Argentina’s economy has a dual currency regime. This phenomenon has resulted from a history of high inflation rates and economic disruptions such as devaluations, public debt defaults and deposit freezes. The solutions to this dual currency regime range from dollarization to a recovery of the national currency. Since a dollarization necessarily entails sacrificing critical economic policy instruments and a dramatic tightening, recovering the peso is imperative to promote development. The initial conditions for both are similar. Then, why relinquish the national currency?

Illustration: Noe Garin

What is a dual currency regime?

Currencies must serve three key functions: providing a reference of the value of things, allowing us to buy things and storing while preserving value. These functions are closely intertwined. A currency that works as a good payment method and allows us to acquire goods at relatively stable and predictable costs is one that will naturally be chosen when setting a price, and also to be demanded as a store of value. Conversely, a currency that fails to fulfill one of these purposes is liable to fail to fulfill others and will more likely be replaced by an alternative currency.

“Dual currency system” or “partial dollarization” are terms usually employed to describe the use of a currency other than the domestic currency (in this case, the US dollar) for at least one of the purposes described above. We speak of “actual dollarization” when foreign currency is used as a means of payment (buying) and unit of account (price-setting), while “financial dollarization” refers to the use of currency as value reserve (saving).

This term describes the prevailing situation in many countries, including Argentina, where although the peso functions to a large extent as a means of payment, it seems to have lost its function as a unit of account and more importantly as a value reserve. This dual currency economy impairs the effectiveness of fiscal, monetary and exchange policies, impedes the development of the domestic capital market and creates an extra demand for dollars beyond what is needed to produce and consume.

Argentina’s dual currency: Where we stand and how we got here

The dual currency phenomenon is not privy to Argentina or its idiosyncrasy. There are underlying economic factors. One of such factors is inflation, which discourages contracts in pesos so that real estate, for example, is usually sold and bought in dollars. Another factor is the historic evolution of the value of the Argentine peso.

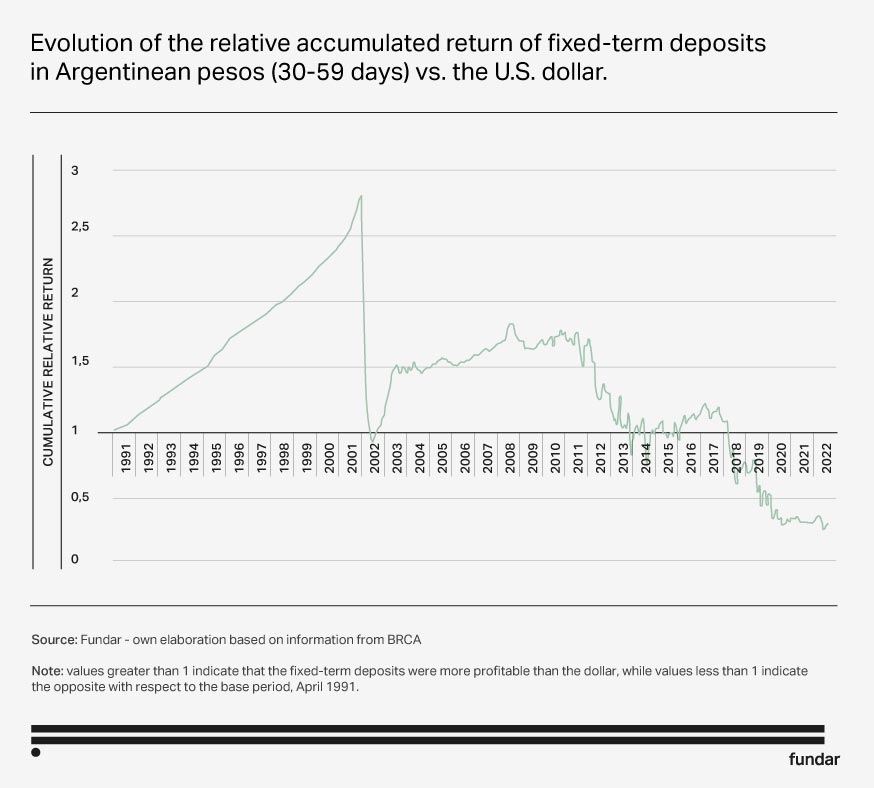

Over the last three decades, those who bet on the peso have consistently lost. Partly because the CD’s interest rate has not always outperformed the dollar’s appreciation against the peso. But above all because of the frequent disruptive events (such as defaults, bank deposit freezes, tampering with official statistics, abrupt devaluations and exchange market restrictions —cepo—) that have favored those who saved in foreign currency. This might explain why there are over 260 billion dollars outside of the Argentine financial system.

