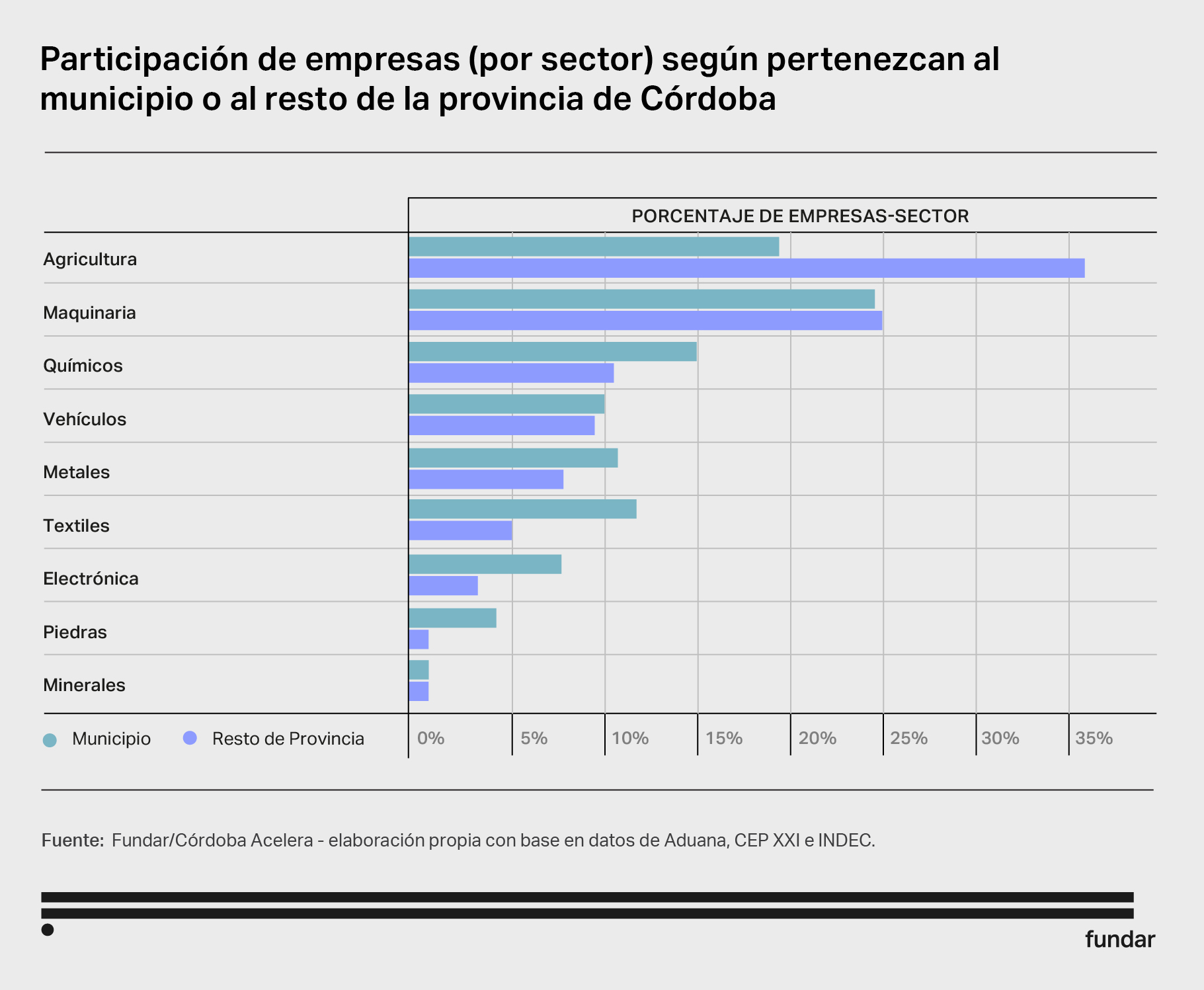

Analysis of exports by Córdoba’s firms

Córdoba city exhibits a higher average product complexity compared to other departments in the province. The rationale lies in the behavior of other departments. Most municipalities witness significant participation from agricultural companies exporting less sophisticated, not necessarily less complex products. Conversely, in Córdoba City, the percentage of Agriculture is lower, replaced by a more pronounced presence in the Chemicals, Metals, and Electronics industries. Similarly, more complex departments typically export high-value added products from sectors like Machinery and Electronics.

