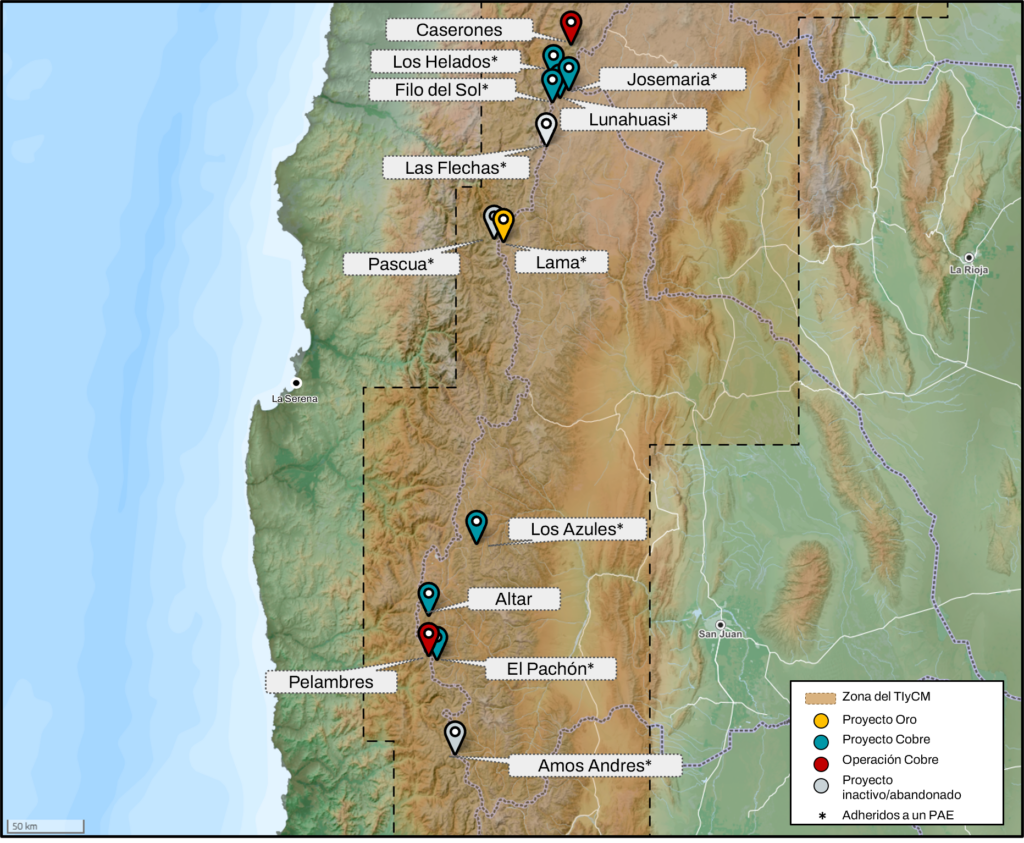

In the context of the energy transition, global demand for copper will grow significantly. The border shared by Argentina and Chile is home to world-class deposits capable of supplying more than one million tonnes of copper per year. This is the total projected supply gap in 2040 in the baseline transition scenarios.

This study examines the opportunities and limitations of the Treaty on Mining Integration and Complementation (TIyCM). It is a unique bilateral treaty signed in 1997, which has facilitated the development of activities in the high mountain range.

The instrument has been successful in advancing exploration and identifying exceptional resources. However, persistent challenges remain in moving to the exploitation stage. Whether due to regulatory asymmetries, socio-environmental tensions, or the absence of more robust and coordinated institutional mechanisms, there is still work to be done.

Binational potential: productive, economic, employment

There is a great opportunity for copper development in the mountain range shared by the Province of San Juan and the Chilean regions of Atacama, Coquimbo, and Valparaíso. It could contribute almost 1 million tonnes of fine copper per year from 2030 onwards, with more than 35 years of average production. The cluster has 1.2% of the resources and 0.4% of the reserves of the world’s copper.

The economic potential of this cluster is enormous for both countries. Argentina would capture more than 16 billion dollars between mining works, plants and associated services. This flow would generate an increase in production in the national economy of more than $24 billion and additional exports of $5.3 billion annually. This amount is equivalent to 8% of the country’s total exports in 2023.

