Economic complexity serves as a tool to detect which sectors have the greatest potential to boost the development of a country, a province or a city. However, can we move from theory to practice? A series of proposals to boost the productive development of the city and province of Córdoba, based on economic complexity.

While the current status of Córdoba appears favorable compared to other cities worldwide, nationwide and even within the province, its complexity could deteriorate in the future. To break the current productive inertia, designing effective policies becomes crucial. In order to enhance the municipality’s international insertion, these policies should be aimed at strengthening and modernizing existing sectors, as well as promoting new development paths. A forward-looking analysis is required to identify the strategic sectors requiring strengthening, ones that would elevate the complexity of the production portfolio and align with sophisticated products. It is also essential to determine the necessary tools to guide a policy aimed at attracting investments targeting the production of such products.

An international insertion strategy for the city of Córdoba

Recent years have witnessed a notable surge in initiatives by subnational governments globally to catalyze economic growth in their regions and cities. Argentine provinces are assuming an increasingly pivotal role in the economic development and global projection of their localities, allocating more resources and efforts to generate and take advantage of new economic growth opportunities paving the way for a possible pathway towards sustainable long-term development.

In this context, the city of Córdoba has initiated an incipient development strategy to boost its productive capacity and stimulate growth. Conceived by the local government, this strategy targets innovation and the city’s internationalization. Addressing these challenges requires identifying strategic sectors that should be the focal point of productive policies, considering their viability and potential impact on the city’s future development.

Present complexity versus future complexity: diagnosing Córdoba

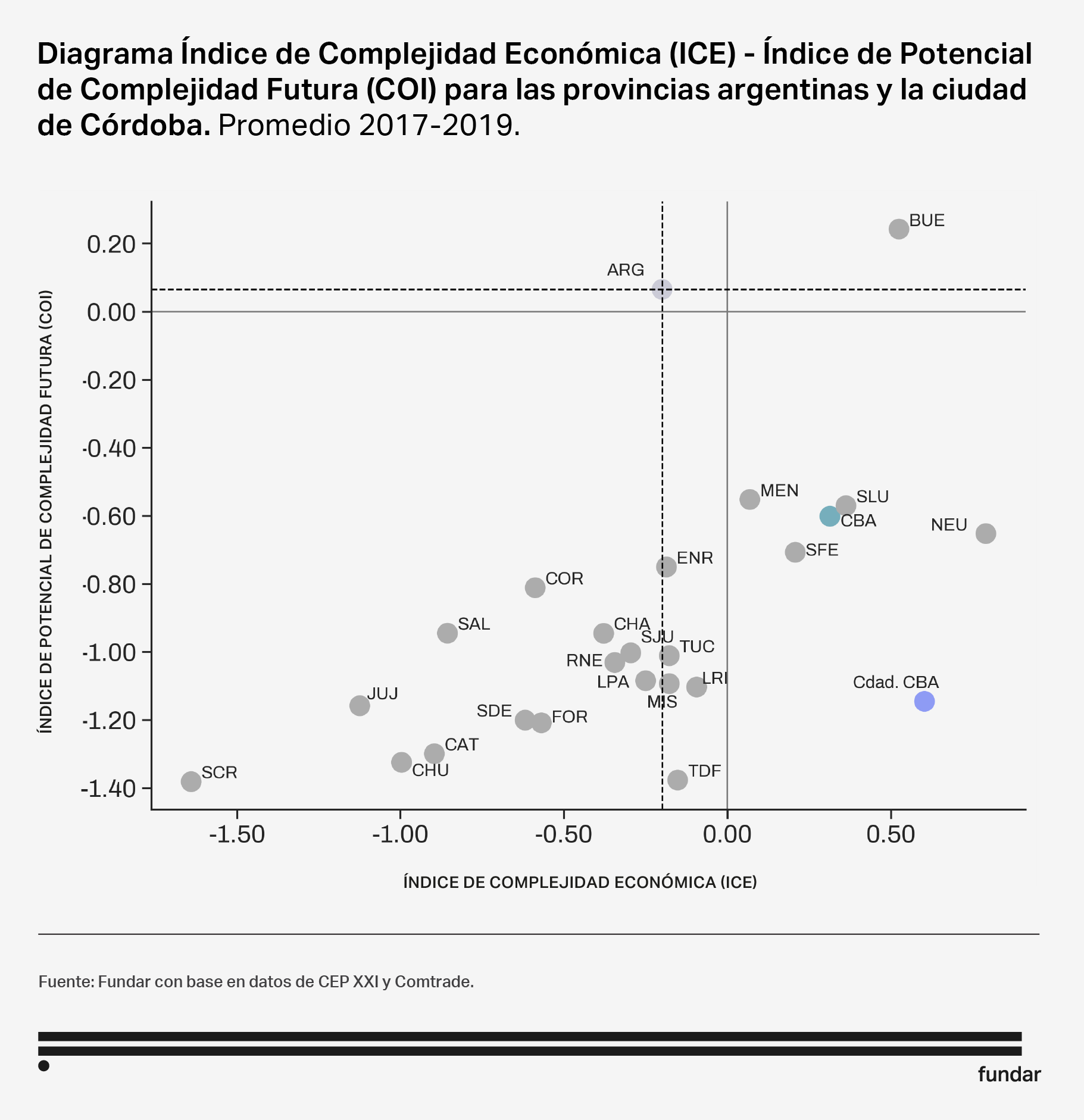

The Economic Complexity Index (ECI) assesses the complexity of a region’s competitively exported products.