A feasible goal for public policy could be to diversify companies’ exports, achieved by exporting new products or adding new items to their portfolios. In this context, it is important to consider not only the complexity but also the variety of products exported per company.

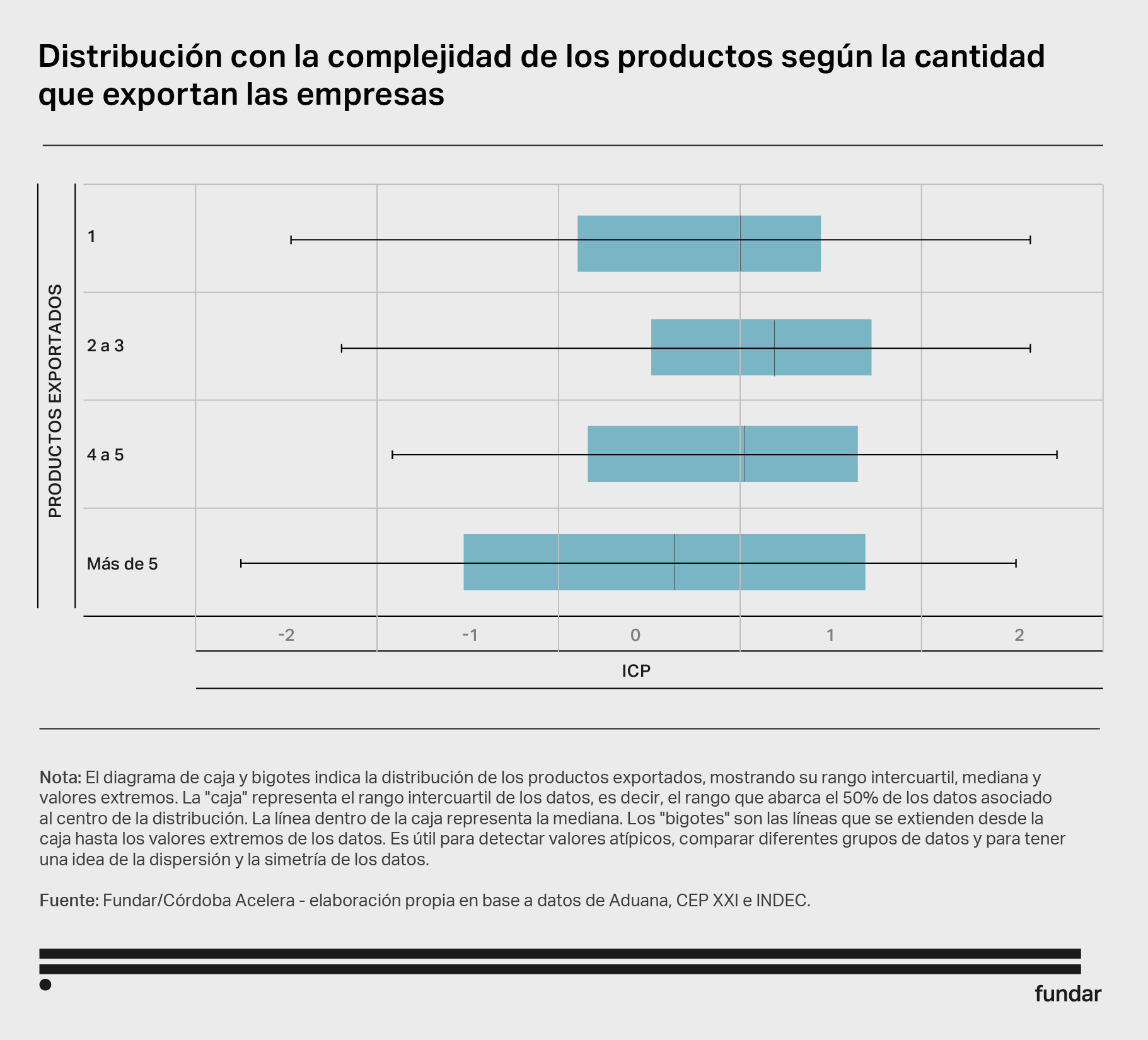

The city is home to companies that primarily export a single type of product, with only a small percentage (6%) exporting more than five. Those exporting fewer goods mostly concentrate on products of medium complexity. Companies exporting two to three products tend to have higher medium complexity. It is worth noting that the graphical representation shows a similar median complexity for all cases. Regarding companies that export more than five different products, although they have a similar median to other groups, their product complexity shows greater variability, which sets them apart with more instances of very low complexity products.