This progressive adoption of an alternative currency is neither linear nor easily reversible. The demand for dollars for saving exerts pressure on the exchange rate. In an inflationary context, this causes a greater passthrough of devaluations to prices. In turn, volatility encourages savings and investment in dollars, which halts the development of the local currency capital market. Less is invested in domestic bonds and Argentine companies shares, resulting in reduced financing capacity for both the State and companies. This also impacts economic growth and exports, leading to a decrease in the supply of dollars and more pressure on the exchange rate. Unless bimonetarism is reversed, an export boom will not be enough to solve these issues.

One alternative currently being discussed is to adopt the US dollar as official currency instead of the peso. Although this could help overcome some of the instability factors, it would fail to solve them entirely and would come at the high cost of sacrificing fundamental policy instruments (such as exchange regulations) to absorb exogenous shocks, reduce volatility and efficiently conduct macroeconomic policy.

Another option is to take the opposite approach and bet on strengthening the value of the domestic currency. This line of action, along with other measures aimed at an overall stabilization of the economy, could provide greater flexibility in implementing economic policies and promoting development.

What would be the consequences of dollarizing Argentina’s economy?

Dollarization is the decision of a government to formally replace its national currency with the US dollar for all three money functions. The dollar has been adopted as official currency by Panama, El Salvador, Ecuador, Montenegro, Palaus, Kosovo, Marshall Islands, Federated States of Micronesia, and East Timor.

Dollarization would require addressing at least two critical issues: exchanging all the pesos in the economy for dollars and balancing public revenues and spending.

The former requires setting the exchange rate at which dollarization would be carried out. This is done by dividing the amount of pesos in the economy by the international reserves of Argentina’s Central Bank (BCRA). As of early March 2023, the BCRA’s net reserves were around 2.3 billion dollars. Hence, the exchange rate applicable to replace only the monetary base (5,242.21 billion pesos) would be around 2,280 pesos per dollar. Nonetheless, Argentine deposits are backed by the Central Bank’s interest-bearing liabilities. If we consider converting these interest-bearing liabilities too (11,017.136 billion pesos), the exchange rate rises to approximately 7,070 pesos per dollar. In both cases, this implies a strong adjustment and a significant loss of purchasing power.

The latter challenge is balancing public revenues and spending. As printing money is not a feasible option, the only viable alternatives for the State to bridge the gap between public revenues and spending include taking debt, increasing taxes, or cutting down spending.

Promoters of this line of action assume that the mere announcement of dollarization (and the reforms required to implement it) would be enough to restore the confidence of international markets and generate “a wave of investments” to avoid this deficit. However, the experience of Ecuador, Panama and El Salvador have shown the situation is more complex. In these cases, dollarization has exacerbated —or at least has not helped to reduce— economic volatility. It has not barred the possibility of incurring unsustainable fiscal deficits and indebtedness, nor has it improved financing for the public and private sectors.

Some additional conditions are necessary for a successful dollarization. Both fiscal and trade deficits must be reduced to bankable levels, international reserves must be built, and relative prices aligned (exchange rate and tariffs), in addition to implementing a salary adjustment policy to curb inertia, which could lead to residual inflation in dollars and undermine competitiveness. These conditions are not different from those required for a stabilization program maintaining the domestic currency. Therefore, if and when these conditions are met, why stabilize the economy by resigning the domestic currency if it could be done by strengthening it instead?

Overcoming the Dollarization of the Argentine Economy?