The Complexity Outlook Index (COI) considers the complexity of those products not yet competitively exported and weights them based on how close they are to the city’s current productive matrix.

Despite Córdoba city’s high 0.6 score in the Economic Complexity Index (ECI) , significantly exceeding that of the province (0.2), it does not guarantee that the complexity of the economy will remain high in the future. Notably, it is crucial to analyze also its complexity outlook (COI), which has a low value (-1.15)., indicating that the city’s complexity is growing at a pace considerably lower than the world’s (0), Argentina’s (0.1) and the province of Córdoba’s (-0.6).

These low COI values are partly explained by the fact that 19 of the 30 competitively exported products are agricultural, averaging a complexity of -0.85. This negative value suggests a potential decline in complexity. The capacities developed and existing today may not suffice for the city to transition towards the production of more complex goods.

Without altering its current trajectory, future competitiveness loss is inevitable. To prevent this and foster a prosperous production path for the city of Córdoba, it is imperative to champion policies that disrupt the current inertia. These policies should aim to strengthen existing sectors, modernize them, and encourage diversification of the production basket.

Identifying strategic products

The Economic Complexity methodology enables a forward-looking analysis to identify strategic sectors that would elevate complexity in the production portfolio and approach more sophisticated products.

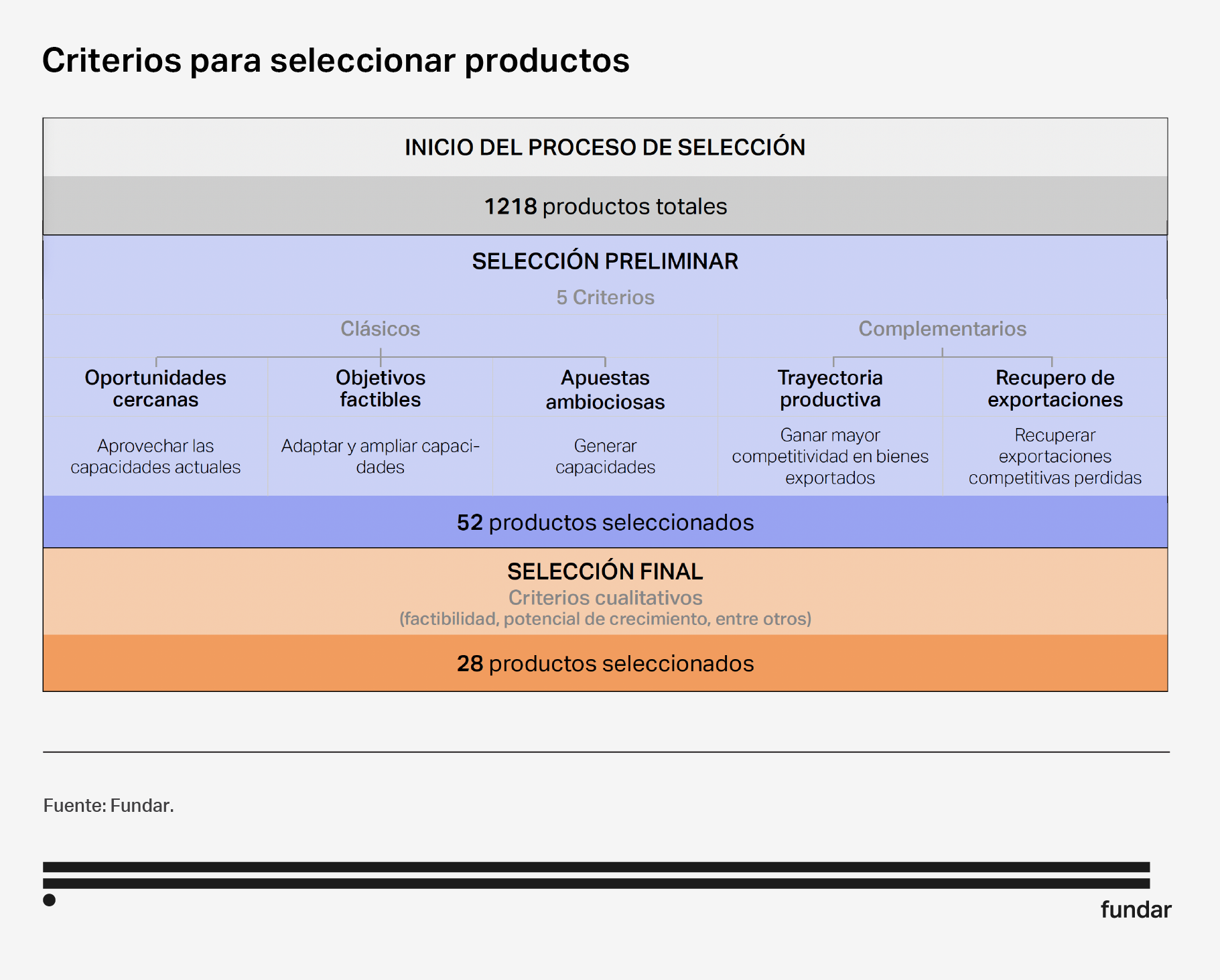

Products and sectors were selected by applying criteria factoring complexity (a country’s knowledge expressed in terms of the goods it exports), proximity (quantity of complex products close to the current productive capabilities), and strategic value (potential future complexity gain for a region or country).

This process resulted in a final selection of 28 products with potential for Córdoba, grouped into three categories: Machinery, Food and Beverages, and Others.

Machinery: Driving city complexity

This group includes machines for the dairy industry, transmission shafts, lifting machinery, engine parts, liquid pumps, and vehicle bodies, among others. These products are more complex than the city’s current exports on average (ICP: 0.12) and hold high strategic value.

While relatively few countries competitively export these products, and Argentina does not export any of them competitively, seven out of nine products are exported by at least one company in the city. Córdoba could delve more decisively into their production for export, but that would require a deliberate approach and strategic productive policies.

This group is particularly attractive in terms of its contribution to present and future complexity, but these products are also the furthest from the current productive matrix. To competitively export them, the city would need a significant effort in adaptation and capacity-building.

Food and beverages, close enough and a potential bridge to more complex products in the future.

Selected products include buttermilk, canned meats, canned meat, cereal-based products, cold cuts, fermented beverages, animal feed preparations, as well as dietary supplements and multivitamins.

Although total exports of this group totaled USD 125.9 billion globally in 2019, less than half that of the Machinery group, its attractiveness in terms of growth stands out. Between 2011 and 2019, exports in this category grew by 53%, doubling the growth rate of total world exports. Argentina competitively exports three of the nine products in this group.