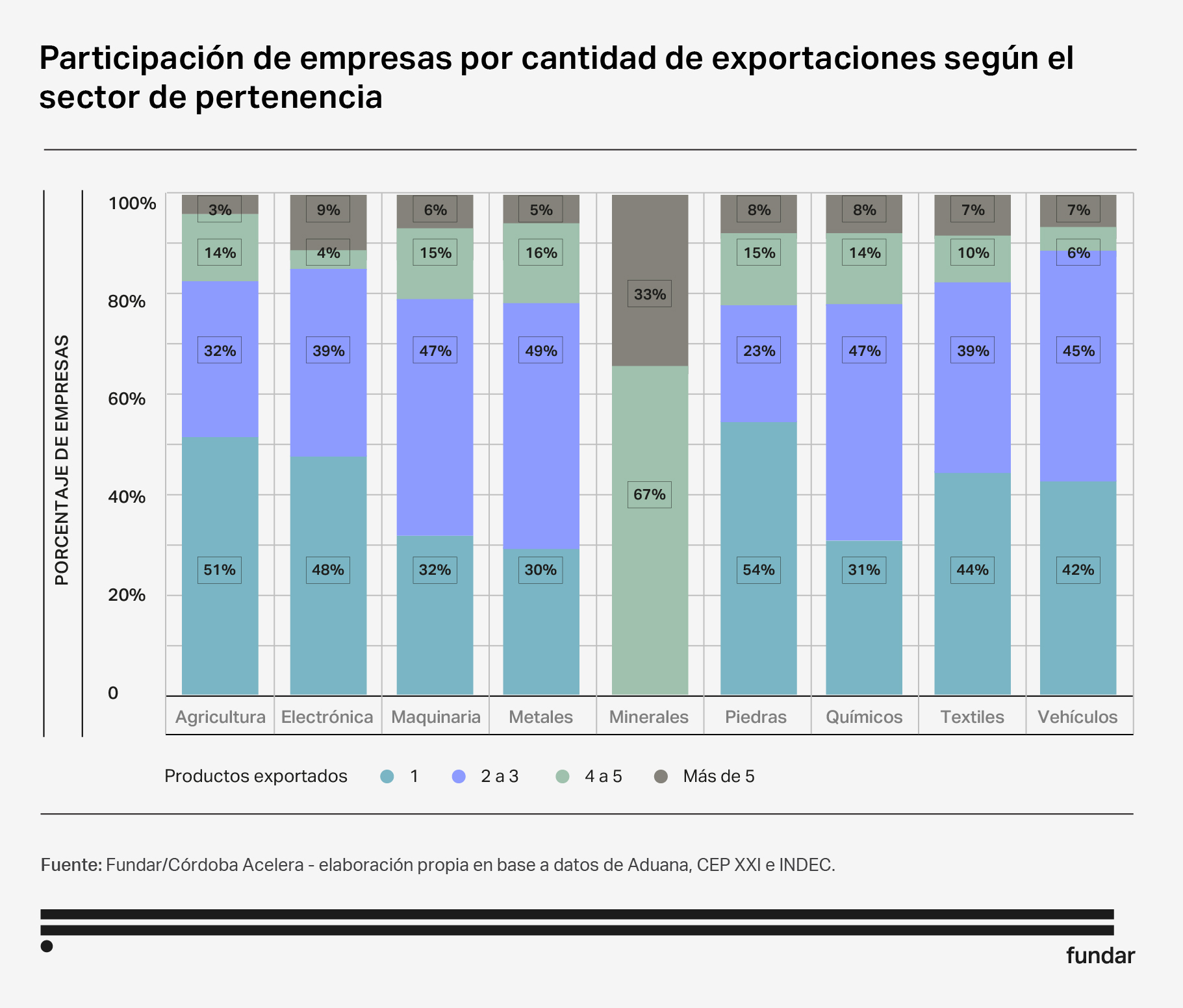

Cordoba companies, regardless of their sector, tend to export a limited range of products. An in-depth analysis reveals sectors where companies have greater opportunities to diversify their exports and others where they specialize in one or a few products to compete in the foreign market. For example, the Metals sector has the highest percentage of diversified companies, while the Electronics sector has specialized companies competing in a few highly complex products.

The diagnosis identified sectors in which the city of Córdoba exports products with high complexity, but not always competitively. To improve exports in these sectors, a specific policy incentive is required to break the inertia of the current production matrix. Additionally, a third document will be published with product incentive recommendations.