At the same time, Chile would receive a projected contribution of 9.3 billion to its domestic product and an increase in exports of 1.7 billion, or 1.8% of its exports in 2023.

In addition to revenue, both countries would benefit from productive linkages in services, logistics, and construction, with distributive effects extending to mountain regions that are currently lagging behind.

Binational complementarity increases regional added value, optimises costs and reduces emissions. If the mining portfolio were to move forward under a coordinated regulatory framework, the copper cluster could boost integration in the Southern Cone while ensuring a cleaner and more coordinated energy transition.

In terms of employment, when the projects are fully operational, for every direct job within the mining operation, three more jobs will be created in related activities. Growth is expected in transport, services, maintenance, supplies and local trade. In other words, for every person working directly in mining, three others will find work thanks to the economic activity generated by the project. During the peak of construction, it is estimated that there will be between 74,000 and 79,000 jobs, including direct and indirect employment.

Atlantic or Pacific?

Transporting goods to a port in Chile (Pacific) or Argentina (Atlantic) can make a difference in terms of greenhouse gas (GHG) emissions.

It is important to note that projects producing SxEw cathodes are smaller in volume than projects producing copper concentrates. The latter are bulk materials with copper contents of around 25%-28%, while SxEw cathodes contain 99.99% copper.

In all cases, the option of exporting the final product via the Atlantic generates more GHG emissions, despite the fact that much of this journey would be made by train (requiring new investment) and this has a lower emission factor than lorries per kilometre travelled.

The greatest differences occur with the shipment of concentrates, as fine copper is accompanied by additional inert material that increases the volume to be transported by up to four times on average. Specifically, in projects closer to Chilean ports, emissions would be reduced by almost six times compared to shipping via the Atlantic.

Opportunities for improving the Treaty on Mining Integration and Complementation

- Update the Treaty’s management timescales

The Arbitration Commission should meet more frequently and have more agile approval mechanisms. In the mountains, weather conditions impose short working windows: missing a season can mean years of delay in an investment. - Build a public information platform

Today, there is no consolidated data on how much is invested or what environmental impact projects under the Treaty have. A platform shared between Argentina and Chile would make it possible to closely monitor operations, make spending transparent, and facilitate state and citizen oversight. - Monitoring the balance between countries

Statistical monitoring of payrolls and the procurement of goods and services is proposed in order to identify the balance between the two countries. This would enable actions to be coordinated to correct significant deviations and ensure that integration is perceived as fair by both parties. - Simplify taxation

The differences between the tax systems of both countries can hinder the development of joint projects. A unified regime for binational mining would avoid double taxation and simplify oversight, benefiting both governments and companies. - Provide a legal framework for private contributions

Currently, there is no clear mechanism for companies to be held accountable for “consequential expenses”—such as dedicated customs, audits, or border controls. This is provided for in the Treaty but not regulated, and doing so would free up public resources.

Opportunities for binational integration

- Coordinate shared environmental management

It is proposed to create a binational institutional framework for environmental assessment and control of projects in the mountain range. Integrating the environmental agencies of both countries—such as SEA and SMA in Chile, and national and provincial authorities in Argentina—would allow for standardising criteria and reducing socio-environmental conflicts. - Modernise border crossings

The current infrastructure is insufficient to handle the increased traffic that mining projects would entail. The Cristo Redentor system and its integrated customs facilities need to be optimised, and new works should only be considered when they are technically and economically justified. - Harmonising regulations and strengthening the Treaty

Joint mining development requires clear and coordinated rules. Consolidating the TIyCM with greater institutional capacity is key to ensuring stable investment and guaranteeing the global supply of copper demanded by the energy transition. - Sharing water infrastructure

Water is a critical resource in the Cuyo region. Evaluating the use of desalinated seawater and promoting efficiency and recirculation in industrial processes would reduce social tensions and improve the sustainability of the projects as a whole. - Promoting regional added value

The combined flow of concentrates could sustain a new smelter-refinery in Chile, driven by a public-private consortium and fuelled by Argentine gas. This would reduce maritime transport emissions by up to 75% and help diversify the global supply of refined copper. - Building a common strategy for the world

Argentina and Chile can gain global influence if they act together in international markets and forums on critical minerals. A binational agenda for technical and diplomatic cooperation would strengthen the region’s voice in the energy transition.