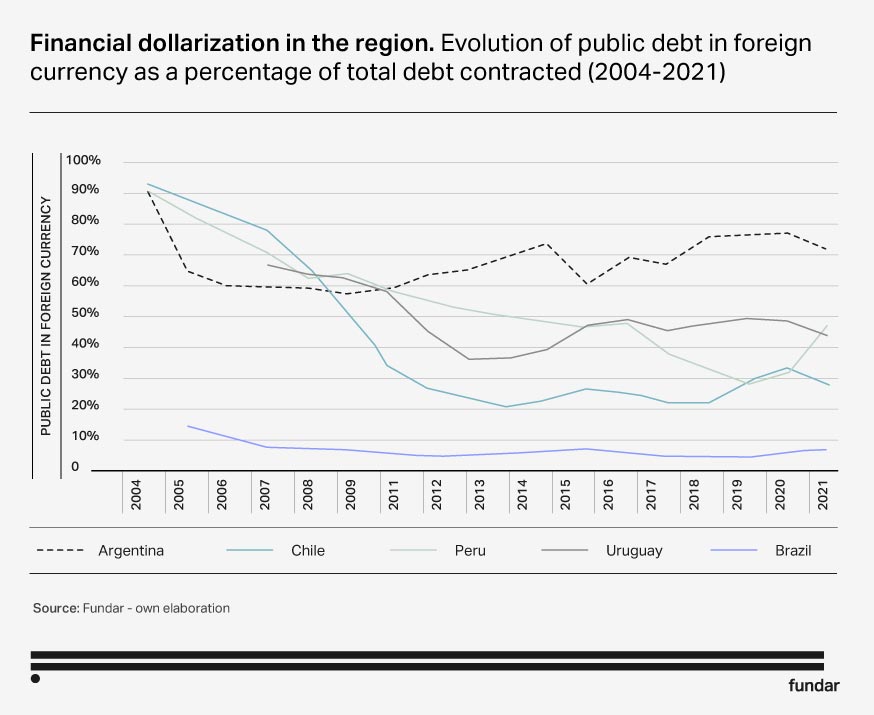

The alternative to dollarization is to implement a public policy agenda to strengthen the domestic currency in all its functions. The regional experience and literature both show that this process will take time, but it is not impossible. Virtually all countries in our region, including very diverse cases such as Brazil, Bolivia, Chile, Mexico, Colombia, Peru, and Uruguay, have managed to curb inflation without sacrificing their domestic currency or unnecessarily forfeiting their policy-setting freedom.

What to do:

- Stabilize the economy.

- Create real and sustained incentives for saving in pesos: To restore the currency’s function as a store of value, the interest rate of peso-denominated deposits needs to outperform inflation forecasts as well as the expected rate of return of dollar-denominated alternatives. To achieve this, it is essential to avoid significant exchange rate adjustments.

- Establish cautious regulations and articulation policies: Peso-denominated deposits must be encouraged by setting lower mandatory cash reserves for peso-denominated deposits than for dollar-denominated deposits, limiting insurance only to peso-denominated deposits. To encourage the use of the local currency as a unit of account and means of payment, measures are needed to induce the listing of prices in pesos.

- Supplement markets: In order to strengthen the power of the local currency as a store of value, the public sector must be able to provide short-, mid- and long-term peso denominated instruments. This will enable banks to offer peso-denominated loans to the private sector with varying maturities.

- Discourage indexation of contracts: While indexation allows to protect some of the currency functions in an inflationary environment, it does so at the cost of entrenching inertia and establishing a very difficult-to-break inflation threshold.

- Be cautious about dollar circulation: If the dollar is allowed to circulate, strict supervision policies are recommended to prevent individuals from saving in this currency outside the system, as it may increase the risk of bimonetarism.

What not to do:

- Compulsively convert dollar deposits into pesos, since this reinforces the incentives to save in foreign currency.

- Destroy public statistics. This undermines confidence, especially when the return on peso-denominated instruments is tied to inflation.

- Defaulting on peso-denominated debt is unnecessary and is the most drastic way to undermine the domestic currency.

- Apply foreign exchange market restrictions broadly instead of as a last resort, as they can create significant distortions and counterproductive incentives.

Some of these measures may seem unlikely in the current context, but they may be attainable with a stabilization process. Stabilizing and strengthening our own currency takes time: it requires the political arc to find a minimum common ground to sustain policies over time, no matter the governing party. The region´s success stories show that it is possible and alternative analysis suggests it is desirable.