Unlike the Machinery group, this group contributes less to the city’s complexity, but is closer to its current productive matrix. In addition to its proximity, its high strategic value makes it attractive, as the competitive development of these products will facilitate future mastery of strategic capabilities to continue to complexify production. In other words, it requires similar productive capacities for more complex products.

Other products, with a good balance between proximity and current and future complexity

The “Others” category comprises 10 products: 5 in Chemicals, 2 in Agriculture, 2 in Metals, and 1 in Stones (construction goods). With an average complexity of 0.34, intermediate among previous groups and higher than current city exports (0.12), global exports of these 10 products reached USD 251 billion, equivalent to 1.48% of total world exports. The accelerated growth of exports stands out: between 2011 and 2019, they grew by 33.8%, exceeding 20.5% of total goods exported worldwide. Additionally, 7 of these 10 products grew by more than 30%. Although Argentina does not competitively export any of these products, for half of them it exports more than USD 20 million and for three of them more than USD 70 million.

This group is characterized by being in an intermediate position in terms of proximity, complexity and strategic value compared to the two previous groups. At the same time, it is the group whose products belong to a greater diversity of sectors.

This group is characterized by being in an intermediate position in terms of proximity, complexity and strategic value compared to the two previous groups. At the same time, it is the group whose products belong to a greater diversity of sectors.

Estimates indicate that the productive drive of the 28 selected products can increase the city’s exports between 3% (in a moderate scenario) and 10% (in an optimistic scenario). The most significant increase in terms of exports is explained by the Machinery group, which has the highest volume in terms of global trade.

Promote a subnational policy to attract investment

Identifying and prioritizing opportunities within the territory is a foundational step in shaping and consolidating a vision for the future. This process guides public and private actions towards an agenda of greater value addition and innovation, i.e., greater Economic Complexity.

At the same time, it enables establishing a productive dialogue with public entities and presenting concrete requests for the necessary actions. The performance of government entities will depend not only on their skills and financial resources, but also on having private sector partners with clear objectives that drive local development.

In this context, apart from focusing on actions necessary for developing each identified product, subnational governments must find ways to support the private sector in building consensus and coordinating efforts.

For this increase to materialize, companies in Cordoba need support from the State and the rest of the private sector at different stages of developing their export capacity. This requires, among other things, the development of specialized institutions capable of providing efficient solutions to the many issues related to production and export.

These include the provision of essential public goods, such as road infrastructure, the development of research on products and production processes, and trade promotion, among others. In this sense, Córdoba Acelera, the provincial agency, will have as its main function the coordination and articulation of the different links of the productive sector, identifying possible market failures and seeking efficient solutions to the problems generated within each value chain.